Investment Thesis

After a brief look at TSMC (NYSE:TSM), you can immediately tell it is not an ordinary company. With a market share of 57%, TSMC is the market leader in the semiconductor foundry business accounting for 30% of the world’s production of integrated circuits, or chips for short.

But this is not just market dominance.

TSMC is the epicenter of geopolitical tensions between the US and China for the control of critical semiconductor technologies, and the presence of TSMC’s precious fabrication plants on Taiwanese soil has avoided the threat of a possible Chinese invasion, granting the gentle giant the title of “silicon shield”.

While many semiconductor stocks have skyrocketed in recent times, as AI technologies turn out to require tons of chips to work, TSMC stocks have remained quite calm.

The depressed valuation must be imputed to the geopolitical risks surrounding the company, however, given the technological moat established by TSMC in the foundry business, and the long-term growth momentum of the semiconductor industry, it would seem foolish to not dig a little deeper into the company.

Business Model

As a pure-play foundry, or Fabs, TSMC doesn’t design any chip, it solely focuses its resources on developing new manufacturing processes, offering its fabrication plants to chip designers who rely on the Taiwanese company to manufacture their advanced chips.

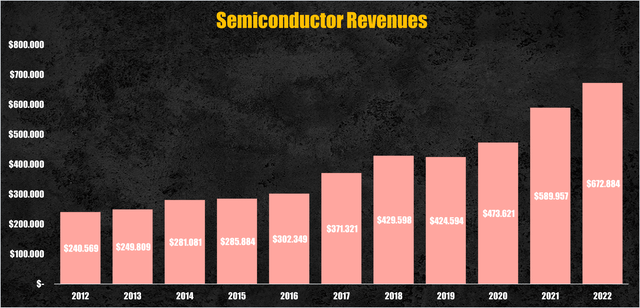

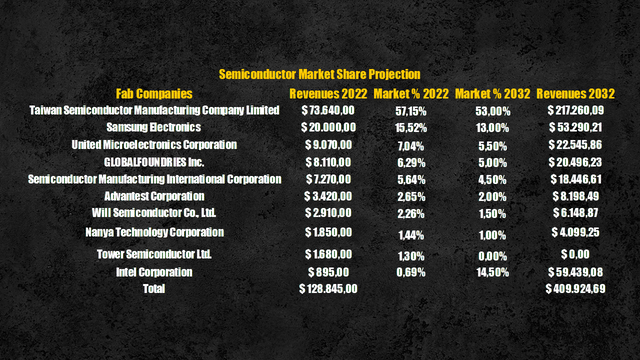

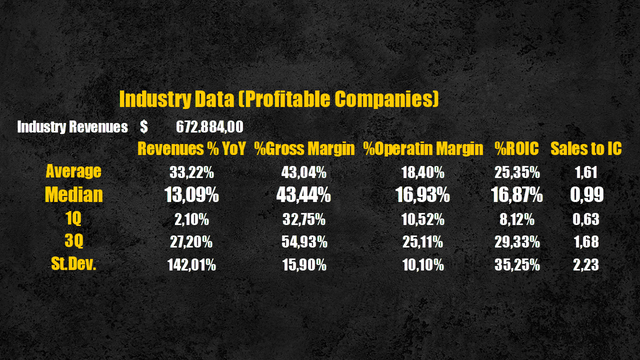

Semiconductors generated a whopping $672 billion in revenues in 2022, with the Fabs segment accounting for 19%, sitting at $128 billion.

Semiconductors revenues (Personal Data)

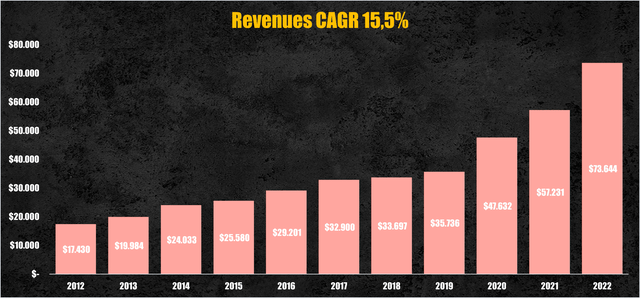

TSMC alone accounted for $73 billion in 2022, the largest semiconductor company by revenues, with a total market share of 11% or 57% in the Fabs segment.

TSMC revenues (TSMC)

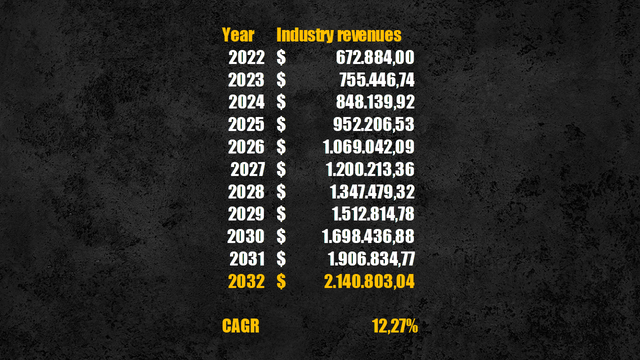

In my recent analysis of the industry, I projected the semiconductors revenues to reach $2.7 trillion by 2032, growing at a CAGR of 12.27%, basing my assumption on how much and how well, collectively, semiconductor companies have reinvested for future growth.

Semiconductor revenues projection (Personal Data)

Assuming the percentage of revenues from the Fabs segment to remain constant, pure-play foundry companies are expected to generate $409 billion by 2032.

Fabs segment revenues (Personal Data)

My TSMC narrative sees the chips giant remaining the undisputed king of the market, however, I couldn’t ignore Intel’s (INTC) pledge to become the second-largest foundry by 2030.

Currently, the runner-up is Samsung Foundries with an estimated $20 billion in revenues and a 15.5% market share. During 2022, Intel Foundry Services (IFS) – the freshly created business unit of Intel – generated only $895 million from external manufacturing, and even accounting for the Tower Semiconductor acquisition – bringing in $1.68 billion in revenues – the total market share of IFS is only 2%, placing Intel at the ninth place of the foundry segment.

Assuming the US chip maker remains loyal to its promise, from ninth to second is a long journey. To make that happen, Intel will have to steal market shares from its competitors, and while the majority can be expected to come from smaller foundries, Samsung and TSMC will have to give up some of their shares too.

Therefore, I assumed TSMC leadership to decline from 57% to 53%, translating into revenues of around $217 billion by 2032.

Semiconductor market share projection (Personal Data)

TSMC, along with Samsung, currently leads the foundry market with its 3 nanometers nodes, and both companies are working on 2 nanometers ones, said to begin production by 2025. According to Intel’s management, they expect their 20A and 18A nodes – comparable to TSMC’s 2 and fewer nanometers nodes – to enter into production by 2024, granting a temporary market lead against its Asian competitors, which would justify a decrease in TSMC’s future market shares.

Efficiency & Profitability

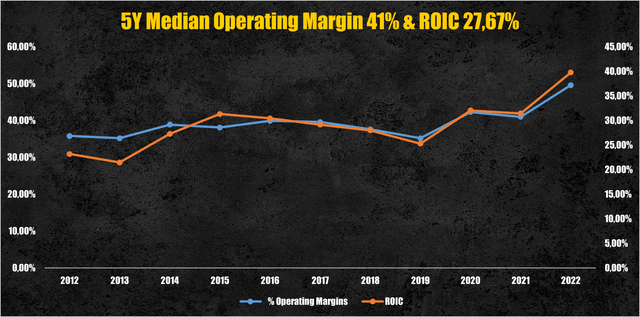

Moving on to efficiency and profitability, here is where TSMC’s moat shines the best. In the past five years, the Taiwanese chip maker achieved a median operating margin of 41% and a median return on invested capital (ROIC) of 27%, way higher than the industry median values of 16.9% for both ratios.

TSMC operating margin & ROIC (Personal Data) Semiconductor industry data (Personal Data)

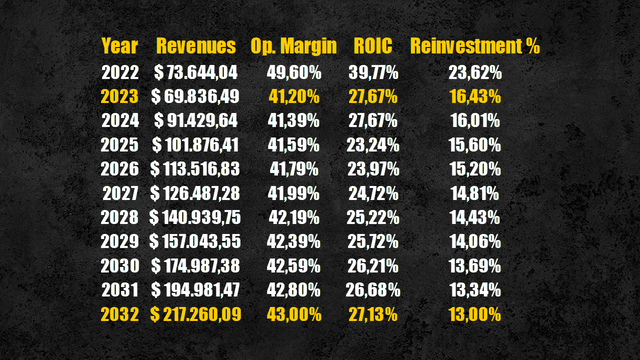

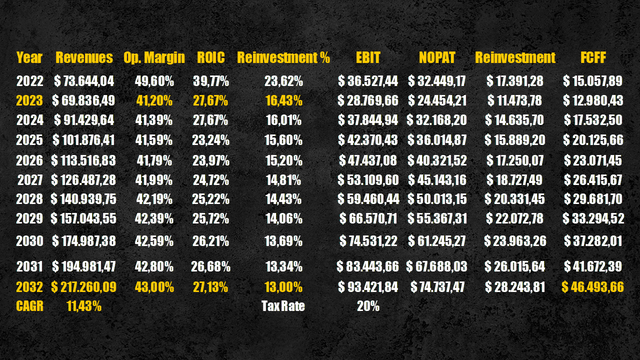

Continuing with my TSMC narrative, as I assumed the company to maintain its moat and significant market dominance, is highly plausible to expect both the operating margin and the ROIC to remain around their historical levels going into the future.

TSMC future efficiency & profitability (Personal Data)

As reported in my semiconductor analysis, a common thread for every company operating in the industry is the need for continuous reinvestments to support future growth.

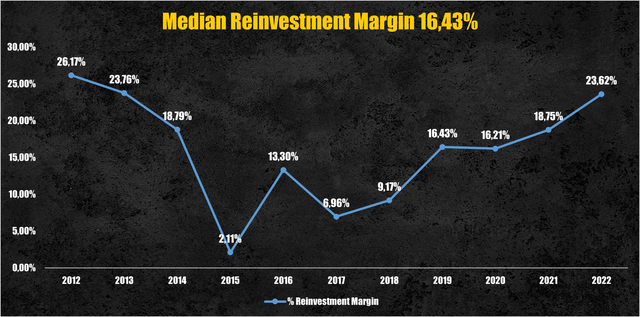

TSMC’s median reinvestment margin for the last decade was 16.4%, and while I expected it to remain in the double-digit territory, I assumed it to decline to 13% of total revenues as TSMC achieves even greater economies of scale.

TSMC reinvestment margin (Personal Data)

With nodes becoming smaller and smaller – while the use of advanced chips expands to new sectors like automotive – only a handful of foundries, including TSMC, will be able to satisfy such demand, permitting them to improve their economies of scale and become more efficient.

Cash Flows Projection

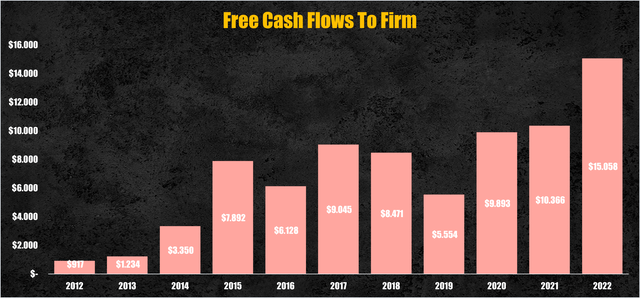

Despite the huge reinvestment required by its business model, TSMC was able to deliver solid free cash flows to the firm (FCFF) in the past, equal to $15 billion in 2022.

TSMC FCFF (Personal Data)

With the assumptions made so far, TSMC’s FCFF are expected to sit around $46 billion by 2032, growing at a CAGR of 11.9%.

TSMC FCFF projection (Personal Data)

Valuation

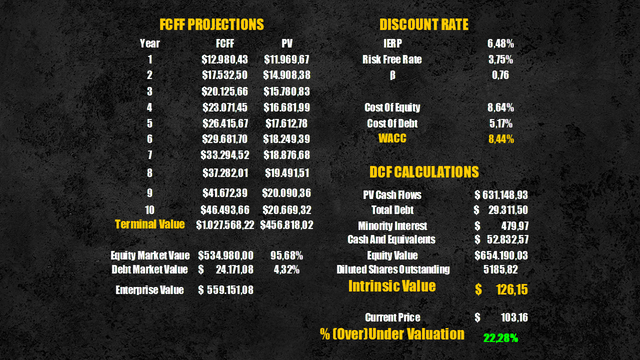

Applying a discount rate of 8.44%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $654 billion or $126 per share.

Compared to the current prices, TSMC’s stock looks undervalued by 22.3%.

TSMC intrinsic value (Personal Data)

Risks

The depressed valuation must be imputed to the geopolitical risks surrounding the company.

Other than the ongoing trade war between the US and China – with the recent news of the latter issuing a series of export restrictions on its rare earth used in semiconductor manufacturing – the major threat to the company is a possible Taiwan invasion.

As China seems to consider Taiwan part of its domain, there are many speculations about the island getting invaded by Chinese forces.

However, considering that 90% of semiconductors are made on Taiwanese soil, a direct military assault to take control of the land would probably damage the delicate and precious fabrication plants, damaging not only Western economies – which heavily rely on Taiwanese Fabs for a continuous stream of chips – but also China itself would have to face catastrophic drawbacks from the destruction of such critical technologies.

If an invasion would ever take place, it would be more reasonable to take the form of a sort of political treaty to preserve the manufacturing capabilities of the island. If this option will grant the survival of TSMC as a company, it doesn’t exclude the risk of potential policy changes – made by an eventual takeover from the Chinese government – that would structurally alter, and likely damage, TSMC’s business model.

Conclusion

It is hard to take into account the geopolitical risk in a valuation, as the result might well be the complete destruction of TSMC’s plant, the survival of TSMC but the end of the company as we know it, or nothing at all.

If the geopolitical risks make you feel uncomfortable with owning TSMC, you should probably avoid investing in the company and look for other opportunities, on the other hand, for those who believe TSMC could keep delivering solid performance in the coming years, at today’s prices, it represents a good investment opportunity.

Read the full article here