This article is part of a series that provides an ongoing analysis of the changes made to Yacktman’s 13F stock portfolio on a quarterly basis. It is based on Yacktman Asset Management’s regulatory 13F Form filed on 8/2/2024. Please visit our Tracking Yacktman Asset Management series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q1 2024.

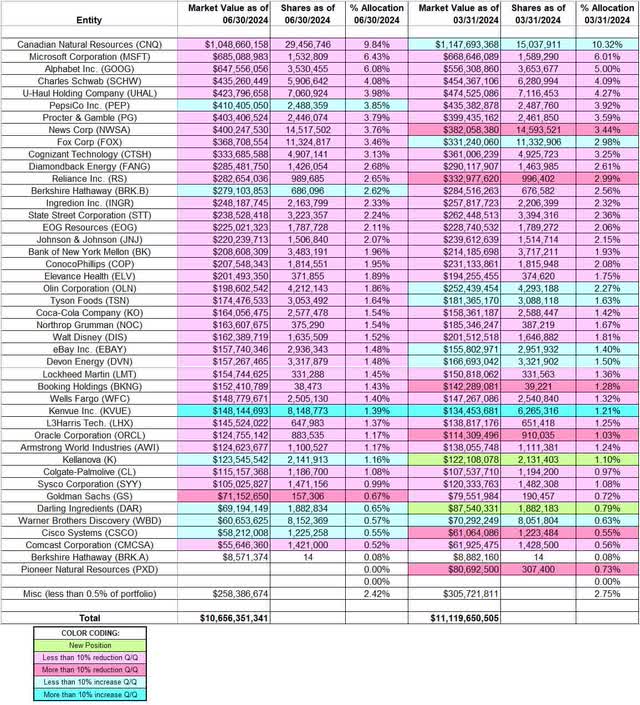

This quarter, Yacktman Asset Management’s (MUTF:YACKX) (MUTF:YAFFX) (MUTF:YASSX) 13F portfolio value decreased from $11.12B to $10.66B. The number of holdings decreased from 73 to 72. The largest holding is Canadian Natural Resources at 9.84% of the 13F portfolio. The largest five individual stock positions are Canadian Natural Resources, Microsoft, Alphabet, Charles Schwab, and U-Haul. Together they account for ~30% of the 13F portfolio. The firm currently holds around ~8.5% cash. The portfolio is concentrated, with recent 13F reports showing around 70 individual positions. 42 of their stakes are significantly large (over ~0.5% of the 13F portfolio each) and they are the focus of this article.

Note: Two of their top holdings in their flagship Yacktman Fund are not in the 13F report as they are not US-listed 13F securities – Bollore SE (OTCPK:BOIVF) and Samsung Electronics (OTCPK:SSNLF) Preferred. The fund has generated alpha since its 1992 inception (10.40% annualized, compared to 9.69% for the Russell 1000 Value Index and 10.53% for the S&P 500 index).

Stake Disposals:

Pioneer Natural Resources (PXD): The 0.73% PXD position was established during Q3 2022 at prices between ~$205 and ~$263. Q1 2023 saw a ~75% stake increase at prices between ~$182 and ~$242. The stake was decreased by ~13% during Q4 2023 at prices between ~$212 and ~$252. That was followed by a ~72% selling in the last quarter at prices between ~$214 and ~$263. Exxon Mobil (XOM) acquired PXD in an all-stock deal (2.3234 shares of XOM for each share of PXD) that closed in May, thereby eliminating this position.

Stake Increases:

PepsiCo, Inc. (PEP): PEP is currently at 3.85% of the portfolio. It was built over multiple years, with the bulk established in the 2011-13 period: over 22M shares were purchased during that time at prices between $60 and $86. The six quarters through Q3 2016 had seen a two-thirds reduction at prices between $91 and $111. The last three quarters of 2019 had also seen another ~40% selling at prices between $121 and $140. That was followed by a ~25% reduction in Q1 2020 at prices between $104 and $147. Q2 2021 saw a one-third increase at prices between ~$141 and ~$149 while during H2 2022 there was a ~40% selling at prices between ~$162 and ~$186. The stock currently trades at ~$178. There was minor trimming over the last six quarters, while this quarter there was a marginal increase.

Berkshire Hathaway (BRK.A) (BRK.B): Berkshire position saw a significant stake build-up in Q1 2021 at prices between $222 and $264. It is now a sizable ~2.70% of the portfolio position. The stock currently trades at ~$428. The last several quarters saw only minor adjustments.

Kenvue Inc. (KVUE): KVUE is a spinoff from Johnson & Johnson that started trading in May 2023. Shares started trading at ~$27 and currently go for $18.82. Last July, Johnson & Johnson shareholders were offered Kenvue shares at a ~7% discount through an exchange offer. The position was increased by ~43% during Q4 2023 at prices between $18.02 and $21.55. The last quarter also saw a ~16% increase. That was followed by a ~30% increase this quarter at prices between $17.96 and $21.01. The position is still very small at 1.39% of the portfolio.

Note: Yacktman has a stake in Johnson & Johnson.

Kellanova (K): The 1.16% Kellanova stake was established in the last quarter at prices between ~$53 and ~$58 and the stock currently trades above that range at ~$63. There was a marginal increase this quarter.

Darling Ingredients (DAR): The small 0.65% DAR position was purchased in the last quarter at prices between ~$41 and ~$51 and it is now below that range at $37.52. There was a marginal increase this quarter.

Warner Bros. Discovery (WBD), and Cisco Systems (CSCO): These very small (less than ~1% of the portfolio each) positions were increased during the quarter.

Stake Decreases:

Canadian Natural Resources (CNQ): CNQ is currently the largest 13F position at 9.84% of the portfolio. It was purchased in Q1 2021 at prices between $11.25 and $16.25. There was a ~90% stake increase in the next quarter at prices between $14.70 and $19. That was followed by a ~30% increase in Q3 2021 at prices between $15.20 and $18.25. The stock currently trades at $33.38. The last several quarters saw only minor adjustments, while this quarter there was a ~9% trimming.

Note: the prices quoted above are adjusted for the 2-for-1 stock split in June.

Microsoft Corporation (MSFT): MSFT has been in the portfolio since 2003, and it became a significantly large position in 2006 when around 2.2M shares were purchased at prices between $22 and $29.50. ~20M shares were added in 2011 at prices between $24 and $28.50. The six years through 2019 saw the position reduced by ~95% at prices between $36 and $190. Q2 2020 also saw a ~17% selling at prices between $152 and $204. There was a ~15% stake increase in Q1 2021 at prices between $212 and $245. Since then, there have been minor adjustments in most quarters. The stock currently trades at ~$409 and the large (top three) stake is at 6.43% of the portfolio. Q4 2023 saw an ~8% trimming, and that was followed by a ~7% trimming over the last two quarters.

Alphabet Inc. (GOOG): The ~6% (top three) stake in GOOG was established in Q1 2019 at prices between ~$51 and ~$62, and it now goes for ~$168. Q1 2020 saw a one-third stake increase at prices between ~$53 and ~$77. The last three quarters saw a ~16% trimming.

Charles Schwab (SCHW): The ~4% of the portfolio stake in SCHW was first purchased in Q4 2020 at prices between $37 and $53. There was a ~20% stake increase during Q4 2022 at prices between ~$67 and ~$83. That was followed by a ~47% stake increase during Q1 2023 at prices between ~$52 and ~$86. The stock is now at $63.39. The last few quarters have seen minor trimming.

U-Haul Holding Company (UHAL): The large ~4% of the portfolio UHAL position saw a ~50% stake increase during Q1 & Q3 2020 at prices between ~$24.20 and $38.40. Q2 2021 saw another ~75% stake increase at prices between ~$52.70 and ~$63.20. That was followed by a ~60% stake increase in Q1 2022 at prices between ~$55.70 and ~$72.60. The position was increased by ~17% during Q3 2023 at prices between $54.57 and $62.10 while in the next quarter, there was a ~8% selling at prices between $48.72 and $72.27. The stock currently trades at $64.92. The last two quarters also saw minor trimming.

Note: the prices quoted above are adjusted for the 10-for-1 stock split in November 2022.

Procter & Gamble (PG): PG is a very long-term position that has been in the portfolio since Yacktman’s first 13F filing in 1999. The position size remained insignificantly small until 2007 when about 520K shares were purchased at prices between $61 and $74. The stake was cut in half in 2008, but the following four years saw a 100-fold stake increase at prices between $47 and $70. The four quarters through Q3 2016 saw a 50% reduction at prices between $72 and $90. The six quarters through Q1 2020 saw another ~80% selling at prices between $80 and $128. The stock currently trades at ~$170 and the stake is now at 3.79% of the portfolio. There was a ~8% trimming during Q1 2023 and that was followed with minor selling over the last five quarters.

News Corporation (NWSA): The 3.76% portfolio position was built in 2019 at prices between $12.50 and $14.60. Q1 2020 also saw a ~30% stake increase at prices between $8.20 and $15. There was a ~25% selling in Q1 2021 at prices between $18 and $27.30. The stake was decreased by 13% in the last quarter at prices between $23.39 and $26.78. The stock currently trades at $26.30. There was marginal trimming this quarter.

Fox Corporation (FOX): The FOX stake came about because of the merger transaction between Walt Disney and Twenty First Century Fox in March 2019. Yacktman had a huge position in Twenty First Century Fox. The deal terms were ~$38 per share in cash or Disney stock subject to a collar and one-third of one share of new Fox for each share of Twenty First Century Fox. The last three quarters of 2019 had seen a ~42% stake increase at prices between $30 and $39. Q1 2020 saw another ~55% stake increase at prices between $20 and $38.60. There was a ~38% reduction over the two quarters through Q1 2021 at prices between ~$25 and ~$41.50. The stock currently trades at $34.88, and the stake is at 3.46%. The last three years have seen only minor adjustments.

Cognizant Technology (CTSH): The 3.13% portfolio stake in CTSH saw a stake doubling in Q2 2019 at prices between $56.75 and $74.60. There was a ~60% stake increase in Q1 2020 at prices between $42 and $71.50. That was followed by a one-third increase in Q3 2021 at prices between $66.50 and $78. The stock currently trades at ~$74. The last several quarters have seen minor trimming.

Diamondback Energy (FANG): The 2.68% FANG stake was increased by ~5% during Q4 2023 at prices between ~$142.05 and ~$166. The last quarter saw similar trimming at prices between ~$147 and ~$198. It currently trades at ~$189. There was a minor ~3% trimming this quarter.

Reliance, Inc. (RS): RS is a 2.65% of the portfolio position established in Q4 2021 at prices between ~$141 and ~$167 and the stock currently trades well above that range at ~$287. There was a ~20% stake increase in Q1 2022 at prices between ~$149 and ~$195. The stake was decreased by 18% in the last quarter at prices between ~$275 and ~$337. This quarter saw marginal trimming.

Ingredion Incorporated (INGR): The 2.33% INGR stake was purchased in Q3 2020 at prices between $75 and $90 and increased by ~170% next quarter at prices between $69 and $82. The stock currently trades well above those ranges at ~$123. The last three years have seen minor trimming.

State Street Corporation (STT): The 2.24% STT stake saw a ~150% increase in Q4 2018 at prices between $60 and $87. Q3 2019 saw another ~63% stake increase at prices between $49 and $61. There was a ~20% selling over the three quarters through Q2 2020. The stock currently trades at $80.91. The last few quarters have seen minor trimming.

EOG Resources (EOG): The 2.11% EOG stake was increased by ~5% during Q4 2023 at prices between ~$115 and ~$134. It is now at ~$123. There was marginal trimming in the last two quarters.

Johnson & Johnson (JNJ): JNJ is a ~2% of the 13F portfolio position that has been in the portfolio since their first 13F filing in Q1 1999. The bulk of the original position was purchased in 2011 in the low-sixties price range. 2015-18 saw a combined ~45% reduction at prices between $91 and $147. The three quarters through Q2 2020 saw another ~50% selling at prices between $111 and $156. That was followed by a ~25% reduction during Q3 2023 at prices between ~$156 and ~$173. The stock currently trades at ~$164. There was marginal trimming in the last three quarters.

ConocoPhillips (COP): The ~2% COP stake was primarily built during Q3 2022 at prices between ~$82 and ~$118. The stock is now at ~$106. The last seven quarters saw only minor adjustments.

Olin Corporation (OLN): OLN is a 1.86% of the portfolio stake established during Q2 2023 at prices between ~$47 and ~$58 and the stock currently trades below that range at ~$43. The last four quarters saw only minor adjustments.

Booking Holdings (BKNG): BKNG is a 1.43% of the portfolio position purchased in Q1 2019 at prices between $1650 and $1935. Q2 2020 saw a ~20% reduction at prices between $1231 and $1841. There was another ~20% selling during Q2 2023 at prices between ~$2509 and ~$2781. That was followed by a ~50% reduction in the next quarter at prices between ~$2633 and ~$3243. The stake was decreased by ~19% during Q4 2023 at prices between ~$2743 and ~$3567. That was followed by a ~16% reduction in the last quarter at prices between ~$3400 and ~$3892. The stock currently trades at ~$3328. This quarter saw minor trimming. They are harvesting gains.

Armstrong World Industries (AWI), Bank of New York Mellon (BK), Colgate-Palmolive (CL), Coca-Cola Company (KO), Comcast Corporation (CMCSA), Devon Energy (DVN), eBay Inc. (EBAY), Elevance Health (ELV), Goldman Sachs (GS), Lockheed Martin (LMT), L3Harris Technologies (LHX), Northrop Grumman (NOC), Oracle Corporation (ORCL), Sysco Corporation (SYY), Tyson Foods (TSN), Walt Disney (DIS), and Wells Fargo (WFC): These small (less than ~2% of the portfolio each) stakes were reduced during the quarter.

Note: Yacktman is known to shy away from investing in banks but has held significant stakes in banks since the financial crisis: The Bank of New York Mellon (1.96%), Wells Fargo (1.40%), and State Street Bank (2.24%) are the current holdings.

The spreadsheet below highlights changes to Yacktman’s 13F stock holdings in Q2 2024:

Donald Yacktman – Yacktman Asset Management Portfolio – Q2 2024 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Yacktman Asset Management’s 13F filings for Q1 2024 and Q2 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here