Dear readers/followers,

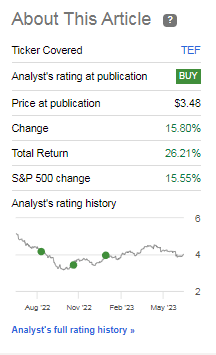

Investing in telecommunications hasn’t been the most profitable venture so far in 2023. Investing in Telefonica (NYSE:TEF) has been profitable since my last article back in mid-January, but overall the investment has failed to outperform most indexes.

Seeking Alpha TEF (Seeking Alpha)

Still, it hasn’t been horrible as such – and I expect the company to be a good performance over time, much like many of the telco investments I’m currently invested in. These companies remain solid income investments, above what you can get from bonds or savings accounts investments, some as high as 8-9% in what I consider to be safe.

In this article, I’ll update you on Telefonica for the 1Q23 period and show you what I expect out of the company and the investment for the remainder of this year.

Telefonica – upside in South-European Telecommunications remains.

Overall, my position in TEF is at a decent RoR due to the low valuation I bought it at. Remember, Telefonica’s largest owners put you in good company – we’re talking about companies like BlackRock (BLK) with 6.7% of the float, with Banks like BBVA, Societe Generale, Caixa, and others in second places, continue to be proponents of the company here.

Telefonica, while having different markets, continues to be Spain-centric, but with the addition of South America and Asia as attractive growth vectors. Telefonica is the second-largest corporation in Spain, behind the Santander Group, and operates under the aforementioned Movistar and O2 brands, Movistar is the largest broadband and phone (both cellular and line) operator in Spain. It’s also a fairly dominant player in Central Europe, with recognizable brands like O2.

Like Telia (OTCPK:TLSNY), Telefonica learned its lesson about unprofitable growth expansion in Eastern Europe and other risky geographies. It left those behind about a decade ago. In South America, the company has significant expertise and already is a leading telephone operator in nations such as Chile, Venezuela, Brazil, and Peru, and the largest in Argentina for fixed lines.

Now, despite Telefonica having one of the worst RoRs over the past 10-20 years, I believe in the upside of this company in the near term – especially at this valuation. The continued upside here is well over double digits each year – but more on that later.

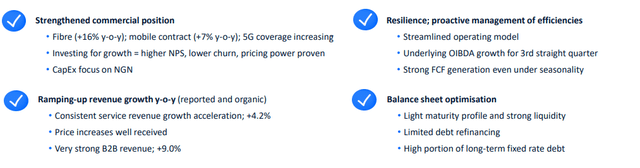

Company results first. Because the results here are solid. The company saw double-digit revenue growth in key geographies, like Spain and Brazil, with good progress in the German 5G rollout. Over 82% of the German population now has 5G coverage – and OIBDA is developing well. In the UK, the company is seeing solid revenue growth.

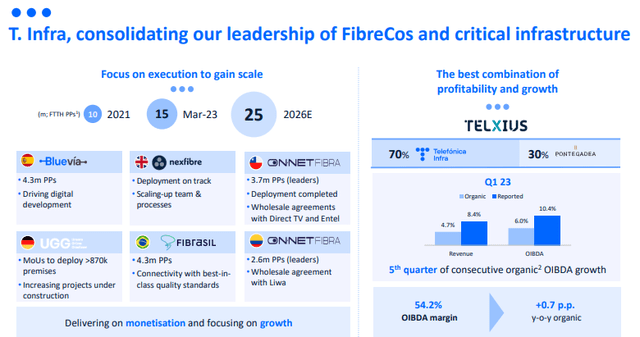

The company’s various parts -tech and infra, meaning the parts outside of the core, are developing well. Telefonica has one of the more attractive infrastructure portfolios out there, with the tech segment, including cloud/cyber expanding 40%+ revenue YoY.

On a company-wide basis, the company saw 4.9% YoY revenue growth. What’s more, the company saw growth in every single business line, with a 1.1% OIBDA growth, over 2% if we exclude CapEx and a reduction in net debt of around €200M since December of 2022. The company generated €500M worth of free cash flow during the quarter.

Some good news reported by the company here.

Telefonica IR (Telefonica IR)

A relevant consideration is also that the legacy copper network is being completely switched off by April of 2024 – if we’re talking about Spain at least. The company is well on track to deliver on its 2023E goal and guidance – low single digit growth in OIBDA and revenue, as well as an overall lower CapEx/sales ratio. 14% is the target – 1Q23 came in at 11.3%. The company is also well on track to deliver its ESG goals, including waste, net-zero, rural coverage, pay gap reductions, and other things.

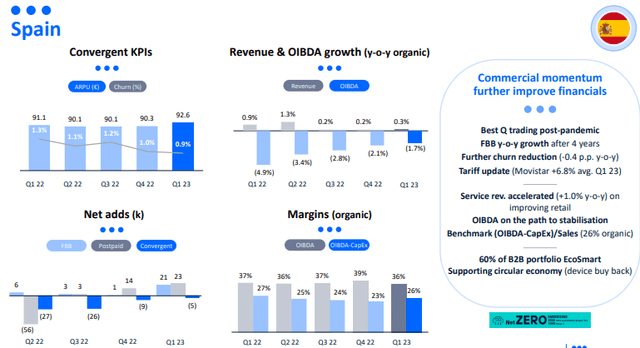

Relative churn is surprisingly low for the company, despite the volatility of some of its geographies. The company, for instance, if we look at Spain, is also managing surprisingly stable margins.

TEF IR (TEF IR)

In other areas, like Germany, the company is managing impressive adds (even if the margins are lower). Remember, a telco usually has solid margins in its home geography, while margins are lower in secondary geographies. The same is true for Orange (ORAN), which has solid margins in France upwards of close to 40% while managing only 30-35% in secondary geographies. Telefonica is the same way, though in Spain with its home geography. The exception here is that Brazil, for Telefonica, is actually the best-margin geography, with current organic margins of 40% on an OIBDA basis.

I also want to take the opportunity and highlight T. Infra, one of the best infrastructure arms of any Telco I invest in.

TEF IR (TEF IR)

The company has reported impressive positive momentum for the first quarter – both as a combination of external trends, as well as the internal execution of its corporate strategy. Revenue is growing, and pricing actions from the company’s side are more than offsetting inflationary pressures and cost pressures from the current macro. The company’s various sub-segments and geographies are doing well, seeing progress in 5G rollout, fibre, and differential infrastructure. Fundamentals and leverage remain strong for the company.

What I am looking at when it comes to Telefonica. EBITDA numbers are significant – so the latest beat is relevant, with an excellent performance out of Telxius (which among other things holds to the company’s submarine cable), with a 54% OIBDA margin and Telefonica Tech especially. However, it’s not just non-recurring excellent performance from two sub-segments, but efficiencies and strategy for costs company-wide that is starting to see results.

This is why I started investing in PIGS and Central-European telco companies years ago, like TEF and ORAN. I saw that once these actually go in line, their performance and reversion potential were going to be significant or massive – and so far, they haven’t disappointed, especially ORAN, where I was able to make market-outperforming RoR even without that 8%+ yield.

Other things to look at for the company or expect are ARPU trends – both market-by-market and company-wide. Any decline or volatility here should be highlighted. We also should consider how the company is pricing compared to peers on a company-wide and sector basis, and see how competitors are matching or beating the offerings – with inflation and cost increases, pricing is going to become key for retaining customers on the B2C side. The company is doing price increases – and so far they seem to be working out, i.e. the company is passing them along successfully.

Also, consider FCF going forward – there is some pressure there. The company is still working on lease optimization and other payment optimization measures. Despite some recent worries from the analyst side on FCF, the company’s FCF for the past few years has been absolutely solid overall – funding the dividend, which at this point is over 6.5%. My own YoC is over 8% for the company, and I’m in the green here – quite significantly.

Telefonica – The valuation is still good enough for a “BUY” here.

The company was at a compelling price around half a year ago. It’s now lower, but it’s still good enough. Based on a normalized EPS growth on an adjusted basis of around 1-3%, the company’s upside at 11.5x to a normalized 12-13x P/E which I consider relevant due to size and the company’s diversification and yield is double-digits here.

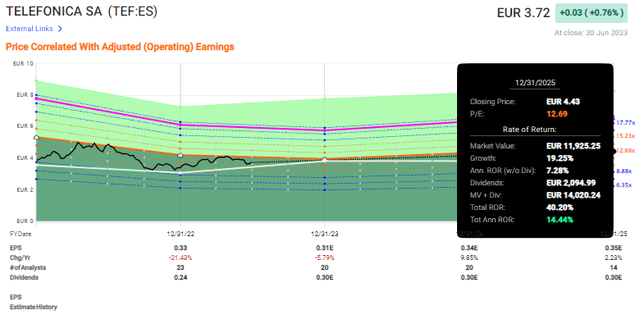

F.A.S.T graphs TEF Upside (F.A.S.T Graphs)

At a near-15% annual upside and around 40% in 3 years, this investment has a good downside protection. Even if Telefonica were to drop back down 20%, I would only buy more of the company.

24 S&P Global analysts follow the company here – 11 of which are currently at a “BUY” or equivalent holding, making it a majority. While there have been times when more of the analysts were positive, we’re still at what I consider to be a convincing long-term upside.

The average PT range is €2.7/share up to €5.5 with an average of €4.4. That’s nearly a 20% upside to the average price target here. Only one analyst has a “SELL” rating.

If we look at every single other European Telco, the company is being pushed at around half those multiples. If you look at TELUS (TU), the same is true – it’s half its revenues, less than 60% of the EBITDA multiple, and a third of the FCF multiple of the Canadian peer. There is reason for the discounting here – obviously TEF is less stable and less exposed to non-volatile geographies compared to some larger peers here. Verizon (VZ) and AT&T (T) are other good examples – all of these companies are currently “BUYs” on par on the level we see here.

Telecommunication companies are currently in a very good position for long-term profitable investment. While nay-sayers continue to point to their sub-par recent performance due to lower growth rates in an environment characterized by higher costs (inflation, tightening spreads, higher overall costs), I remain at a position where I see them as very solid income investments. A 6-9% yield, which you can get from safe and A-rated or equivalent-safety Telco’s at this time, is more than twice the amount (or thereabout) you can get risk-free. If you have enough time to wait for a reversal, that means that you can get a much higher RoR than if you were to invest in preference stocks or bonds – at least in theory.

My own logic for investing in preferreds or bonds as opposed to common share investments has always been if I view the common shares or company as being either less safe, or the returns for the former to be “better” compared to the common. With TEF or similar telco investments, that simply isn’t the case.

That is why i remain heavily invested in the telco sector and make averages of 5-9.5% yield from these investments. I know that reversal, even full reversal, is going to take time – but that’s fine.

And sometimes the company’s surprise you. ORAN is one of them. And TEF, if you look back at my previous article on the company, has managed this.

Seeking Alpha Telefonica RoR (Seeking Alpha)

With those returns, I’m very happy to continue putting money to work strategically – and this company is certainly one of those potentials.

Here is my updated thesis for Telefonica.

Thesis

My thesis for Telefonica is as follows:

- Telefonica is currently one of the cheapest telco majors in all of Europe, and one that warrants individual attention and consideration, even with everything that’s happening here – and even with the valuation now being higher than prior.

- There are reasons for the valuation, but I view those reasons as unfairly discounting the fundamental advantages of the company. We can heavily discount the cash flows, assets, and multiples, and still come out with higher targets than the market is giving us for Telefonica.

- I view this one as a “BUY” with a €5/share price target – it’s unchanged from my last target, and I consider some premiumization to be relevant here.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

It bears mentioning that we have BBB- here, but this does not take away from this valuation. I like what I see here and remain very positive. I just don’t consider it “cheap” any longer – but it’s still attractive.

Read the full article here