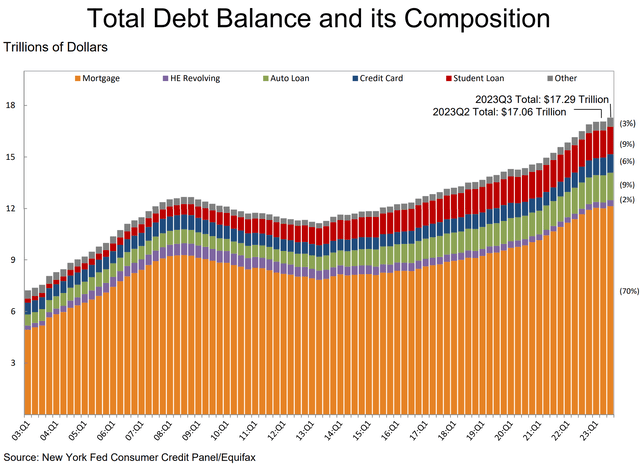

On the 7th of November, the Center for Microeconomic Data at the Federal Reserve Bank of New York published its latest “Quarterly Report on Household Debt and Credit.” The trends indicate that the total debt held by Americans increased Year-on-Year (YoY) by $786 billion to reach $17.291 trillion.

Around 70% of this debt is in mortgage loans:

Source: Federal Reserve Bank of New York

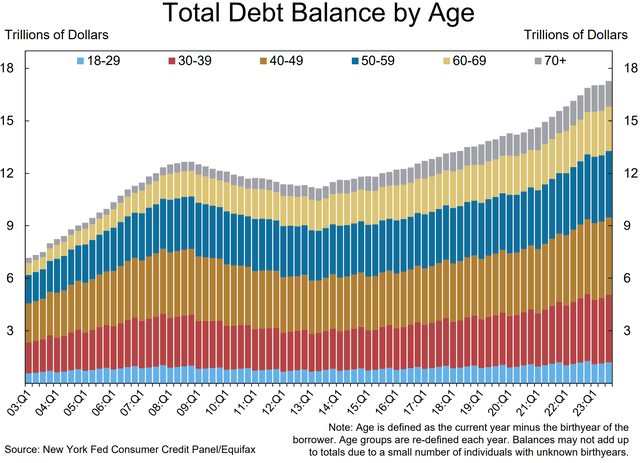

Overall, “Millennials,” i.e., 18-29 year-olds, held the lowest proportion of loans, while those in their forties held the highest proportion by a slight margin over those in their thirties and fifties.

Source: Federal Reserve Bank of New York

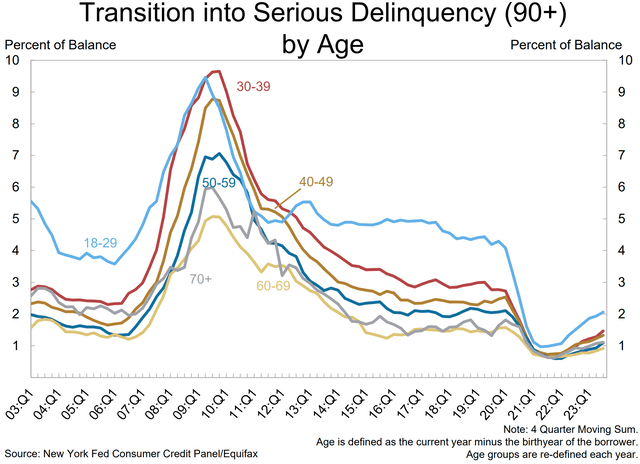

The lowest holder of loans, however, are also the ones advancing more rapidly into delinquency. However, it bears noting that all age groups – including those above the age of 70 – have been registering an increased upswing since Q3 2022.

Source: Federal Reserve Bank of New York

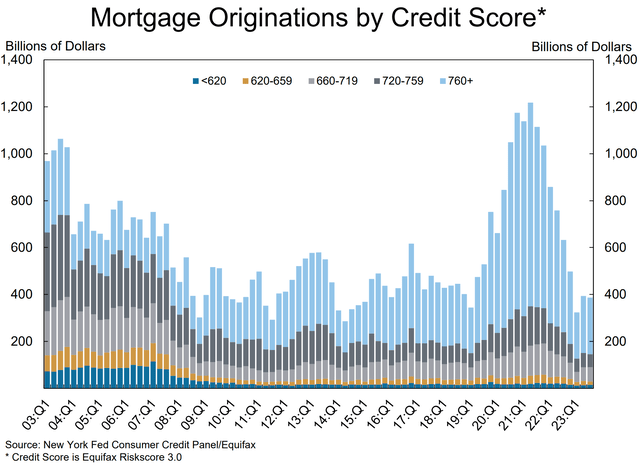

Until the Great Financial Crisis, mortgage originations were effectively spread out across credit score buckets. In the present, those with a credit score above 760 effectively control the market. Overall mortgage originations, however, are down by over 200% from the highs seen in Q2 2022.

Source: Federal Reserve Bank of New York

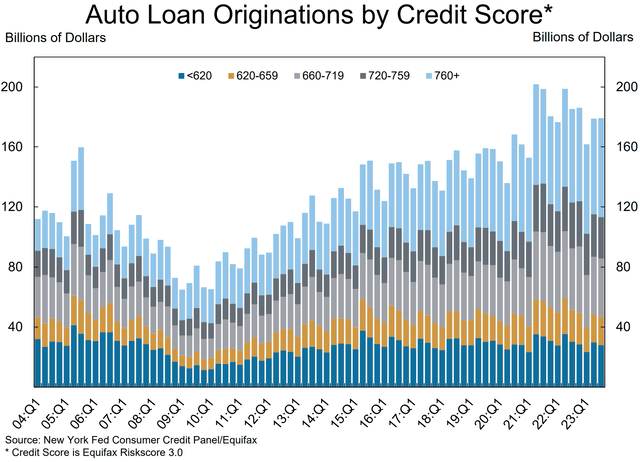

Auto loans’ history tells a similar overall tale. In a sector where buyers with low- to mid-level credit scores dominated market volumes, loan volumes by those with higher credit score have been increasing their proportions for over 20 years now – with the present seeing them the leading segment. However, other credit score buckets – particularly those in the 660-760 range – continue to generate volumes.

Source: Federal Reserve Bank of New York

As per Fitch Ratings, the share of subprime auto borrowers at least 60 days past due on their loans rose to 6.11% in September, the highest in data going back to 1994. After burning through tax returns, contending with a shakier job market, and grappling with still-elevated inflation, more car owners have become delinquent.

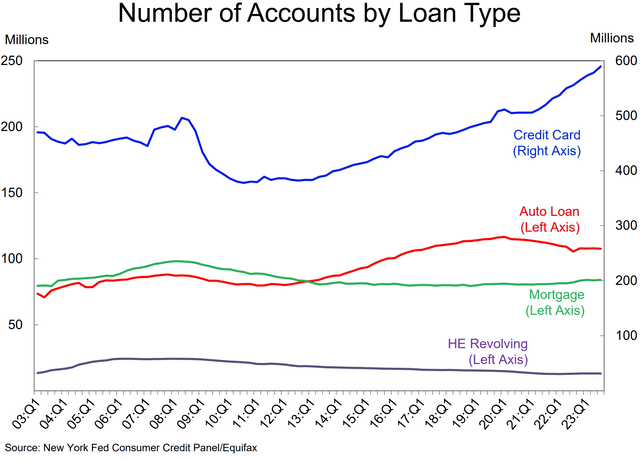

While the number of auto loan and mortgage accounts has more-or-less run level for at least two years, credit card accounts have been skyrocketing since 2011.

Source: Federal Reserve Bank of New York

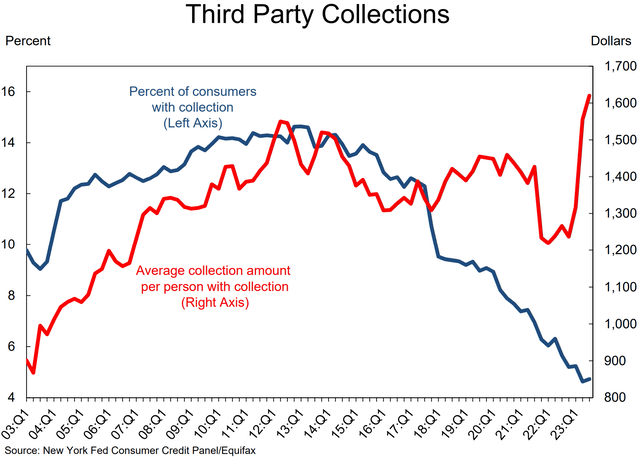

In terms of third-party collections of bad debt, dollar volumes have gone up 37.5% since lows seen in Q1 2021.

Source: Federal Reserve Bank of New York

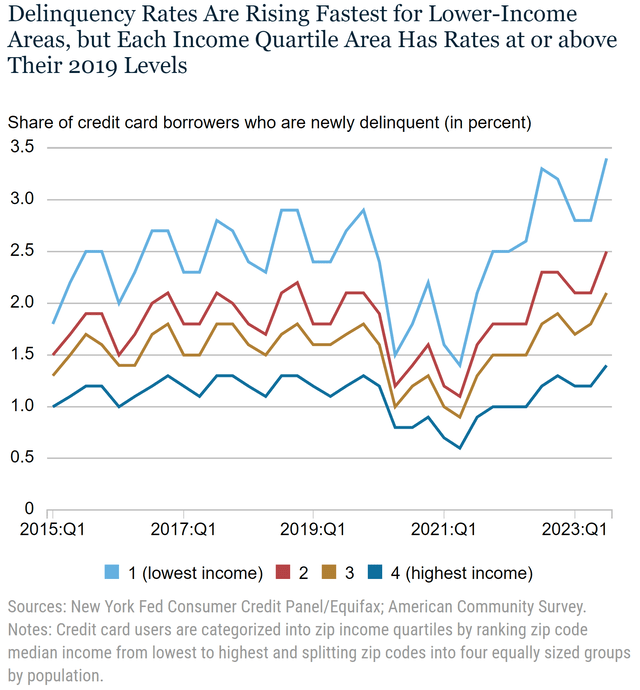

Among credit card loans, delinquency rates in the traditionally-shaky lower-income areas of the United States have been rising the fastest in recent times. However, every income quartile is at rates above those seen before the pandemic.

Source: Federal Reserve Bank of New York

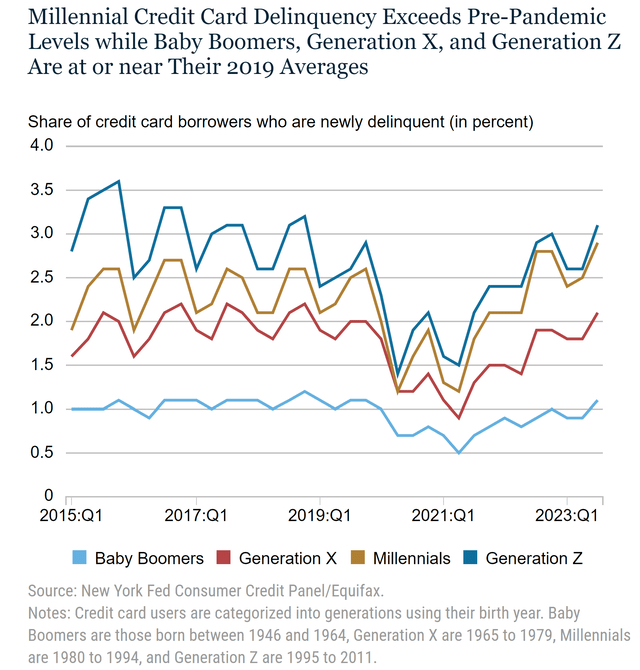

Once again, “millennials” are the worst hit while all other age demographic are presently around pre-pandemic levels.

Source: Federal Reserve Bank of New York

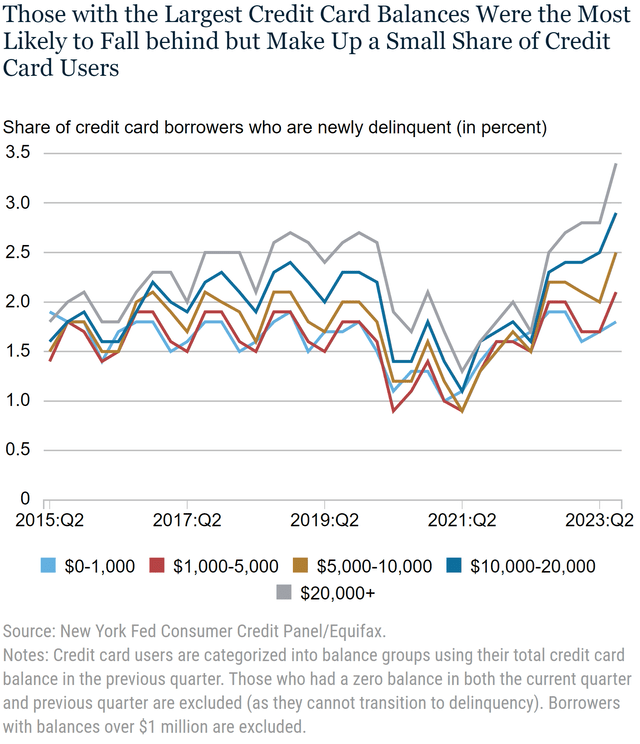

Signs of “credit loading” are now apparent: credit card users who continually accrue large balances are now most likely to default. Current, “credit loaders” are a small but rising demographic within the credit card users segment.

Source: Federal Reserve Bank of New York

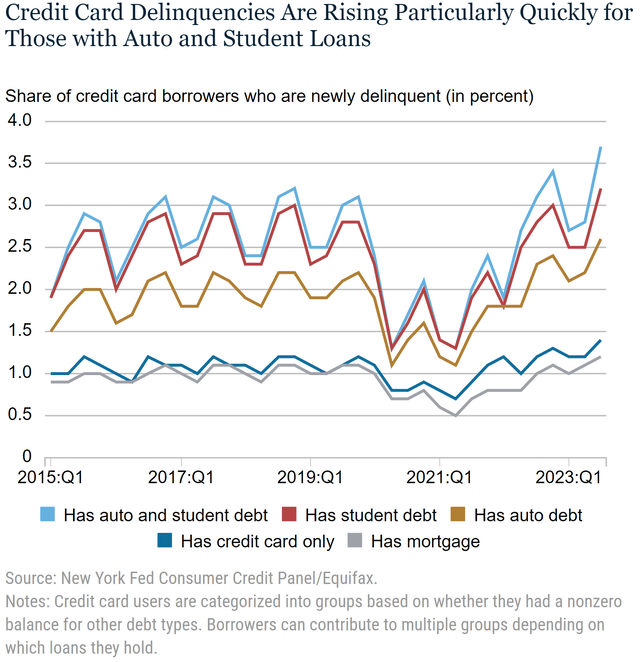

Furthermore, credit card users are showing increasing signs of “debt stress”: those with auto and student loans are going delinquent faster.

Source: Federal Reserve Bank of New York

Broader Consequences

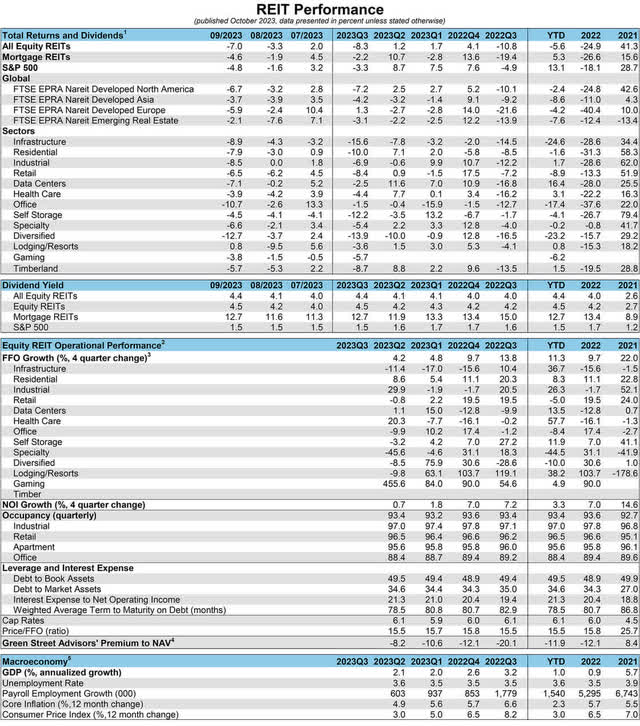

In almost every American asset class, one common theme that emerges is “market breadth stress”. In the REIT space – which is closely correlated with the mortgage business – total returns were negative in the third quarter of 2023, as per Nareit, a global advocacy group for REITs and real estate companies with an interest in U.S. real estate. All equity REITs were down 8.3% for the quarter, and mortgage REITs posted a total return of -2.2%.

Source: Nareit

As of the second quarter of 2023, the average REIT leverage ratio was 34.6% and the weighted average term to maturity of total debt was nearly 7 years. The returns on nearly REIT sub-class have been flashing red since August.

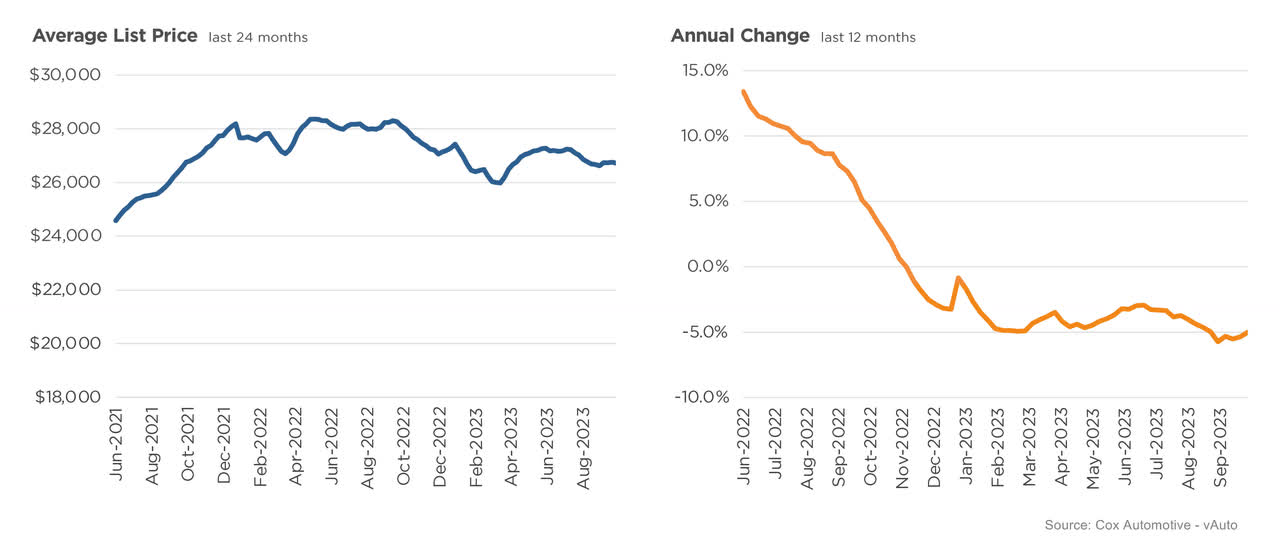

The average used-vehicle listing price at the beginning of October was down 5% compared to the same period in 2022. Meanwhile, wholesale prices were down 3.9% year over year.

Source: Cox Automotive

The lower the price segment, the tighter the inventory. Used vehicles priced under $10,000 had a days’ supply of 32, with days’ supply increasing with every higher price segment with the “over $35,000 category” having 58 days of supply. Rising car loan rates would have an even further effect on sales volumes and days in supply.

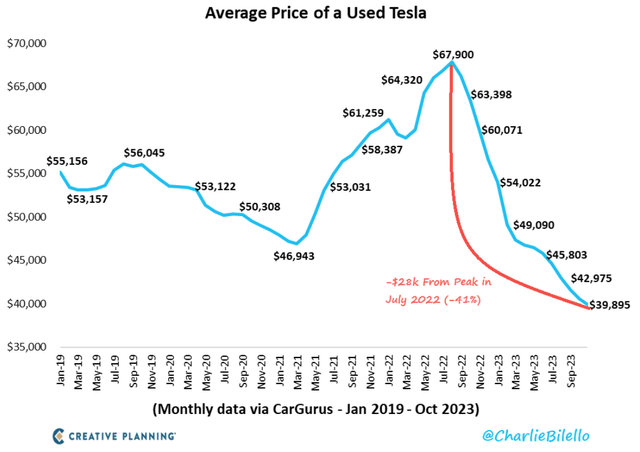

When it comes to Electric Vehicles (EVs), a number of articles published before indicated that consumption was limited to a number of “creamy segments” that were over-catered. This has had a deflationary effect on demand within the used EV car market as well. For instance, the average price of a used Tesla has had a 41% drop in value relative to the all-time highs seen in July 2022.

Source: Charlie Bilello

While the latest meeting by the Federal Reserve resulted in a unanimous decision to hold rates steady at their current level of between 5.25% and 5.5%, it still marks a more than five-fold increase on rates relative to April 2020 when they were at a record-low of 0.5%. The Fed’s benchmark rate has had an explosive effect on mortgage rates, car loans and credit cards’ annual percentage rates (APRs). In that regard, the Federal Reserve is between a rock and a hard place: while mopping up money supply and reining in inflation requires rate hikes, doing so would eventually trigger a further drop-off in American consumption going into a year that is fraught with ever-deepening political polarization while the U.S. Presidential election looms large.

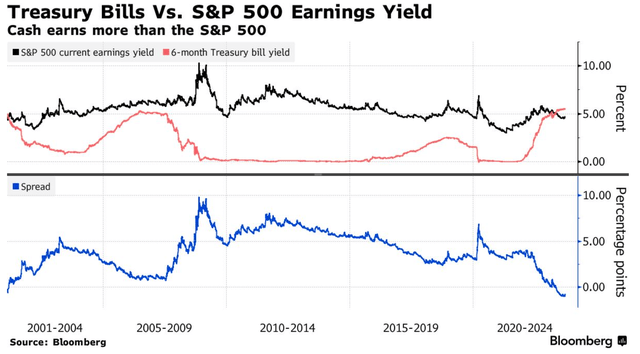

A “high rate for longer” in conjunction with dropping consumption trends has had the broad market’s forward earnings being estimated as trending downwards. The present rate throws forth an interesting “crossover” point: for the first time in this current century, cash (short-term Treasury Bills) is at an advantage versus equities: six-month U.S. T-Bills (US6M) yield about 5.5% while the S&P 500’s earnings yield 4.7% as of end of September.

Source: Bloomberg

In record level highs over the past couple of months, money market funds have steadily allocated more and more resources to cash over an equity market with very little market depth or conviction beyond the “Magnificent Seven” stocks – especially given that short-dated Treasury Bills offer virtually zero credit risk.

All in all, the disciplined investor would stand to gain from being cautious of hazy growth narratives hand, conscious of the potential inherent within cash and be prepared for the macroeconomic gloom to continue. Caveat emptor.

Read the full article here