Upstart (NASDAQ:UPST) has been on a roll as of late. While it is not immediately clear how much is due to the recent AI frenzy, one mustn’t ignore the important business developments helping to support the bullish thesis. UPST previously reduced headcount substantially and has announced that it has secured long term funding partners. Management seems to indicate that they will not need to hold more loans on its balance sheet and its cash balance appears sufficient to absorb the modest operating losses. UPST is still reasonably valued based on expectations for a decline in interest rates, though it remains unclear exactly when the company may see revenue growth accelerate amidst the current interest rate environment. I reiterate my buy rating but caution on the lack of near term catalysts.

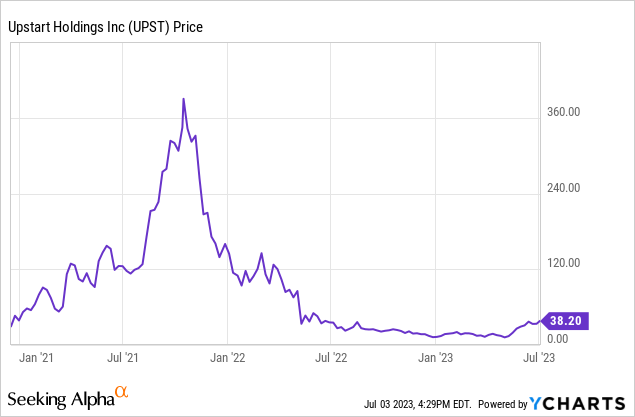

UPST Stock Price

After a brutal valuation reset from the highs, UPST stock has caught new life amidst the hype for artificial intelligence stocks.

I last covered UPST in April where, despite reiterating my bullishness, explained why I viewed the stock as lacking obvious near term catalysts. I clearly did not anticipate the AI bump that the stock would experience, as the stock is up 128% since that report. The stock still remains reasonably valued though it is becoming hard to determine what is already being priced in.

UPST Stock Key Metrics

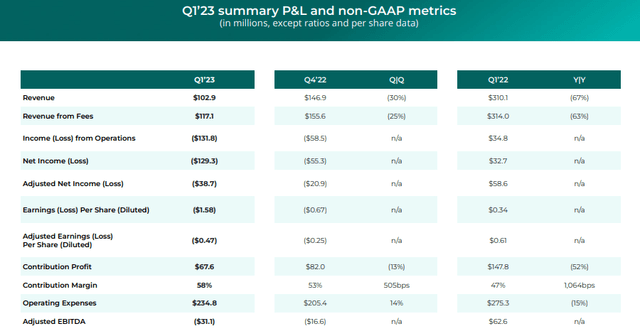

In its most recent quarter, UPST saw continued pressures on its business, with revenue declining 30% sequentially and 67% YOY. Adjusted net income swung from $58.6 million to negative $38.7 million, a stunning YOY comparison. The rare bright spot was that the contribution margin stood at 58%, materially higher than the 47% posted in the prior year, as the company was able to show pricing power amidst lower demand.

2023 Q1 Presentation

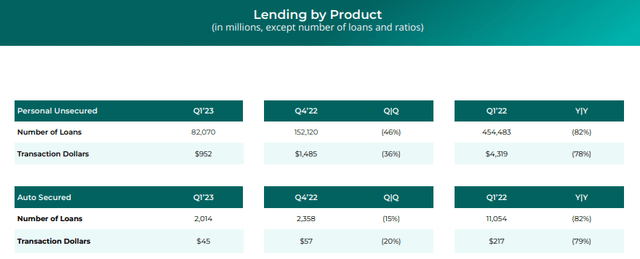

UPST saw similar YOY weakness in both its personal and auto lending products, but its auto product was slightly stronger on a sequential basis (albeit from a significantly smaller base).

2023 Q1 Presentation

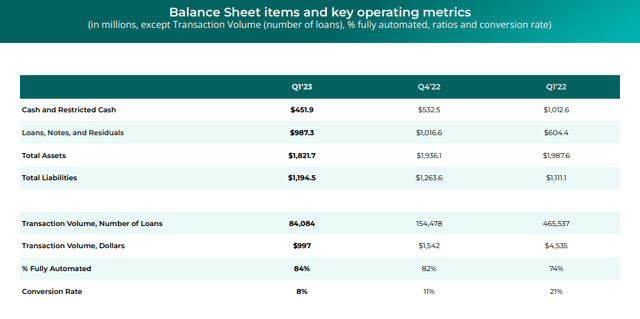

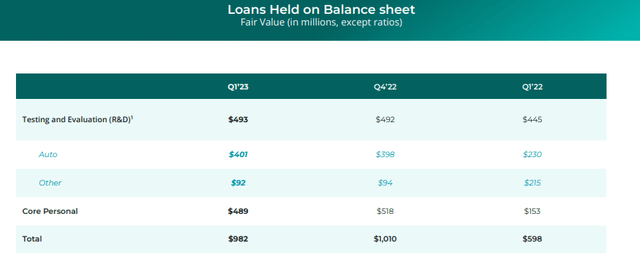

UPST ended the quarter with $451.9 million of cash versus $1 billion in debt, though it did also have $987 million in loans held on its balance sheet. Given the volatility in the regional bank sector, it bears reminding that UPST is not a bank and its liabilities are not from deposits but instead from debt instruments with maturities several years out.

2023 Q1 Presentation

UPST was able to increase its percentage of fully automated loans to 84%, up 1,000 basis points YOY, but this is likely due to the substantially lower transaction volume. It is worth noting that the conversion rate plummeted 1,300 basis points YOY to 8%, possibly reflecting that potential borrowers are facing some sticker shock.

UPST ended the quarter with $982 million in loans held on its balance sheet, down slightly from the sequential quarter. Management has indicated that they intend to keep loans on its balance sheet to below $1 billion, but they have a history of flip-flopping on such guidance.

2023 Q1 Presentation

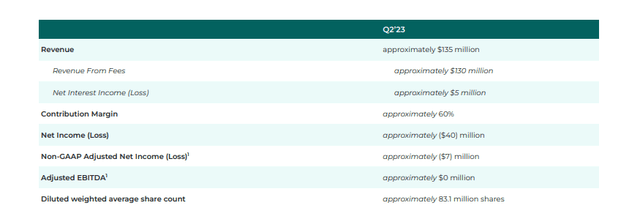

Looking ahead, management expects revenue to remain pressured at $135 million, reflecting 40.7% YOY declines. The non-GAAP adjusted net loss is expected to remain modest at just $7 million.

2023 Q1 Presentation

On the conference call, management discussed long-term funding agreements expected to bring $2 billion to their platform over the next year. This development would perhaps help offload much of the loans held on the balance sheet, but is arguably not too significant in itself, as there is still a wide gap between the $1 billion in transaction volume of this past quarter and $4.5 billion of the prior year’s quarter. The way that the long-term funding works is that a third-party would purchase loans on a monthly basis from the company. It is not immediately clear if that $2 billion figure represents a recurring number or is just what to be expected over the next 12 months. Subsequent to the quarter end, the company announced an agreement to sell up to $4 billion of loans to Castlelake. Together, these two agreements might be significant enough to address the company’s funding issues, but there were not too many details given regarding the latest deal.

Management explained that the struggling conversion rates may be due to its loans being “priced conservatively relative to UMI,” their Upstart Macro Index. UPST is facing lower demand not only from potential borrowers but also from banking partners and has aimed to win back trust that its loans can perform to expectations. While the company continues to face struggling revenue growth and negative profit margins, I remind readers that UPST reduced headcount by almost 30% since the fourth quarter of last year, a move that may have positive implications for profit margins if and when the macro environment improves.

Is UPST Stock a Buy, Sell, or Hold?

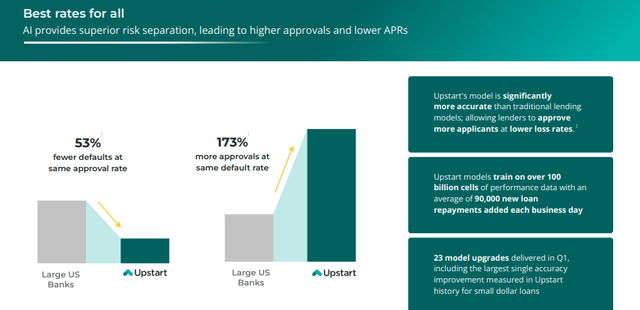

UPST aims to expand the availability of credit by using artificial intelligence to supplement traditional credit scoring methods.

2023 Q1 Presentation

The cynical might point out that this may be catering more to the high yield borrowers market, but UPST management is of the view that their product “has the potential to eradicate more than 70% of payday loans in the next five years.”

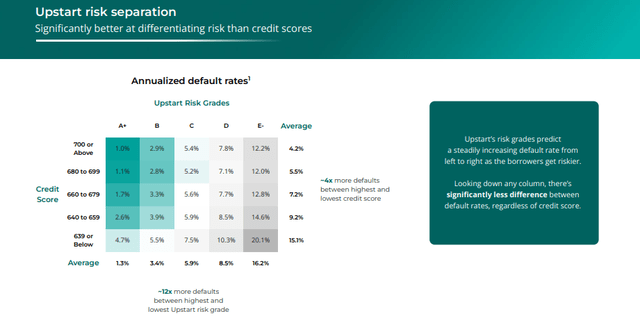

UPST is of the view that it is able to extend credit to a wider range of individuals at a lower risk than traditional credit scores.

2023 Q1 Presentation

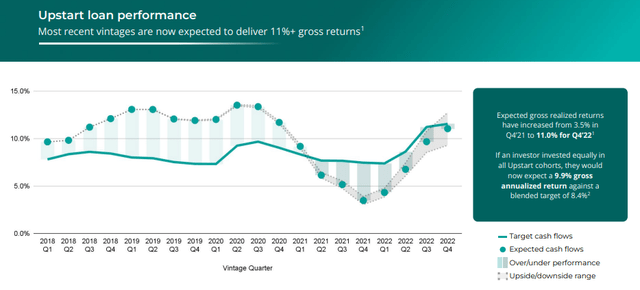

Unfortunately, bank partner confidence in the model may have suffered in recent quarters as UPST’s loans began to underperform expectations. The fact that they had outperformed previously seemed to matter less as it is not immediately clear how UPST’s models would perform under the higher interest rate environment. It is promising that the most recent quarter saw the projected underperformance narrow.

2023 Q1 Presentation

The growth thesis for UPST centers around its ability to take market share in personal and auto lending, as well as enter new markets such as HELOCs. On the conference call, management noted that “95% of HELOCs are financed by banks and credit unions,” making it likely that banking partners would be willing to work with the company.

After a big rally, UPST stock is now trading at more healthy valuations, recently trading hands at around 5.4x sales.

Seeking Alpha

Consensus earnings estimates call for a rapid return to profitability with the stock looking more reasonably valued after a couple of years.

Seeking Alpha

Two years ago, I might have called these valuations dirt-cheap (and indeed I did so, something I greatly regret). But after the business model essentially imploded as interest rates rapidly rose, it is clear that things are not as simple as they seem. UPST might have seen strong fundamentals during the pandemic mainly due to the low interest rate environment. With interest rates markedly higher, there is now substantial doubt regarding the company’s ability to originate enough loans to operate profitably on a sustainable basis. This is evidenced by both the plunging transaction volume as well as the large number of loans still on the balance sheet. There also remains the question of how to properly value this stock. If one believes that this is a tech company due to having an asset-light model, then the current 5.4x sales multiple may be a good bargain if the company can return to robust growth rates. But if one views the company as being more like a bank, then one must wonder why the stock is more attractive than any traditional banking stock which might trade at 6x to 9x GAAP earnings. I view UPST stock as being an “all or nothing” kind of play. Either the stock succeeds and performs spectacularly, or the stock fails and goes close to zero. The stock valuation is not yet close to bubbly but it is unclear how high the chances for success are. Investors only have a handful of profitable quarters to look towards, though the company’s announcement of long term funding and headcount reduction might bode well moving forward. It is very difficult to assign a price target given the high degree of uncertainty, but I can attempt to illustrate the potential rewards. Assuming a return to 20% revenue growth, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at 9x sales, implying considerable upside. If the company can succeed in regaining bank partner trust and increase its transaction volume while adding new lines of business, then it may be able to sustain even higher rates of growth for many years.

What are the key risks? The greatest risk here is that of execution. It might not be so easy to bring in new funding partners given the several quarters of underperformance. Moreover, the high interest rate environment might continue to dampen demand for UPST loans, or UPST might reduce its target yield to increase conversion rates, which might prove risky over the long term. While one could argue that UPST does not have the same deposit risk as that seen in the banking sector, this is also a management team that has shown a great willingness to hold loans on the balance sheet to sustain operations. If economic conditions worsen, it is possible that UPST would need to recognize a larger than expected loss on these loans which would still pose great financial risk. I reiterate my buy rating for the stock but caution regarding the great risk and wide range of potential outcomes.

Read the full article here