Momentum investing refers to a strategy built around the fact that both individual stocks and whole funds tend to keep on performing when they’ve already been performing. Momentum is well documented and works. So if it works, why not lean into it by only focusing on stocks that have momentum and getting rid of those that don’t? Well – that’s what the Invesco S&P 500 Momentum ETF (NYSEARCA:SPMO) does. The fund tracks the S&P 500 Momentum Index, which invests in the 100 highest-momentum stocks in the S&P 500. Its portfolio rebalances twice a year.

The fund’s approach is based on the idea that, by investing in companies with the strongest upwards price trends that are most likely to sustain their outperformance, it can harness persistence for an extra boost to performance. By rebalancing the portfolio to hold the best-performing momentum stocks, SPMO aims to let investors catch a ride with the market’s leaders, while at the same time avoiding the dangers of stock picking.

A Look At The Holdings

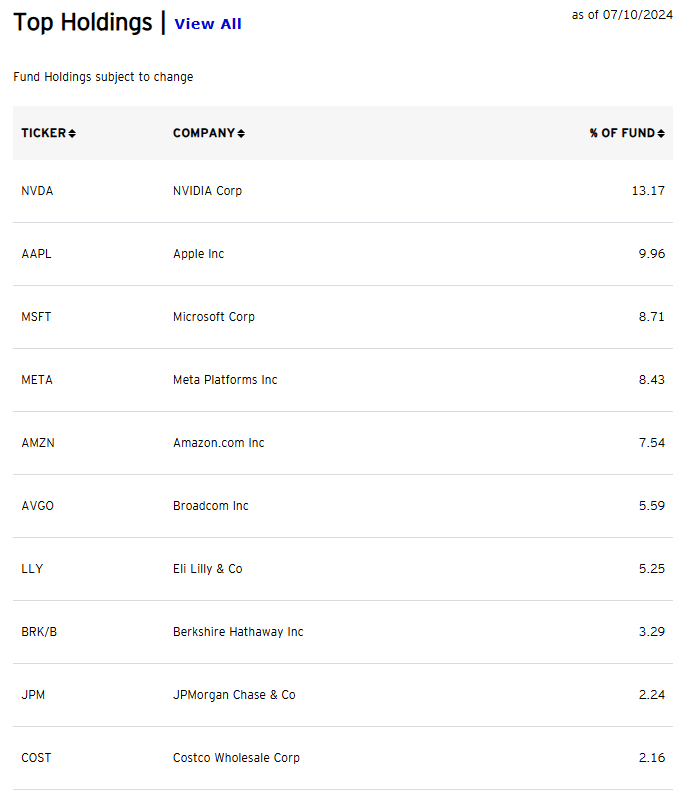

The fund currently holds 101 positions. The largest position, Nvidia (poster child of momentum) makes up 13.17% of the fund. Yes, folks – if you wanted a momentum fund, that momentum fund better have Nvidia at the very top.

invesco.com

All of the positions here are companies you know, just with a higher weighting overall than in broader passive benchmarks like the S&P 500 itself. I will say that the fund has been on fire because of the names it’s in, whereby the rebalancing frequency of twice a year has allowed momentum to compound in some of these high-flyers.

A strong case to be made so far, but the thing with momentum investing is that when it turns, it can turn ugly. That clearly hasn’t happened yet, but it’s worth thinking about given how much concentration there is in the top 10 names.

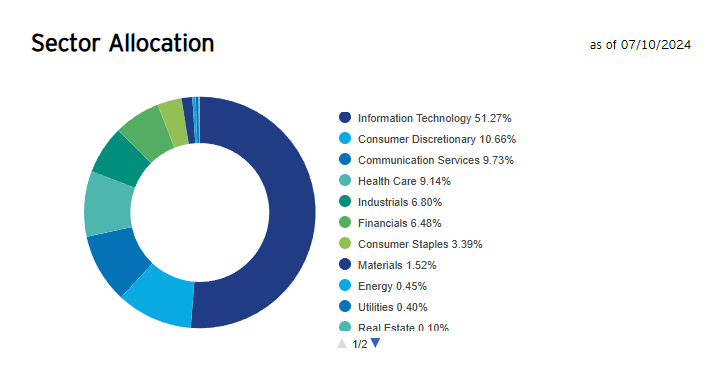

Sector Composition

The high-growth, innovative companies that SPMO focuses on also drive the high exposure the fund has to the Information Technology sector. Nearly 52% of the fund is in Tech, with Consumer Discretionary a distance second at 12% and Communication Services at nearly 10%. This hefty exposure to the tech superstars – Nvidia, Microsoft and Apple, among others – is not a surprise. We all know how concentrated Mag 7 performance has been relative to everything else, and we all know Tech has been the only real place to be from a momentum perspective since the very end of 2022.

invesco.com

Pros and Cons

Constantly holding the best-performing stocks looks like a winner on paper – but should investors in SPMO expect momentum or mayhem? On the positive side, momentum investing seems to work. Since the Dow Jones Index was first calculated, price trends have tended to persist far longer than a random walk would predict. By continually rebalancing shares, a momentum ETF like SPMO can surf market leaders, which in turn should improve returns.

The problem is momentum does tend to have momentum crashes that seemingly come out of nowhere when they hit. Chasing this strategy pushes you along a slippery slope because of that risk. It’s easy to start believing in hot-stock performance continuing, but at some point you’ll become overinvested in yesterday’s hot stocks, just as everyone else does. You’ll miss out on investing in the stocks that will actually perform well tomorrow. That’s the joke about momentum. You need momentum for momentum to take place.

In addition, because SPMO has huge exposure to the Technology sector, this fund is especially vulnerable to a downturn there. I know it’s hard to envision a scenario where Tech weakens, but it was hard to envision that Tech would turn in early 2000 as well. The point is there is significant risk here, which, although it’s working, could reverse and end badly.

Conclusion

If you want exposure to a momentum portfolio in the US large-cap equity market, the Invesco S&P 500 Momentum ETF could be an attractive avenue for capturing momentum returns. Its portfolio is dynamically managed to contain the stocks with the highest momentum within the S&P 500. However, investors need to be aware there is a potential for sharp reversals and periods of underperformance because of the inherent risk in the momentum strategy. Moreover, the concentrated sector exposure in SPMO will lead to an increase in volatility and firm-specific industry risks. Personally, I’d be afraid of positioning into the fund now, given how extended it is. Still – worth keeping an eye on.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.

Read the full article here