Introduction

Topicus.com Inc. (TSXV:TOI:CA), the Constellation Software (OTCPK:CNSWF) spin-off, recently released its Q3 FY23 earnings results. Topicus is positioned as a leading vertical software solution and platform provider. Vertical software are niche software solutions designed for a specific industry. Vertical software is a broader term and includes specific subsets like vertical SaaS (vertical software as a service). Vertical SaaS is the current trend and it has gained popularity in the last few years, and its adoption continues to rise, especially, among professional services firms. Niche-specific demand for SaaS offerings is gaining traction because of its SaaS-related advantages like faster time to market, scalability, and cost-effectiveness, among others. The adoption rate of vertical SaaS has pushed cloud providers to begin offering cloud services focused on specific industries. Microsoft introduced its Cloud for Retail platform about two years ago. The platform targets the retail sector; it provides solutions to improve e-commerce personalization, supply chain optimization, analytics and insights, security, and other features for cloud-based retail stores. Microsoft also launched its Cloud for Healthcare platform in October 2020. Google and Amazon have developed software platforms that target specific industries. Amazon, via its cloud platform AWS, has developed niche-specific cloud offerings including AWS for Retail and AWS for Industrial.

Topicus strategically positions itself in the vertical finance, education, and healthcare industries, having acquired or developed comprehensive platforms for each of these segments. Topicus Pension and Wealth platform serves wealth managers and their clients, Findesk for mortgage advisers, Somtoday for schools, and Fyndoo for corporate financing, among several other vertical software platforms targeting segments within the aforementioned industries. Topicus’ niche-specific software offerings continue to expand through acquisitions, giving the company a steady competitive advantage. Topicus mainly invests and operates in Europe, which can be considered a strategic advantage.

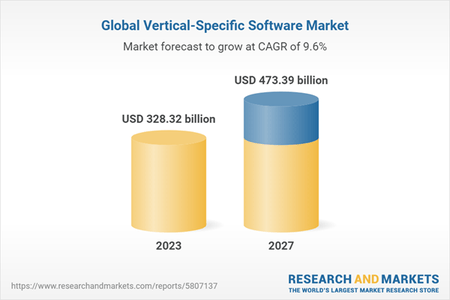

Vertical SaaS Market (Research and Markets)

Topicus’ latest results were decent, showing the company’s favorable position in the growing vertical software and vertical SaaS market. The global vertical software market is currently valued at $328.32 billion and is expected to reach $473.39 billion by 2027, according to market data and statistics website Research and Markets.

A Look At Q3 Numbers

Topicus’ growth is fast-paced, especially because of its serial acquisitions. Topicus’ business model involves building or acquiring and managing software companies providing specialized, niche software solutions. When Topicus acquires a niche software company, it typically involves taking over the acquired company’s assets, customer base, and revenue streams. This leads to an inorganic increase in Topicus’ overall balance sheet and financial metrics.

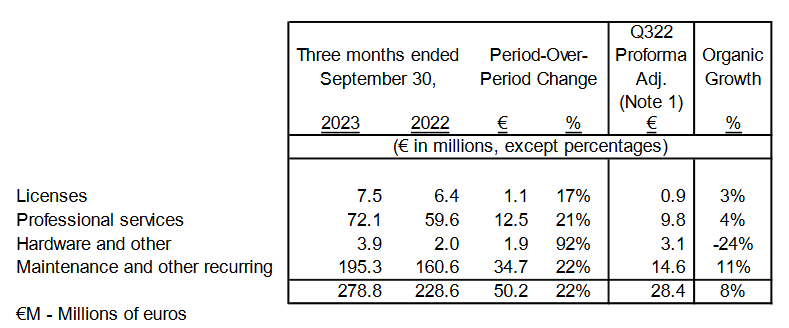

Q3 Aggregated Revenue (Topicus MD&A)

Topicus mainly makes the bulk of its money from professional services, and maintenance, and other recurring fees. In Q3, Topicus recorded €278.8 million (~$294.8 million) in sales, representing a 22% YoY growth. The top line grew organically by 8% in Q3. An aggregated breakdown of revenue shows that maintenance and recurring revenues currently make up about 70% of the top line, while licenses revenue makes up about 2.6% of Q3’s topline. Based on my analysis, I think this composition of the top line is a somewhat good outlook.

In my view, having a significant portion of revenue coming from maintenance and recurring fees can be considered a positive factor. Maintenance and recurring fees often come from existing customers who continue to use and value Topicus’ software products and platforms. High levels of recurring revenue indicate a strong customer base and customer loyalty. Another reason why high recurring revenue is a good thing for Topicus is that it contributes to a more predictable cash flow, enabling the company to plan investments and other strategic moves, especially its serial M&A, with greater confidence. Conversely, I think a very small licenses revenue needs to be improved upon. License revenues are associated with perpetual licensing fees for new product or service purchases. Low licenses revenue could mean a low influx of new customers.

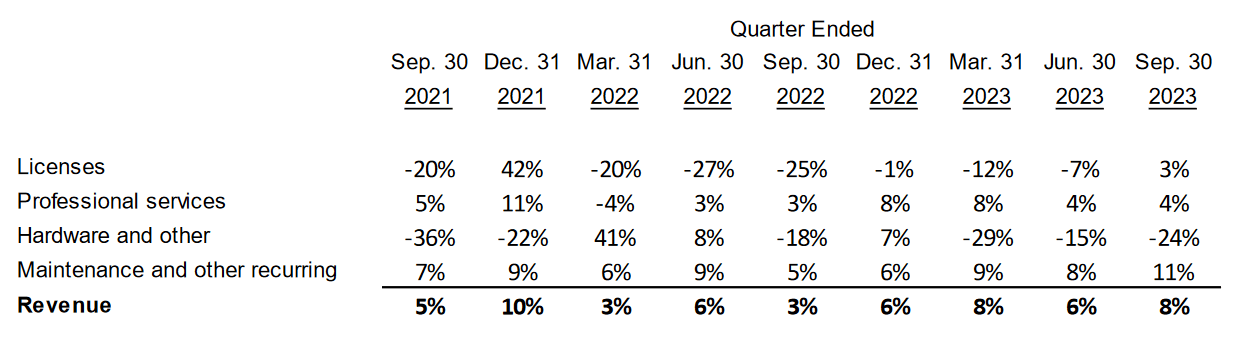

Organic Revenue Trend (Topicus MD&A)

The figure above shows the organic growth trend of different compositions of Topicus’ revenue since Q2 FY21. Maintenance and other recurring revenue have seen steady organic growth for multiple quarters. This organic growth trend seems good since most of Topicus’ cash flow is used for M&A rather than reinvesting into existing businesses.

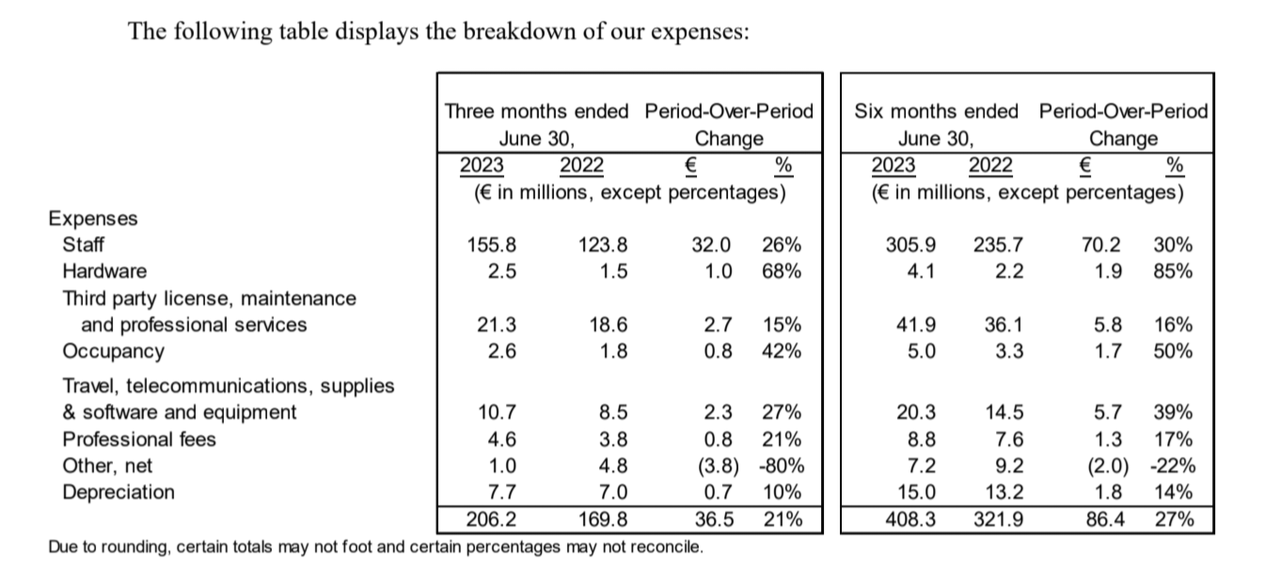

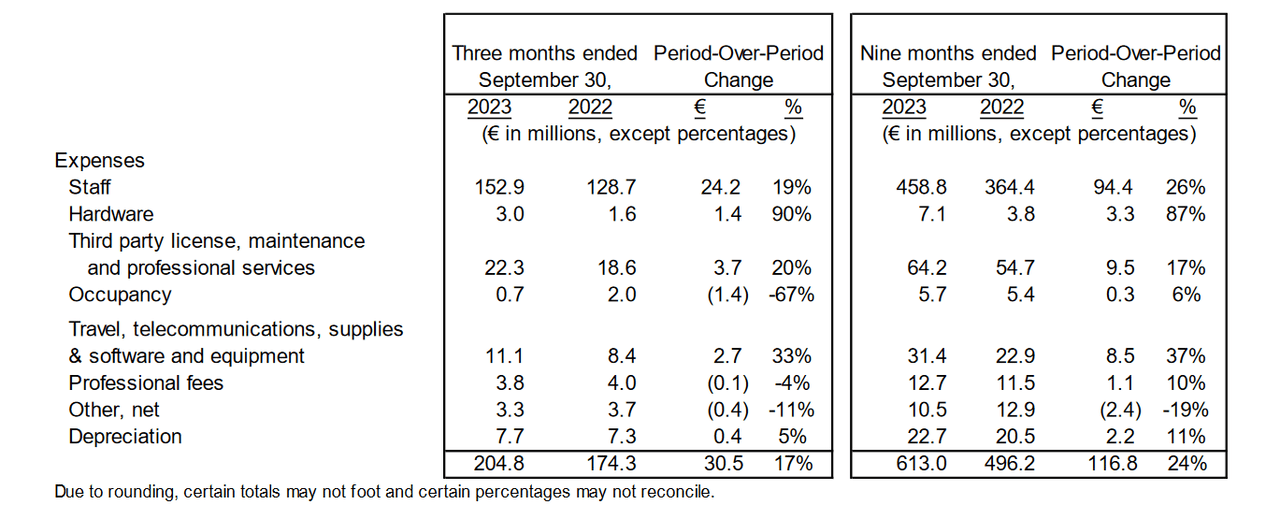

Q2 Expenses Breakdown (Topicus MD&A) Q3 Expenses Breakdown (Topicus MD&A)

Topicus Q3 expenses showed a slight improvement over the last quarter. Though revenue grew by about 2.5% between quarters (from €272.1 million in Q2 to €278.8 million in Q3), expenses showed a slight decrease. Q2 expense was €206.2 million, which decreased by 0.7% to €204.8 million in Q3. This indicates effective cost management between quarters. If Topicus continues with this trend for the coming quarters, it will strengthen the bottom line.

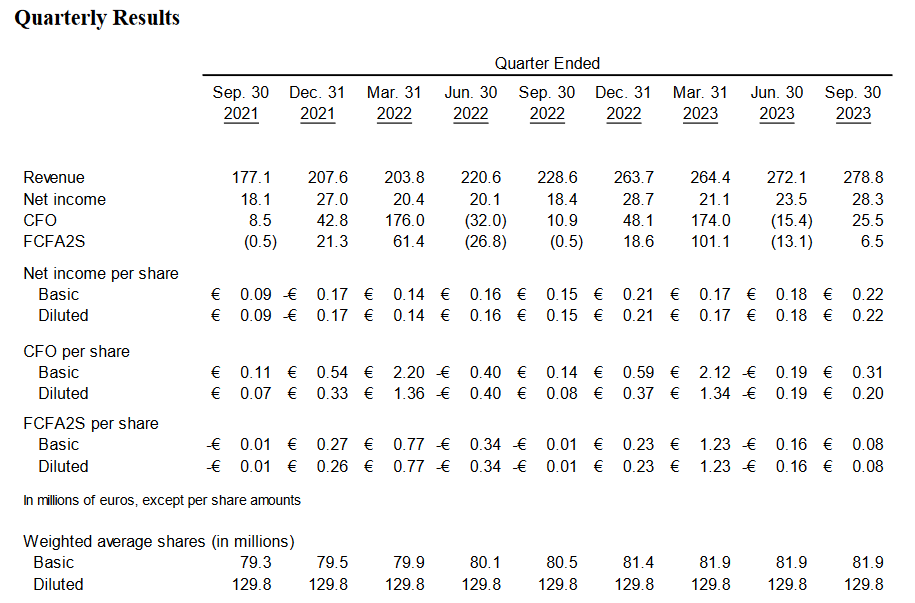

Quarterly Results Trend (Topicus MD&A)

Q3 net income for Topicus was €28.3 million, marking a YoY increase of €9.9 million or 53.8%. This growth translates to both basic and diluted EPS values of €0.22. Notably, diluted EPS retains its basic value due to Topicus’ simple capital structure, which lacks convertible securities, stock options, or other instruments that could lead to dilution. Over the years, Topicus management has adopted a conservative approach to issuing securities which could lead to dilution, reflected in its stable quarterly results. This stability is among the many factors that make this stock attractive.

In Q3, Topicus generated €25.5 million in cash from operations (CFO). After applying non-GAAP adjustments, the adjusted figure stands at €12.8 million. This is a significant improvement in cash generation from core operations compared to the same period in FY22. Similarly, Q2’s CFO, which was -€15.4 million, was a 780 basis point improvement over Q2 FY22’s CFO of -€32 million. The generation of adequate cash from core business activities is beginning to look sustainable and stable for Topicus. It is worth noting that Topicus’ cash flow experiences some seasonality because its businesses invoice their customers for annual maintenance fees in Q1 each year, which leads to a significant surge in cash in Q1 of every fiscal year. Q1 CFOs can be considered an outlier; however, a YoY comparison of Q2 and Q3 CFOs gives a somewhat clearer picture.

Conclusion

Topicus had a decent financial performance in Q3. Topicus is a long-term hold for patient investors who value stability. Monitoring the company’s recurring revenue trend and the organic growth rate of its revenue, its expense management trends, and its ability to sustain cash generation from core operations will be key factors for future investment decisions.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here