The race against recession

Until the December FOMC meeting, the Fed was signaling that it needed to induce a recession to bring down inflation – that was the “higher for longer” policy. The Fed was willing to hold interest rates at a restrictive level until the labor market weakened, and the economy contracted, which was supposedly necessary to bring inflation down to the 2% target.

At the December FOMC meeting, the Fed signaled that it does not need to induce a recession to bring down inflation, and thus, it signaled that it will lower interest rates to prevent an unnecessary recession. The lagged effects of the prior monetary policy tightening are expected to eventually cause a recession. Thus, the Fed now plans to remove the restrictive monetary policy before the expected recession arrives – with the aim of canceling that recession. That’s called interest rate normalization policy.

However, the interest rate “normalization” policy must be aggressive to make sure the monetary policy restriction is removed before the recession arrives. Thus, the market expects the Fed to start cutting interest rates in March.

So, it’s really a race between the expected Fed cuts and the expected recession. Will the Fed be able to remove the restriction quickly enough before the recession comes?

Note, there are other variables that are in favor of the recession. For example, the student loan payments have resumed, and it looks like each borrower now has to divert around $300/month on average for student loan payments on a national average of $27,000 loan balance. That is likely to reduce discretionary spending. Also, it looks like most of the pandemic-era savings are now mostly exhausted. Thus, the Fed should move aggressively, as the market expects, to ensure a soft landing.

The expected Fed cuts

The market currently expects the Fed to start cutting interest rates in March (with 81% probability), and to cut down to 3.73% by December 2024 (from currently 5.33%), which implies at least six cuts in 2024, and further down to 3.03% by October 2025, or three more cuts in 2025. Note, the Fed projects a 3% interest rate in 2026, so the market is simply assuming that the Fed will get there much faster – by late 2025, with most cuts in 2024. This makes sense because the Fed’s easing has to be aggressive to prevent a recession.

|

Theme |

Near Term |

First cut |

Dec 2024 |

Terminal (2.5% long-run neutral – dot plot) |

|

Soft landing – normalization |

Pause 5.33% |

March (prob. 81%) |

3.73% (Fed: 4.6%) |

3.03% Oct 25 (Fed 25: 3.6%, Fed 26: 2.9%) |

The key recession indicator

The US economy remained resilient as the Fed was hiking interest rates in 2022 and 2023 due to the strong labor market, and the labor market remained strong due to the labor shortage. Thus, as long as the labor market remains tight, the US economy is not likely to enter a recession.

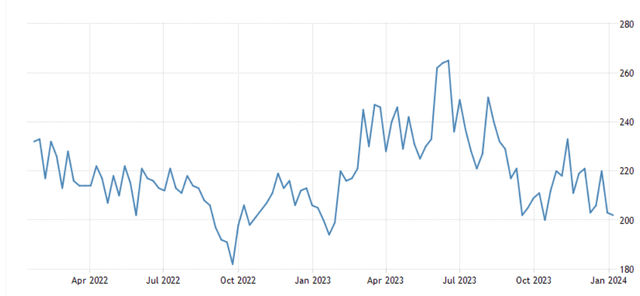

Thus, the initial claims for unemployment are the key leading recession indicator – once the initial claims start spiking, the recession becomes inevitable. Currently, the initial claims are very low, near the 200K level, and thus, the probability of an imminent recession is very low. Once the initial claims move sustainably above the 250K level towards the 300K level, the recession probability will significantly increase.

Thus, the Fed is likely to achieve a soft landing if it acts aggressively, as the market expects, given the tight labor market. A delay in cuts could be costly.

Trading Economics

Disinflation is predictable until June

The Fed has been able to pivot because the disinflationary process has been faster than expected, and it’s expected to continue. However, the disinflation process is predictable until June.

Specifically, the fall in shelter inflation is predictable (and this is important because shelter accounts for 60-70% of total inflation) based on the New Tenant Rent Index, which is back to the pre-pandemic levels, and it’s the leading indicator for shelter inflation. Thus, shelter disinflation is likely to stall during the summer of 2024.

Also, the fall in core CPI inflation is predictable until June due to the base effects – the monthly core CPI had a deep drop in June 2023 after the inflationary spike and guarantees the fall in core inflation as long as the monthly core CPI continues to come below 0.4%, and recently the core CPI has been rising at 0.2-0.3% pace.

However, the monthly core PCE must come down to 0.1-0.2% for the annual inflation to reach the 2% target. The current pace of monthly inflation at the 0.2-0.3% pace puts the annual inflation at around 3% in June – and that’s when and where the disinflationary process could stall.

The risk of stagflation

The Fed also projects that the GDP growth will slow to 1.5% in 2024, so if we do have inflation at 3% in the summer of 2024, with GDP growth at 1.5%, the market narrative could shift to a stagflation – low growth and higher inflation. In this situation, the Fed would not be able to further cut interest rates as the disinflationary process stalls due to the sticky 3% inflation – at the time the economy could need a boost.

But more importantly, the Fed’s race against recession could actually boost inflation, especially in an environment of tight labor market and the unfolding trend of deglobalization. Thus, the Fed could shift back to the “higher for longer policy” during the summer of 2024, acknowledging that the return to the 2% inflation target is difficult to achieve without a recession.

Implications

The interest rate normalization policy is positive for the stock market (SP500).

- Lower interest rates support PE multiples, with possible expansion, but no contraction, and this is positive for overvalued big tech stocks (QQQ) and continues to support the AI theme.

- No recession means that earnings growth continues, which is overall positive for stocks. The Fed pivot could trigger the inflows into cyclicals and small-cap stocks (IWM), which were priced for a recession.

- No credit crunch (due to lower interest rates) means no forced selling and bankruptcies, which is positive for overleveraged small stocks, and REITS (XLRE), and banks (KRE).

However, this outlook is valid as long as the normalization theme holds, which is likely at least until June. Given the uncertainties with respect to growth and inflation after the disinflationary process likely stalls in June, the investors should be ready to possibly Sell in May. The second half of 2024 will be more challenging.

Read the full article here