Most income-oriented investors have been caught off-guard by the surge of inflation in the last two years, as inflation had remained suppressed for the past 15 years. High inflation erodes the real annual return of portfolios and their real value. Therefore, investors should do their best to protect the real value of their portfolios and their income streams. Fortunately, the Fed has raised interest rates to 16-year highs, thus making it possible for investors to lock in attractive yields for the long run.

The preferred stock of Tsakos Energy Navigation (NYSE:TNP.PR.E) is currently offering a dividend yield of 9.2%, which is highly attractive. The shipping company is thriving right now, with all-time high earnings per share of $11.34 in the last 12 months. As the stock has offered a common dividend every single year since the formation of the company, the preferred stock seems to have a material margin of safety, particularly given the record profits of the company. Nevertheless, investors should be aware that the 9.2% yield of the preferred stock is not entirely safe.

The preferred stock of Tsakos Energy Navigation

The preferred stock of Tsakos Energy Navigation is perpetual and is offering a fixed coupon, which currently corresponds to a 9.2% yield. The stock may be called from May 2027. If it is not called, its coupon will become floating at that point and it will equal 6.88% plus 3-month Libor. If the 3-month Libor remains around 6.5% in 2027, the total yield will exceed 13% but it is prudent to expect interest rates (including Libor) to deflate in the upcoming years.

Notably, the two preferred stocks of Tsakos Energy comprise just a small portion of the capital stack of the company. They have a total nominal value of $235 million whereas the company has common equity of $1.6 billion and total liabilities of $1.7 billion. Given also that preferred dividends amount to only $36 million per year, they hardly burden the company from a financial point of view.

Business overview

Tsakos Energy Navigation provides seaborne crude oil and refined product transportation services around the globe. It has 68 vessels and signs long-term contracts with major oil companies, such as Exxon Mobil (XOM), Chevron (CVX) and BP (BP). In this way, it tries to secure as reliable cash flows as possible. Equinor (EQNR) is the largest charterer of Tsakos Energy Navigation, with 11 existing and 2 new-built vessels on long-term contracts.

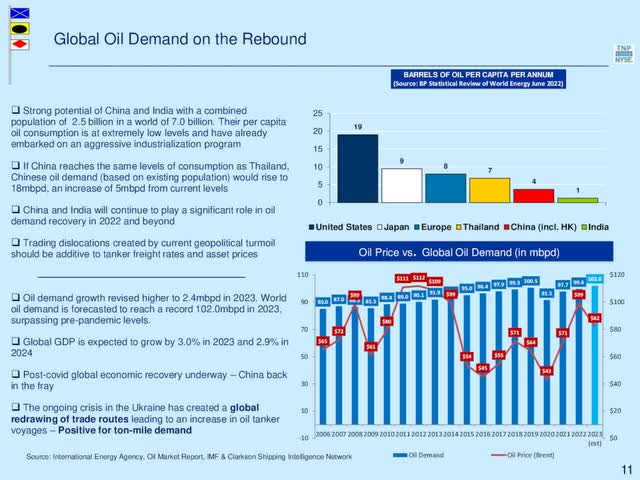

Tsakos Energy is thriving right now thanks to the strong recovery of global oil consumption from the coronavirus crisis. According to the latest report of the Energy Information Administration [EIA], global oil consumption is expected to grow from 99.2 million barrels per day in 2022 to 101.0 million barrels per day in 2023 and an all-time high of 102.4 million barrels per day in 2024. This trend certainly bodes well for the number of the required voyages for oil transportation.

Tsakos Energy has also greatly benefited from the Ukrainian crisis. Due to the sanctions imposed by the U.S. and the European Union on Russia, there have been major changes in the trade routes. These changes have reduced the efficiency of the global oil market and thus they have resulted in a steep increase in the number of oil tanker voyages. This is negative for the global economy but positive for Tsakos Energy.

Tsakos Energy also expects to benefit from a secular tailwind in the upcoming years, namely the growing consumption of oil of China and India. These two countries have a population of 1.4 billion each and have an exceptionally low consumption of oil per capita.

Global Oil Demand (Investor Presentation)

China and India are doing their best to increase their industrialization levels to approach the levels of western countries. As a result, these two countries are likely to continue growing their oil consumption at a fast pace for many more years. As they consume much more oil than they produce, they will require a great number of tanker oil voyages.

The favorable business conditions are clearly reflected in the results of Tsakos Energy. Thanks to sky-high tanker freight rates, which resulted from the recovery of global oil consumption and the market dislocations caused by the aforementioned sanctions, the company posted blowout earnings per share of $6.01 in 2022. Even better, it has nearly doubled its earnings per share in the last 12 months, as it has achieved all-time high earnings per share of $11.34.

It is also important to note that the preferred dividend of Tsakos Energy has an additional safety pillar. The company cannot cut its preferred dividend unless it first eliminates its common dividend. As Tsakos Energy has paid a common dividend every single year since 2002, when the company took its current form, it is evident that management is shareholder-friendly and does not intend to eliminate the common dividend. The consistent dividend record also proves the ability of the company to pay a common dividend even under the most adverse business conditions, e.g. during the coronavirus crisis in 2020-2021. Moreover, the current payout ratio of 13% signals that the common dividend has a wide margin of safety and hence the preferred dividend has an even wider margin of safety.

Risks

All the above facts lead to the conclusion that the 9.2% yield of the preferred stock of Tsakos Energy has a material margin of safety. This is true but the dividend is not entirely safe. The shipping industry is infamous for its dramatic cyclicality and its boom-and-bust cycles. This cyclicality is clearly reflected in the performance record of Tsakos Energy.

The company has incurred losses in 6 of the last 10 years. In 2018 and 2021, it incurred excessive losses per share of -$7.63 and -$9.53, respectively. It is also worth noting that the common stock has dramatically underperformed the broad market over the last decade, as it has declined 13% whereas the S&P 500 has rallied 152% over the same period. The comparison becomes even worse if one takes into account that Tsakos Energy is thriving right now.

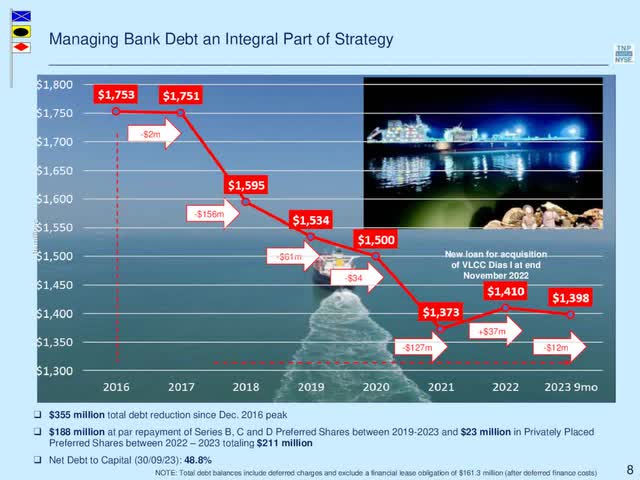

Moreover, just like the vast majority of shipping companies, Tsakos Energy carries a high debt load. Its interest expense consumes 23% of its operating income and hence it is not extreme. In addition, the company has reduced its total debt significantly off its peak at the end of 2016.

Tsakos Energy Navigation Debt (Investor Presentation)

However, the current liabilities, which are due within the next 12 months, exceed the current assets ($417 million vs. $394 million). In addition, the net debt of the company (as per Buffett’s formula: net debt = total liabilities – cash – receivables) is standing at $1.3 billion. This amount is more than double the market capitalization of the stock and hence it is high.

As long as the business conditions remain favorable, Tsakos Energy will easily service its debt. However, if it faces a severe and prolonged downturn, it may be pressured by its debt load. A potential threat is the secular shift of the entire world from fossil fuels to renewable energy sources. This transition has accelerated since the onset of the pandemic and hence it may cause global oil consumption to peak at some point in the upcoming years.

Given the high cyclicality of the freight market and the extreme sensitivity of tanker freight rates to the underlying fundamentals of the oil market and the global economy, Tsakos Energy may face a fierce downturn at some point in the upcoming years. The history of the company has shown that the preferred dividend is likely to remain safe even during a fierce downturn but investors should be aware that a suspension of the preferred dividend cannot be excluded in such an instance.

Final thoughts

The preferred stock of Tsakos Energy is offering an outstanding dividend yield of 9.2%, which has a wide margin of safety under normal business conditions, let alone the current conditions, under which the company is thriving. However, the market has good reasons for offering such a high yield, namely the boom-and-bust cycles of the shipping industry and the debt load of Tsakos Energy. Therefore, the stock may be unsuitable for highly conservative investors.

Read the full article here