Editor’s note: Seeking Alpha is proud to welcome Argumento Institute as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Thesis

I believe the stock of Tarsus Pharmaceuticals (NASDAQ:TARS) is undervalued due to misconceptions about competitors and the market’s undervaluation of Demodex blepharitis (‘DB’). DB is a prevalent disease without effective treatment, making the potential drug XDEMVY™ promising, as a 2% market capture would result in $1 billion in sales. While all new drugs, including XDEMVY™, have risks of varying real-world results from clinical trials, this drug is based on a known compound effective against mites and has shown manageable side effects. The initial cost of XDEMVY™ seems high, but rebates can bring it down to $50, competitive with over-the-counter options. With an approved prescription alternative available, professionals might hesitate to recommend other products.

Company Background/Overview

Tarsus Pharmaceuticals is a biotechnology enterprise specializing in innovative therapies for ophthalmology. Founded in 2016 and headquartered in Irvine, CA, it trades on the NASDAQ Exchange as TARS. Tarsus is currently harnessing the compound lotilaner to curate therapies targeting eye diseases like Demodex blepharitis and dry eye disease, Rosacea and Lyme disease. Despite its notable achievements, Tarsus has faced financial hurdles, reporting consistent losses since its inception. It has depended on multiple funding sources, like equity capital raises and out-license agreement proceeds. Though the current capital is expected to cover expenses for the upcoming year, Tarsus foresees continued operational losses, indicating potential future fundraising endeavors.

Key Executives

Bobak Azamian, MD, PhD: Serving as CEO and Chairman, Bobak co-founded Tarsus in 2016. His vast biotechnology background includes co-founding Vibrato Medical and Metavention. He pursued his MD from Harvard and PhD from Oxford.

José Trevejo, MD, PhD: The Chief Medical Officer, José, is an expert in R&D for rare diseases, having previously served at Rocket Pharmaceuticals and SmartPharm.

Jeff Farrow: With over 25 years of expertise in the life science industry, Jeff, the CFO and Chief Strategy Officer, has raised over $2 billion in financing during his career.

Aziz Mottiwala: Chief Commercial Officer Aziz brings over two decades of biopharmaceutical leadership, including significant time in the eye care sector.

Sesha Neervannan, PhD: As Chief Operations Officer, Sesha adds 25 years of global therapeutics development experience.

Elizabeth Yeu, MD: Elizabeth, the Chief Medical Advisor, holds significant positions in multiple organizations, with extensive experience in eye care.

Existing Products: XDEMVY™ (TP-03)

XDEMVY™ (lotilaner ophthalmic solution 0.25%) is the first and only FDA-approved treatment for DB, and it is available at pharmacies in the US for prescription since August 24, 2023. The drug acts specifically via mite GABA-gated chloride channels to target, paralyze, and kill Demodex mites. The endpoints of mite eradication (mite density of 0 mites/lash) of XDEMVY™ vs. vehicle demonstrated statistically significant improvement at Day 43 across Saturn-1 (68% vs 17%) and Saturn-2 (50% vs 14%) studies. The most common observed ocular adverse reactions were instillation site stinging and burning which was reported in only 10% of patients.

Potential Revenue Estimates from XDEMVY™

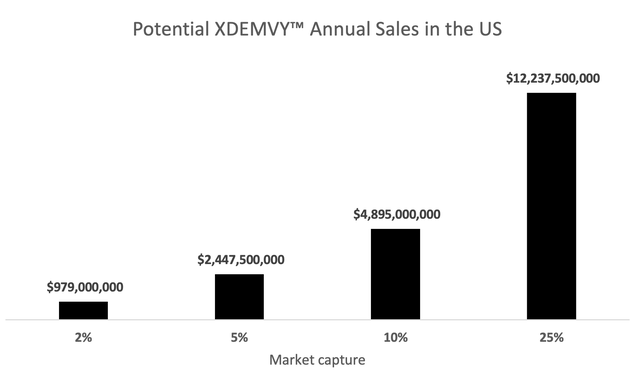

To calculate potential annual revenue from XDEMVY™ for different levels of market capture, it is assumed that the market size of patients with DB in the US is 25 million and each vial would be sold for $1,958. Note that it is believed that DB is currently misdiagnosed/underdiagnosed because of 1) the overlap of symptoms with other ocular conditions and 2) the lack of a specific therapy until recently. Also, in this model, I am not including the use off-label of XDEMVY™ for conditions other than DB, like MGD or dry eyes. Also, I am not counting the future indications that are pending following the results of ongoing trials. Therefore, I’m inclined to believe that the market size will actually be larger.

Potential XDEMVY™ Annual Sales in the US (prepared by the author)

Pipeline Candidates and TAM

TP-03

TP-03 is also being investigated in other trials to expand the number of indications and, consequently, the potential market size. A phase 2 trial to treat MGD in patients with Demodex lid infestation. According to Lemp MA, et al, signs of MGD are seen in 86% of patients with dry eyes, which translates to 14.4 – 43.2 million patients in US alone. A recent study showed that half of patients (21.6 million patients) with MGD were positive for Demodex, with a significant correlation between the number of Demodex and clinical markers for disease severity. A phase 3 trial to evaluate the efficacy and safety of TP-03 for the treatment of DB in Chinese patients (in collaboration with LianBio LLC). LianBio estimates there are approximately 43 million patients with Demodex blepharitis in China. A prospective, randomized controlled, three-arm, investigator- and interpreter-masked study intended to compare the effect of two dosing regimens of a preservative-free vehicle on MGD in participants with Demodex lid infestation.

TP-04

A topical gel formulation Lotilaner, 2.0% (TP-04) applied 2x/day for 12 weeks is being evaluated in a phase 2 study to treat and eradicate Demodex mites in participants with moderate to severe papulopustular rosacea (‘PPR’).Rosacea is a common skin condition with a prevalence of up to 10% characterized by facial redness, visible blood vessels, and acne-like bumps. According to estimates from the American Academy of Dermatology, approximately 16 million Americans are affected by rosacea.

TP-05

A phase 2a study is evaluating the safety, tolerability, and whole blood concentration of an oral, systemic formulation of lotilaner in the killing of ticks after they have attached to human skin. TP-05 is believed to be the only non-vaccine, drug-based, preventive therapeutic in development that targets and kills infected tick vectors before they can transmit the Borrelia bacteria that causes Lyme disease. According to the Centers for Disease Control and Prevention (‘CDC’), it’s estimated that approximately 476,000 Americans are diagnosed and treated for Lyme disease each year. Because this number represents only the confirmed cases, the actual number of cases may be higher, with almost 700,000 estimated cases each year in the US and Europe.

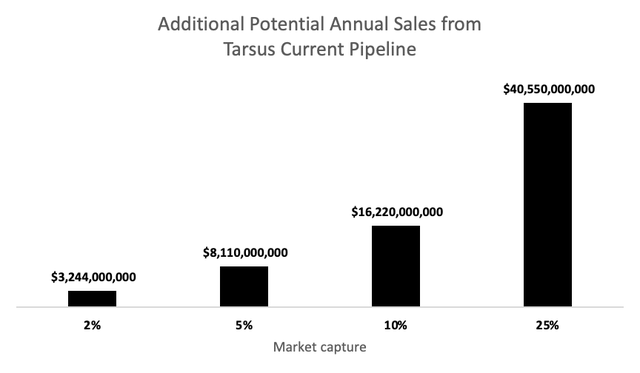

Additional TAM pending results of ongoing clinical trials

Upon successfully meeting clinical endpoints and receiving approval, the additional estimated TAM for Tarsus pipeline would be 81.1 million patients (MGD: 21.6 million + Rosacea: 16 million + Lyme: 0.48 million + China 43 million). Note that this number still do not consider expansion into other countries, which does not require additional studies and it largely consider just a matter of paperwork and time.

Additional Potential Annual Sales from Tarsus Current Pipeline (prepared by the author)

Financial Analysis

Brief Analysis of Financial Statements

As per the company’s Q2/2023 earning press release from Aug 10, 2023, the company reported a net loss of $31.4 million, a significant increase from a net loss of $5.7 million in the same period of 2022. This change was primarily due to several factors: a $15.3 million decrease in license fee and collaboration revenue, a rise in general and administrative expenses by $9.9 million, and a $2.9 million increase in research and development expenses.

There were no revenues from license fees and collaboration in the reported period that were associated with the strategic partnership with LianBio. This contrasts with the same period in the previous year when there were revenues of $15.3 million. The research and development expenses for 2023 totaled $12.5 million, which included stock-based compensation costs of $1.5 million, compared to $9.6 million in the prior year.

The general and administrative expenses amounted to $20.3 million, which included $3.7 million in stock-based compensation. This is an increase from $10.4 million in the previous year. The rise in expenses was mainly due to a $5.3 million increase in payroll and personnel-related costs and a $3.5 million increase in commercial and market research costs. These additional costs are associated with the commercial expansion as the company prepares to launch its recently approved product, XDEMVY™.

As of June 30, 2023, the company’s cash, cash equivalents, and marketable securities stood at $178.2 million. This figure does not include the $100 million in gross proceeds from a recent equity public offering completed in August 2023. The company has stated that with its current financial resources, it expects to maintain its operations for at least the next 12 months. With the anticipated increase in sales following the launch of XDEMVY™, the company considers its financial position to be relatively solid.

Valuation

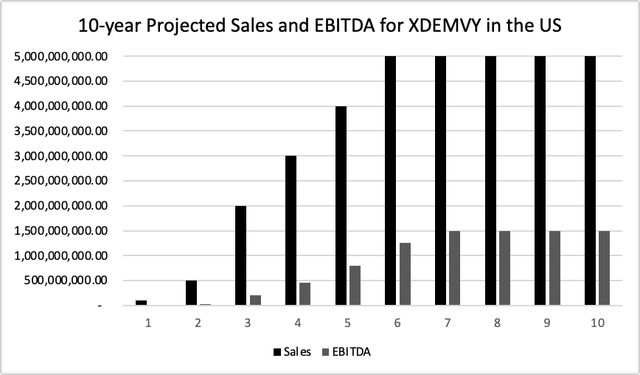

To reach a fair valuation of Tarsus, the DCF model was used, considering only the sales from its current approved indication in US, in a scenario that XDEMVY captures only a conservative 10% market share representing approximately $5,000 million peak annual sales. EBITDA was used a proxy of cash flow. To calculate the EBITDA, the 20% rate was used at peak sales, which is more conservative than the 30% average of 35 large pharmaceutical companies from 2000 to 2018. The reason that potential sales dependable on the outcome of ongoing trials was excluded is three-fold: 1) Pricing a pipeline of a company with no approved drugs is different and must assume the risk of a failed trial; 2) LianBio licensed rights from Tarsus in March 2021 for the development and commercialization of TP-03 in Greater China. Although Tarsus will be entitled to payments and royalties upon meeting certain milestones, the pricing model is different, 3) As shown below, the sales from XDEMVY in US alone, just for its current approved indication (‘DB’), already ensures a multiple of its current valuation, and a considerable upside from current stock prices. My viewpoint is that investors today are basically getting the entire pipeline for free.

10-year Projected Sales and EBITDA for XDEMVY in the US (prepared by the author)

A 2012 analysis of publicly traded biotech firms calculated an average WACC of 8.7% for market-stage firms. Using a rate of 8.7% in the DCF analysis, a valuation of Tarsus would be $3.6 billion, about than 7x the current market valuation.

Another method to value biotech companies is to use Comparable Transactions (‘CT’). A study looked into the acquisitions of biopharma companies developing new molecular entities for therapeutic use from 2005 to 2020. For designated approved therapeutics, the average company valuation was $3,703 million (similar to the DCF analysis above) with orphan compared to $1,964 million with non-orphan (p < 0.05) designated status. The current market cap for Tarsus is only $521 million (November 6, 2023), making it relatively cheap and an attractive buyout target in my opinion. Moreover, valuations and annualized returns of companies developing multi-indication relative to single-indication approved lead drugs are significantly higher for most clinical stages. Tarsus has ongoing clinical studies to expand the clinical indications for its lead drug.

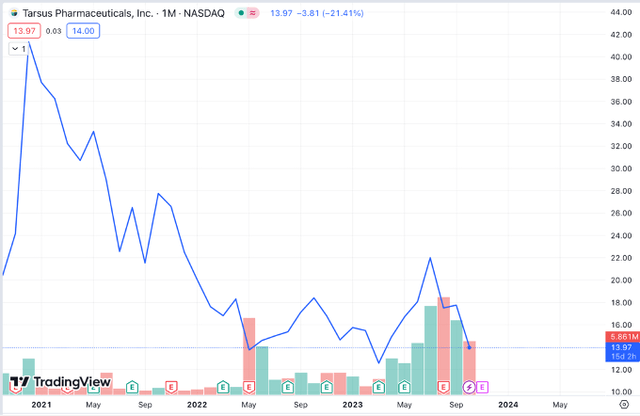

Stock Performance and Analyst Price Targets

Since becoming public on October 1, 2020, at around $22, the stock rose to an all-time high of around $45.78 a few months later. Since then, the stock has started a downward trend, reaching an all-time low of $11.33 in April. The stock saw a short-lived bump on the days leading to the FDA approval on 24 July 2023, but it reversed soon after, and the stock now trades at $16 (as of November 6, 2023), coming from the low-end of its 52-week range ($11.33- $25.25). Current analyst consensus is a “Strong Buy“. Based on 8 analysts offering 12-month price targets for TARS in the last 3 months, the average price target is $48.67 (268.71% upside) with a high estimate of $60 and a low estimate of $40. (Source: Nasdaq.com)

TARS Stock Performance since inception (tradingview.com)

Competitor analysis

As mentioned earlier, XDEMVY™ is the sole FDA-approved treatment for Demodex blepharitis. While off-label and OTC treatments have been attempted with mixed results, I feel that the preference among eyecare professionals is expected to shift towards a disease-specific, tested therapy. In fact, a survey revealed that 93% of eyecare professionals would prescribe an FDA-approved treatment for DB.

Tea Tree Oil

Tea tree oil (‘TTO’) is an essential oil derived from the leaves of Melaleuca alternifolia, a Myrtaceae plant. The main constituent of TTO is active in killing Demodex mites, including larvae and eggs, and possesses antibacterial, antifungal, anti-inflammatory, and acaricidal activities. Ten studies have demonstrated varying degrees of TTO efficacy in treating DB. These treatments may help control the mite population, but the TTO concentration in them might be insufficient to eradicate them completely. Moreover, because those compounds have not been rigorously studied in clinical trials specifically for DB, eye care professionals show concern regarding patient tolerability, treatment efficacy, and potential damage to the meibomian glands.

Ivermectin

Ivermectin, isolated from the bacterium Streptomyces avermitilis, selectively binds to invertebrate-specific, chloride channel receptors leading to paralysis and death of the parasite. Although a small case series showed anecdotal evidence of the effectiveness of off-label topical ivermectin 1% cream in producing a reduction in the clinical signs of Demodex infestation, further investigation is needed to confirm its efficacy.

Mechanical Intervention

An option for patients with DB is to remove the parasite from their lids mechanically. Controlling their population is likely to improve symptoms, although temporarily. To do so, there are lid scrubs that patients can use at home. Also, there are instruments to be used by medical professionals that claim to provide a more in-depth removal of excess bacteria, biofilm, and bacterial toxins. A recent study showed that the use of at-home or in-office lid exfoliation is not a consensus among eyecare professionals, and that, if there is an effective therapeutic agent for the treatment of DB, mechanical intervention may no longer be necessary.

Risk Factors

Sales

The cost for a single bottle of XDEMVY™ ophthalmic solution 0.25% is around $1,958 for a supply of 10 milliliters, for cash-paying customers and is not valid with insurance plans, depending on the pharmacy. It is unclear at this point the percentage of patients that would be willing to pay the full price for XDEMVY™, considering cheaper OTC alternatives. Therefore, a slow rollout of access to the drug, until it is widely covered, could result in sales numbers below market expectations. The company has stated that patient out-of-pocket costs are expected to be $100 or less. In fact, some patients have already reported using coupons and rebates to obtain the medication for as low as $50.

Clinical Development

The pharmaceutical industry is inherently risky, and success often depends on factors such as research outcomes, regulatory decisions, and market dynamics. Although a development pipeline covering a wide array of prevalent conditions is a strength, clinical trials are costly, and there is no assurance that results will be positive. Any failure to meet efficacy endpoints, or the rise of safety concerns, are events associated with negative pressure on stock prices.

Liquidity

The company has stated that it has enough liquidity to maintain operations for at least 12 months. In the event that XDEMVY™ sales do not ramp up fast enough to provide sufficient cash flow, it is possible that the company might need to raise more money, which could mean further dilution and negative pressure on the stock price. A liquidity crunch could also put the company in a precarious financial position, forcing management to accept an otherwise unattractive buyout offer in order to survive.

Conclusions

Tarsus is leveraging a known drug compound (lotilaner), with a proven mechanism of action, to develop proprietary formulations and target prevalent eye diseases. XDEMVY™ received FDA approval for Demodex blepharitis and is currently being investigated for meibomian gland disease. From my perspective, considering the target market size, there is potential for XDEMVY™ to eventually become a blockbuster drug with over $1 billion in annual sales. Other lotilaner formulations are being tested for Rosacea and Lyme disease.

The only therapeutic alternatives to XDEMVY™ are off-label and over-the-counter products. Although those have not undergone rigorous clinical testing for efficacy and safety, they could take a significant percentage of the market share within patients without insurance coverage, given their much lower price point.

The company recently raised $100 million through an equity offering. That plus its current cash balance and considering the likely ramp-up of sales in the following quarters puts the company in a relatively comfortable financial position.

The stock is now nearly half the post-FDA-approval peak and less than a third from its all-time high. There is significant upside potential in the near term once sales figures are released and long-term potential for sizeable gains due to the expansion of clinical indications and a possible buyout. In my opinion, the stock price movement after the FDA approval looks unwarranted, possibly a “sell the fact” overreaction

Read the full article here