It has been an eventful two months since I last updated Unity Software Inc. (NYSE:U) investors in mid-September. The debacle surrounding the company’s disastrous launch of its runtime fee led to the departure of its ex-CEO, John Riccitiello, from all leadership roles. The new team, under the leadership of Interim CEO James M. Whitehurst, clarified that the “revenue softness” attributed to the runtime fee introduction is “now largely behind the company.”

Despite that, the real-time 3D and gaming engine leader didn’t provide guidance for the fourth quarter or FQ4, leading to a sharp selloff in U in early November 2023. However, I assessed the collapse as a possible deck-clearing event, forcing peak pessimism and attracting dip buyers who pounded on the plunge in U.

Unity sellers have since lost significant momentum, suggesting that the company can focus on an organizational reset, helping it overcome its recent challenges.

Whitehurst has laid out clearly in Unity’s third-quarter earnings scorecard that the company was too distracted under the previous CEO. Such introspection is likely appreciated by investors, anticipating management to do the right thing, helping the company to get back on track.

While the company was focused on improving its profitability profile under Riccitiello, the numerous M&As have led to a backlash among investors, as seen in the weak performance of U relative to its software peers and the S&P 500 (SPX) (SPY). Accordingly, U posted a 1Y total return of -14.3% as it struggles for traction. Therefore, the departure of Riccitiello is likely welcomed by investors, although I expect U to remain in the penalty box for some time.

Management stressed that the company doesn’t anticipate significant changes to its adjusted EBITDA trajectory as it looks to shed less/unprofitable business segments. Also, the company will focus on cutting costs as it looks to streamline its operations to deliver improved operating leverage. Despite that, management hasn’t provided concrete action plans to investors. In addition, a lack of clear forward guidance suggests investors have likely incorporated significant uncertainties into its valuation as they await management’s next update in early 2024.

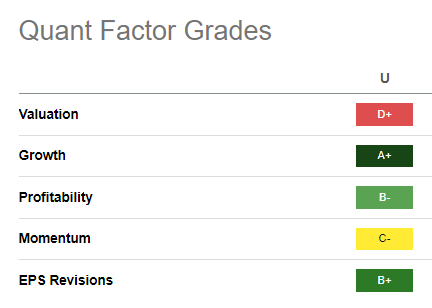

U Quant Grades (Seeking Alpha)

U is still priced at a premium (“D+ valuation grade) for its best-in-class growth potential (“A+” growth grade). Therefore, I believe much is at stake for Unity to deliver its updated strategies to reignite its growth strategies while gaining focus to improve its profitability.

Despite that, its positive profitability metrics (“B-” grade) suggest Unity has some space to work on its execution unless management stuns investors with a sharply lowered adjusted EBITDA guidance moving ahead. While that remains a possible risk factor, the company’s assurance at its Q3 earnings call suggests it’s not expected to be the base case, as Unity looks to shed less or unprofitable opportunities.

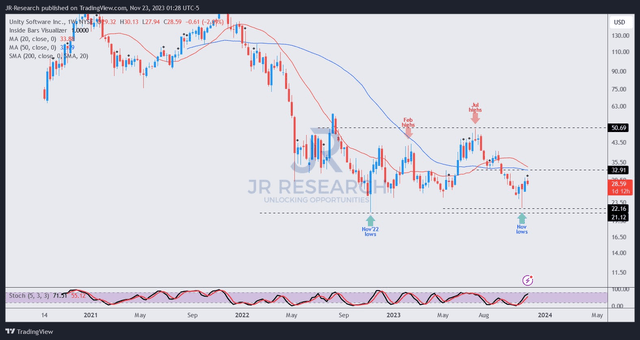

U price chart (weekly) (TradingView)

Furthermore, U’s price action suggests buyers returned aggressively in early November 2023 to defend against the collapse as sellers attempted to force a capitulation.

As a result, U’s November 2022 low ($21 level) was held firmly by dip buyers, suggesting U doesn’t seem likely to break further below that level.

Therefore, I assessed that an even better opportunity for investors looking to add U has arrived, as the reset that occurred in November should set the stage for U’s recovery. Investors have likely baked in a pessimistic scenario, reflecting the execution risks from management’s reset intentions. As long as Unity doesn’t deliver a much worse guidance than anticipated, U’s $21 support zone should hold robustly.

Rating: Upgraded to Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here