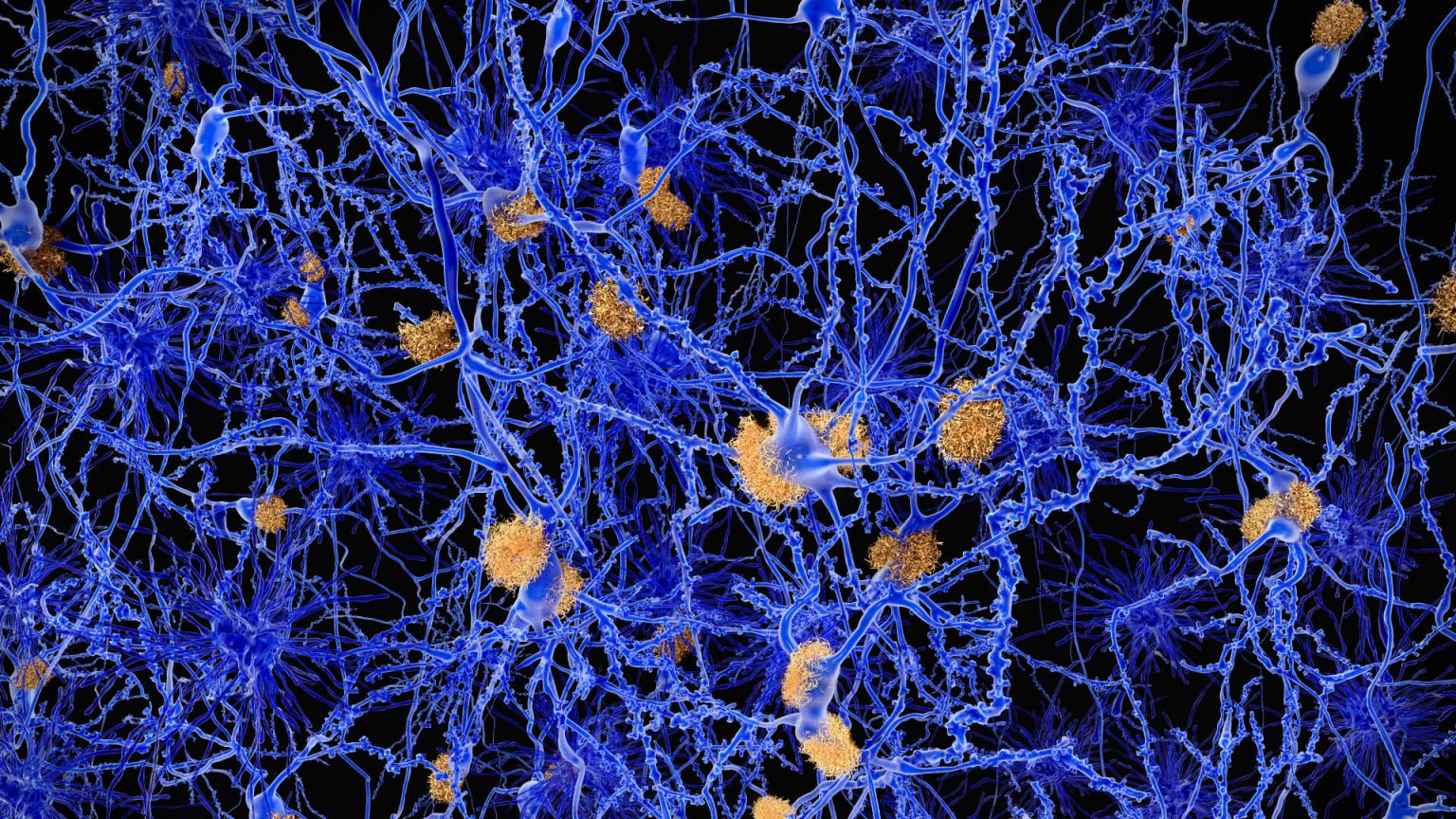

Positive developments for one of Eli Lilly ‘s (LLY) competitors in the nascent Alzheimer’s treatment market are good news for the Club name, too. However, a Wall Street bull has grown more cautious on Humana (HUM). Here’s a deeper look at the headlines and their implications for our investment theses in these two health-care companies. The news on Eli Lilly : The Food and Drug Administration granted full approval to Alzheimer’s treatment Leqembi, prompting the agency that administers Medicare to implement broader coverage for the expensive drug. Both actions, announced Thursday night, were widely expected on Wall Street. Nevertheless, they are important steps forward for the commercialization of Leqembi and similar Alzheimer’s treatments that may be cleared in the future, including Eli Lilly’s donanemab. Leqembi — developed by Japanese pharmaceutical firm Eisai and its Massachusetts-based partner Biogen (BIIB) — is the first anti-amyloid Alzheimer’s antibody to receive full FDA approval. Prior to Thursday’s announcement, U.S. regulators had only granted conditional clearance to Leqembi, which slowed cognitive decline in early-stage Alzheimer’s patients and people with mild cognitive impairment by 27% compared with a placebo over an 18-month trial. The drug’s side effects, which can be serious in some cases, include brain swelling and bleeding. This also marks the first time the Centers for Medicare & Medicaid Services (CMS) has agreed to broad reimbursement for this kind of Alzheimer’s treatment, which seeks to reduce build-up in the brain of amyloid beta, a protein linked to the memory-robbing disease. To be eligible for reimbursement, patients’ doctors must agree to submit data to a registry, which CMS says is designed “to study the usefulness of these drugs” outside a clinical trial for Medicare recipients. CMS’ coverage decision has been viewed as a critical step in Leqembi’s commercial success because its $26,500 list price puts it out of reach for many Alzheimer’s patients to pay out of pocket. Most of the millions of Americans living with Alzheimer’s are seniors eligible for Medicare, the government health-care program mainly for people who are 65 or older (and some younger people with certain conditions or disabilities). LLY 1Y mountain Eli Lilly’s stock performance over the past 12 months. The Club’s take: The first-of-their-kind FDA and CMS actions came in generally as anticipated, and represent incremental positives for Eli Lilly. That’s why some of the decline seen Friday in Eli Lilly shares – down over 2%, to around $453 each – could simply represent a sell-the-news situation. The stock is only a little more than 3% off its all-time high close of almost $469 on June 30. Eli Lilly has said donanemab could be approved by the FDA late this year or in early 2024. In a large-scale 18-month study, the drug slowed cognitive and functional decline by 35% in one early Alzheimer’s patient group compared with those on a placebo. Donanemab also targets amyloid in the brain. It may take time for Leqembi to generate meaningful sales, analysts have said, because it’s a new class of drugs, and the health-care system needs to establish the infrastructure to give these intravenous drugs to patients. Still, with the FDA and CMS decisions now in hand, Eisai and Biogen are able to continue their work on commercialization. Having some sort of foundation in place for both administrating anti-amyloid drugs and monitoring patients once they’re on them could ultimately be helpful for Lilly, if donanemab secures approval. As a reminder: The need for more infrastructure to support these new drugs is one reason why we like and own GE Healthcare (GEHC). It has a full suite of products used across the entire Alzheimer’s patient journey, which includes confirming the disease diagnosis and monitoring the drug’s side effects. To be sure, in April, GEHC management said the company hasn’t yet seen an uptick in demand tied Leqembi. But it’s something to monitor as the drug rollout progresses. Our expectations around donanemab sales also are measured, and the drug is not the primary driver of our multiyear optimism for Eli Lilly. That crown belongs to Mounjaro, a type-2 diabetes treatment that’s soon expected to be given approval to treat obesity, as well. Lilly is also studying Mounjaro as a treatment for sleep apnea and other conditions. The news on Humana: JPMorgan downgraded Humana to neutral from overweight — the equivalent of hold from buy — due to elevated uncertainty about medical cost trends and political risks as the 2024 presidential election cycle starts to ramp up. The firm also lowered its HUM price target to $540 per share, from $576. JPMorgan remains bullish about Humana’s long-term prospects because of its focus on the fast-growing Medicare Advantage (MA) market. But, at this moment, the analysts see Humana’s MA concentration as more of a hindrance than a help. “If I think about how this stock is going to trade in the next six months, I think it’s more likely to underperform other [managed-care] names … like a Cigna than outperform,” the analyst behind the call, Lisa Gill, told CNBC on Friday. Unlike Humana, Cigna, which has a buy-equivalent rating from JPMorgan, has sizable exposure to the commercial health insurance market. Humana’s medical costs have been a big concern in recent weeks, after UnitedHealth warned that outpatient surgeries among older Americans started to trend higher in April and continued into June. A few days later, on June 16, Humana said in a securities filing that it was observing similar patterns. As a result, the company expects its benefit expense ratio to be toward the high end of its full-year guidance between 86.3% and 87.3%. That’s a closely watched industry metric that captures a health insurer’s spending on patient care versus what it collects in premiums. From an investor standpoint, a lower number is better. While Humana may be able to manage higher medical costs in 2023, Gill said that “the bigger concern is around 2024,” and whether the company can incorporate recent trends into its Medicare Advantage plans for next year before the regulatory submission deadline in early June. Upcoming second-quarter earnings calls from Humana and its peers should offer some insights into 2024 plans and management’s expectations for them, Gill said. Additional clarity will arrive when the open enrollment period begins in October, which will give analysts and investors the opportunity to see the plan design more completely. HUM 1Y mountain Humana’s stock performance over the past 12 months. The Club’s take: Humana is in a tough situation because our initial thesis around its improving Medicare Advantage offering hasn’t changed. The company has been gaining market share on its competitors, and it maintains some of the best membership growth in the industry. What’s changed is decreased visibility on Humana’s costs due to that uptick in utilization — a very important metric for investors that looks at people using their health-care benefits. That’s why Humana shares are down about 14% since UnitedHealth’s comments last month. At this point, Humana requires patience given the murkiness in the near term. We’ll be paying close attention to UnitedHealth’s upcoming earnings release next Friday, and Humana’s a few weeks later on Aug 2, in hopes that at least some of the uncertainty can be lifted. (Jim Cramer’s Charitable Trust is long LLY, HUM, GEHC. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Positive developments for one of Eli Lilly‘s (LLY) competitors in the nascent Alzheimer’s treatment market are good news for the Club name, too. However, a Wall Street bull has grown more cautious on Humana (HUM). Here’s a deeper look at the headlines and their implications for our investment theses in these two health-care companies.

Read the full article here