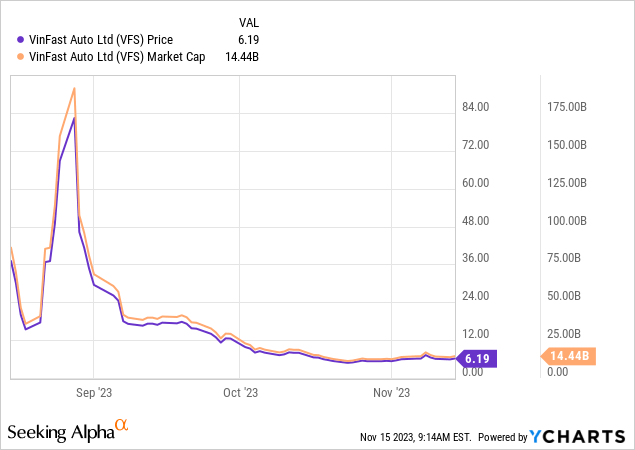

One of the latest entrants in the public equity markets from the auto manufacturers industry is VinFast Auto Ltd. (NASDAQ:VFS). This Vietnam-based electric vehicle company went public in August and after a quick rip up to $93 per share, the stock has since fallen about 95% from its all-time high just a few months ago to a low under $5.

Despite that fall, VinFast still commands a $14 billion market capitalization which makes the company more valuable than Subaru Corporation (OTCPK:FUJHY) as of article submission. Given the selloff from the high and the triumphant return of equity market bulls in recent weeks, one might be wondering of VFS shares are worth a look today. In this article, I’ll detail why I think it is wise to still avoid this ticker.

Preposterously bad first impression

VinFast Auto’s flagship American market vehicle is the VF8 EV. Since hitting the states earlier this year, it has not been an easy go for the VF8 from a reception standpoint. This is just a sampling of the review headlines from notable industry publications:

The VF8 ratings sourced from both consumers and other automotive testers weren’t much better. Car and Driver gave the vehicle a 6 out of 10 and the lone consumer review from Edmunds is a 2 out of 5 stars. From the Edmunds review:

The concept and design of VF8 are great, but VinFast is failing in quality and reliability. Both in hardware and software. The car body has lots of squeak noises like it is going to fall apart. The software keeps faulting and can’t drive away without any faulty message on the screen. Driver preference set ups don’t stick around, needs to be reset every time, very frustrating. VinFast should have not offered this car for sale yet.

Honestly, it can’t get much worse than saying the car shouldn’t be on the market yet. Among other things, the common complaints from each of the reviews I read and watched online were the prevalence of cheap materials, poorly functioning climate controls, annoying notifications systems, and uncomfortable seating. Some of these things can likely be fixed with software upgrades but the bigger issues are likely not fixable in the vehicle’s current model year.

The main takeaway here is that the car has been rushed and isn’t ready for the market. I think it’s going to be difficult to shake that horrid first impression, but time will tell. However even if the reviews were good, VinFast would be a risky investment. Financially, there are plenty of other concerns to consider.

Q3 Results

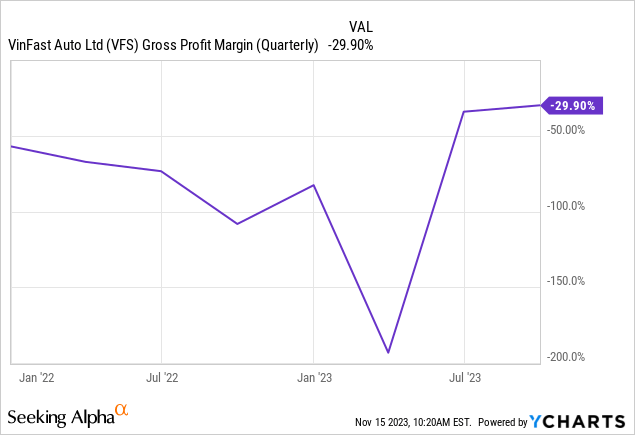

Even with what appears to be an obviously rushed vehicle, the company is still selling the EVs at a deeply negative gross margin. Though that trend has improved over the last two quarters:

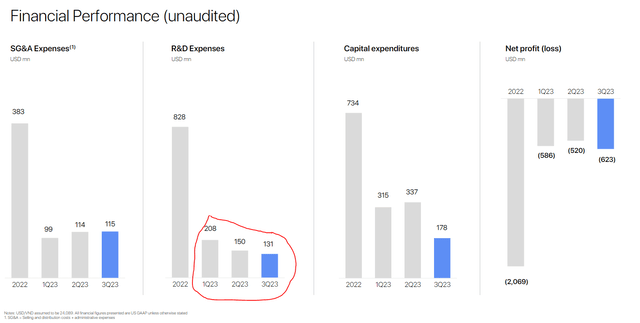

At a negative 29.9%, VinFast’s gross margin is comparable to some of the other fledgling EV peers in the equity markets. But there is a long way to go before the company is competing with a business like Tesla’s (TSLA). What’s also interesting to me is the decline in research and development spending in the last two quarters:

Q3 Deck, Slide 12 (VinFast Auto)

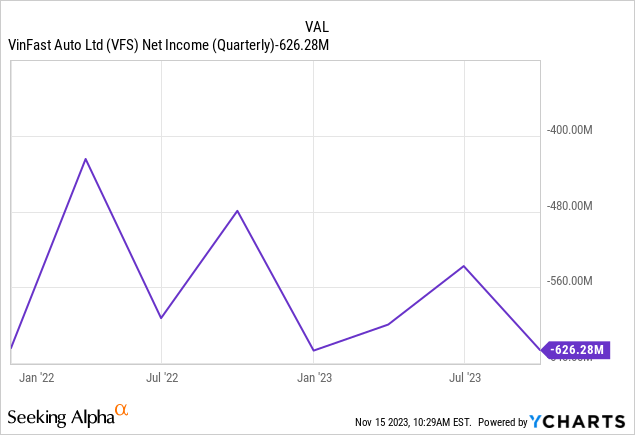

The big R&D expenses a year ago are not surprising given the company’s fast pivot from ICE to electric. But I’m a bit surprised R&D is still going down given how new VinFast’s EV business is and the plethora of issues the company’s vehicles appear to have. Regardless, net income to the company remains deeply negative at over $626 million in Q3 and the broader trend is very uninspiring:

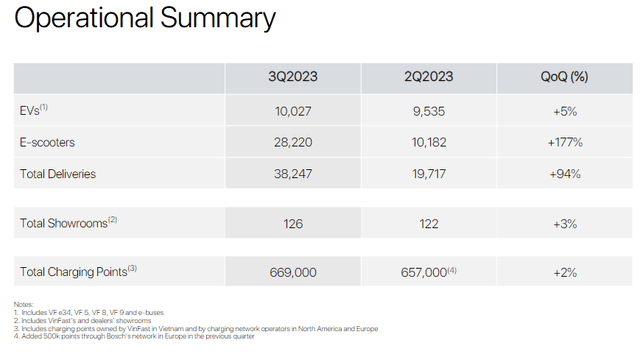

From a raw sales figure standpoint, VinFast reported 10,027 EV deliveries in Q3 which was an increase of 5% sequentially:

Q3 Deck, Slide 6 (VinFast)

Of those sales, VinFast’s US footprint remains very small. The overwhelming majority of the company’s vehicles are still being sold in Vietnam and through July there were less than 200 cumulative vehicle registrations in the US:

| Month | VinFast Registrations |

|---|---|

| March | 16 |

| April | 66 |

| May | 45 |

| June | 23 |

| July | 19 |

Source: InsideEVs

It’s important to note that VinFast vehicles are available only in California at this point in time, though the company has expansion plans for the rest of the country. In recent weeks we’ve seen an apparent sponsorship deal with Jimmy Kimmel Live. However, the execution on that campaign is very much up for debate. Problems aside, VinFast is guiding for 40-50k EV deliveries for fiscal 2023.

Final Thoughts

There is just way too much risk in these shares at this point in time for me. It’s certainly possible that VinFast could end up being a surprise success story many years down the line. But at this point, the company has just $131 million remaining in cash and is burning through hundreds of millions of dollars per quarter. There is impending dilution through the recently announced $1 billion equity agreement with Yorkville Advisors. Finally, the automaker has an enormous uphill battle given how poor the VF8 has been received domestically so far. I’d stay steer clear for now.

Read the full article here