In August, I tactically went short the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (BATS:TLTW), as I felt the U.S. government’s fiscal profligacy and rising global yields meant that the path of least resistance was up for long-term yields.

Soon after I published my article, the TLTW ETF entered a steep decline, as the U.S. economy surprised to the upside, fanning fears that the Federal Reserve would keep short-term interest rates ‘higher for longer’. A ‘higher for longer’ Fed meant that short-term interest rates would not be declining anytime soon. This risked pushing long-term yields higher, since long-term interest rates can be thought of as short-term rates plus a ‘term premium’.

Furthermore, the U.S. government’s increased issuance of coupon bonds to fund its enormous annual deficit swamped treasury markets, which was already suffering from a lack of buyers as banks were hamstrung by unrealized mark-to-market losses from prior purchases and foreign buyers were stepping away from U.S. treasuries. This led to multiple ‘tailed’ treasury auctions where investors demanded far higher interest rates to bid for treasury bonds.

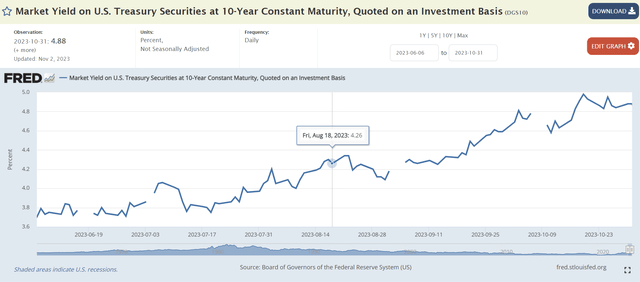

In total, the 10 year treasury yield widened by 62 bps from 4.26% on August 18th to 4.88% on October 31st, and had briefly surpassed 5% (Figure 1).

Figure 1 – 10 year treasury yields rose significantly since August (St. Louis Fed)

This rise in long-term yields led to a sharp 8.5% decline in the TLTW ETF and a 10.3% decline in the underlying iShares 20+ Year Treasury Bond ETF (TLT), measured from August 18th to October 31st (Figure 2).

Figure 2 – Causing steep losses for TLTW and TLT (Seeking Alpha)

As I have warned in prior articles on BuyWrite strategies, although they may outperform their underlying assets by selling upside calls, when markets are caught in serious downdrafts as we witnessed recently in treasury markets, the nominal premium income is little solace against significant capital losses.

Upgrading TLTW To Neutral Following Treasury QRA

In the short-term, I recently covered my tactical bearish bet against long-term treasury bonds on November 1st, following the Treasury Department’s Quarter Refunding Announcement (“QRA”) (Figure 3).

Figure 3 – Author exited bearish position on TLTW on November 1st (Seeking Alpha)

On the surface, the November QRA is still quite large, with the Treasury needing to borrow $776 billion in the October to December quarter. However, this figure is actually $76 billion lower than originally forecasted back in August.

In a recent article on the US Treasury 3 Month Bill ETF (NASDAQ:TBIL), I explained how the August QRA acted as a liquidity drain for the financial markets as the Treasury had to borrow $274 billion more than originally forecasted. Since the October to December Treasury borrowing is less than expected, the November QRA may act as a liquidity booster for financial markets.

Moreover, reading the Treasury Borrowing Advisory Committee’s (“TBAC”) report to the Treasury Secretary, this passage stood out:

Ultimately, the Committee’s second charge highlighted the importance of retaining flexibility in issuance strategy within Treasury’s regular and predictable framework. The charge suggested Treasury consider skewing increases in issuance towards tenors which have less sensitivity to term premium increases, and ones that benefit from greater liquidity. The Committee supported meaningful deviation from the historical recommendation for 15-20% T-Bill share. While most members supported a return to within the recommended band over time, the Committee noted that the work Treasury has done to meaningfully increase WAM over the past 15 years affords them increased flexibility with T-Bill share in the medium term.

(Author highlighted relevant sentences)

The gist of this report is that the Treasury will be significantly increasing the share of treasury bill issuances in the short- to medium-term, above the historical 15-20% share, in order to avoid exacerbating the term premium pressures pushing long-term yields higher.

With lower than expected total issuance and lower than expected coupon bond issuances in the coming few months, it no longer made sense to maintain a tactical short on long-term treasuries.

TLTs Deeply Oversold With Positive Divergence

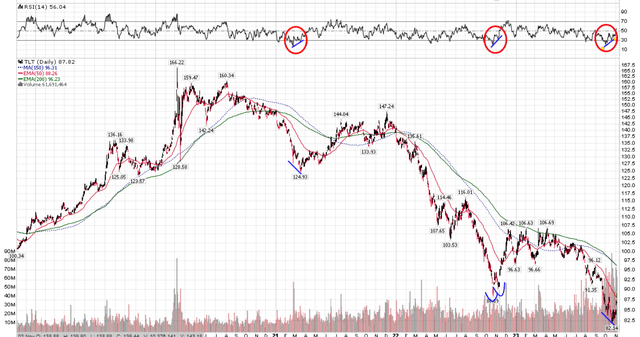

Another reason why I decided to close out my short recommendation was because shorting treasuries had become deeply consensus, with the TLT ETF registering deeply oversold Relative Strength Indicator (“RSI”) readings with positive divergence, similar to meaningful rallies in the past (Figure 4).

Figure 4 – TLT deeply oversold with postive divergence (Author created with stockcharts.com)

Nimble traders can even consider entering a long position in TLT and TLTW, as the sentiment pendulum had swung very far to the downside and may reflexively squeeze higher on short-covering.

Long-Term Problems Remain Unresolved

However, investors are cautioned against getting too bullish on treasury bonds and the TLTW, since the root cause of the problem, the U.S. fiscal situation, remains unresolved.

According to a recent interview with famed hedge fund manager Stanley Druckenmiller, if interest rates stay where they are and the U.S. government continues to rack up deficits as projected by the Congressional Budget Office (“CBO”), the government’s yearly interest expense will reach 4.5% of GDP by 2033 and 7% by 2043. This is equivalent to 144% of the government’s discretionary spending on programs like national defense, foreign aid, education, and transportation!

So while tactically, I believe a relief rally on bonds may be in order given the Treasury surprise, longer-term, I am still quite bearish on the TLT and TLTW ETF.

Risks To TLTW

The biggest risk to maintaining a cautious view on the TLTW ETF is if long-term interest rates were to decline, that will buoy long-duration bond funds like the TLT and TLTW. This could occur if the U.S. economy were to weaken and investors start to position for lower short-term interest rates.

However, I believe upside on the TLTW ETF is capped, as it sells call options to generate premium income.

Conclusion

The TLTW ETF declined by over 8% since my last article as U.S. treasury bond issuances to fund government deficits swamped investor demand, causing yields to rise.

However, tactically, I am now neutral, as the Treasury recently announced a positive surprise for the upcoming October-December quarter in terms of treasury bond issuance. Nimble traders may even consider a tactical long position to play the short-squeeze, given how bearish everyone had been positioned.

However, the longer-term fiscal picture remains dire for the U.S. government, with interest expenses expected to reach 4.5% of GDP by 2033.

Read the full article here