One pound of uranium is worth about 3 million pounds worth of coal or oil. – James Lovelock.

I’ve hosted a number of Lead-Lag Live Twitter Spaces/podcasts with thought leaders in the clean energy space who make strong arguments around investing in Uranium, which is a heavy, radioactive metal that is primarily used as a fuel source in nuclear power plants. It has the remarkable ability to generate massive amounts of electricity without producing carbon emissions. This feature makes it a viable candidate for the global transition towards cleaner energy alternatives.

I’ve said all along I believe in the thesis, but the question is why?

Why Invest in Uranium?

There are several compelling reasons to consider investing in uranium:

- Growing Demand for Clean Energy: The global shift towards sustainable, low-carbon energy sources is driving the demand for uranium. Nuclear power is gaining recognition as a reliable and emissions-free energy source.

- Emerging Market Demand: Rapid industrialization and urbanization in emerging economies, like China and India, are driving up electricity consumption. Nuclear power, fueled by uranium, is poised to meet this growing demand.

- Portfolio Diversification: Including uranium in your investment portfolio can offer diversification benefits. The factors influencing uranium prices often differ from those affecting stock and bond prices.

However, investing in uranium also comes with its share of risks, including global economic downturns, lower fossil fuel prices, potential nuclear accidents, and geopolitical turmoil.

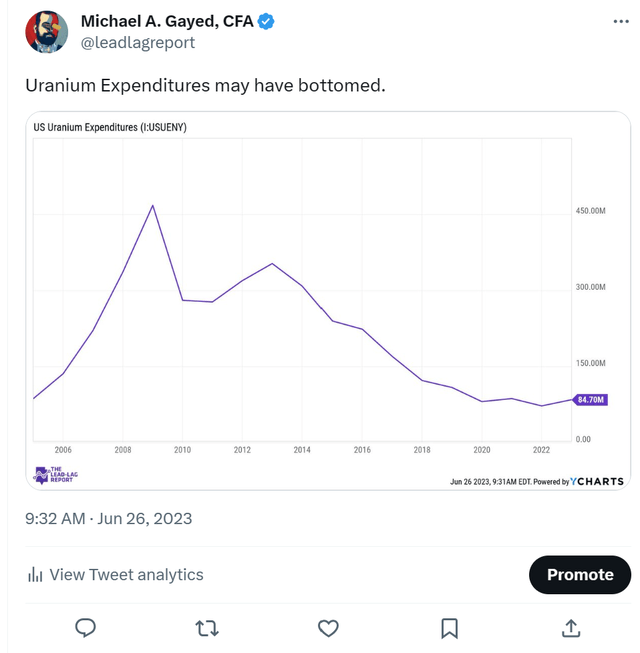

There’s also the case that expenditures have nowhere to go but up.

YCharts

How to Invest in Uranium?

Investing in uranium isn’t as straightforward as buying a stock or bond. Here are the main methods you might consider:

Uranium Stocks

Investing in stocks of companies involved in uranium mining and processing is one of the most direct ways to invest in uranium. Prominent uranium mining companies include Canadian giants like Cameco Corporation (CCJ) and Kazatomprom, along with Australian heavyweight BHP (BHP), and NexGen Energy (NXE).

Investing in these stocks offers exposure to uranium price movements. However, these stocks may also be influenced by company-specific factors, such as management decisions, production costs, and geopolitical concerns.

Uranium ETFs

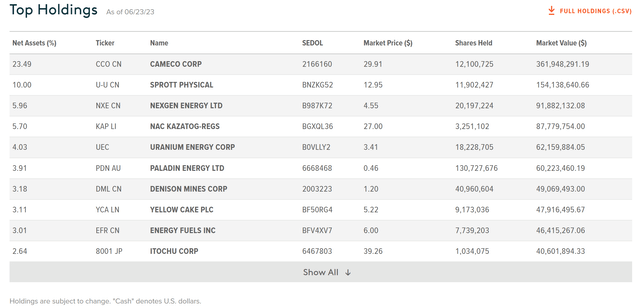

Exchange-Traded Funds offer a diversified exposure to the uranium market. Uranium ETFs like the Global X Uranium ETF (NYSEARCA:URA) and VanEck Market Vectors Uranium + Nuclear Energy ETF (NLR) track indices of companies involved in uranium mining and nuclear energy.

ETFs offer a basket of equities, reducing the risk associated with single company stocks. However, the selection of uranium-focused ETFs isn’t extensive, and investors would need to be comfortable with the specific selection of companies in the ETF’s portfolio.

The price ratio of URA to the S&P 500 (SP500) has been volatile and sideways, but I suspect longer-term can show real outperformance against core markets.

TradingView

Uranium Futures

Investing in uranium futures is another option. Futures are financial contracts that obligate the buyer to purchase an asset at a pre-determined future date and price. The CME Group (CME) offers UxC uranium U3O8 futures, which track the price of uranium.

Investing in futures requires a high level of knowledge and skill, as factors like storage costs and interest rates can affect pricing. Moreover, futures contracts can be risky due to their leverage and the potential for significant losses.

Physical Uranium Investments

Investing in physical uranium isn’t common due to the radioactive nature of the commodity. However, there are some investment vehicles like the Sprott Physical Uranium Trust (OTCPK:SRUUF) that invest in physical uranium, offering investors direct exposure to uranium prices.

It’s worth noting that the URA ETF has exposure to this, which makes it even more representative of investing in the space.

Sprott Website

Uranium Royalties

Another unique investment option is uranium royalties. Companies like the Uranium Royalty Corporation (UROY) provide capital to uranium mining companies in exchange for royalties or other interests. This approach offers exposure to uranium prices while also supporting the uranium mining industry. This one is volatile and speculative, so be mindful of the company’s market cap if considering it.

Risks of Investing in Uranium

While investing in uranium presents potential opportunities, it’s not without risks. The demand and price of uranium can be significantly affected by various factors, including:

- Geopolitical Risks: Uranium production is highly concentrated in a few countries, making it susceptible to geopolitical risks. Political instability or conflict in these countries can disrupt supply and cause price volatility.

- Environmental Concerns: The nuclear industry has faced significant criticism due to the potential environmental and health risks associated with nuclear accidents. Any major nuclear incident can have a profound negative impact on the demand for uranium.

- Regulatory Risks: The uranium industry is heavily regulated, and changes in regulations can impact uranium mining and production. Stricter environmental regulations or changes in nuclear policy can affect the uranium market.

- Market Volatility: Like all commodities, uranium prices are subject to market volatility. Factors such as changes in supply and demand, global economic conditions, and commodity market trends can lead to price fluctuations.

Conclusion

As the world grapples with the challenge of transitioning to clean, sustainable energy, uranium is gaining prominence as a viable solution. With increasing global demand for electricity and a growing emphasis on low-carbon power sources, the uranium market offers intriguing investment opportunities. However, potential investors should carefully consider the inherent risks and conduct thorough research before investing in this volatile market. Investing in uranium is not for everyone, and it’s crucial to understand the unique dynamics of this commodity market before diving in.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here