US manufacturing employment has hit its highest levels since George W Bush’s presidency, but its growth has slowed significantly this year and continues to lag behind the rest of the labour market.

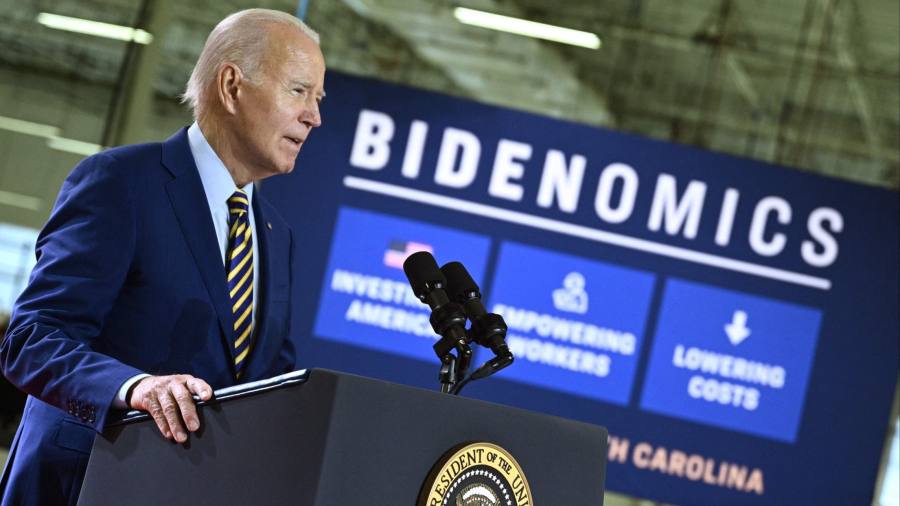

The data on industrial jobs presents a mixed picture for President Joe Biden, who is banking on a manufacturing rebound to sustain the economy and boost his prospects in the 2024 presidential election.

Since Biden took office, US manufacturing employment has grown by slightly less than 800,000 positions, contributing to the more than 13mn jobs created as the country’s economy bounced back quickly from the pandemic. Last month, close to 13mn were employed in the US manufacturing sector, which is the highest monthly tally since late 2008.

However, the 6.5 per cent job growth in manufacturing under Biden is still slower than the overall increase in employment since January 2021, of about 9.3 per cent — as other sectors have experienced a more rapid rebound. While nearly 1.2mn jobs have been created since January this year across the economy, there has been virtually no change in manufacturing jobs.

Biden administration officials — and many economists — believe manufacturing employment will be buoyed by the passage of three pieces of legislation worth hundreds of billions of dollars to boost government support for domestic infrastructure, semiconductor production, and clean energy development.

“Policy has really been an increasingly powerful tailwind to the manufacturing base,” said Mark Zandi, chief economist at Moody’s Analytics, saying it will help the sector both in the near term given the tight monetary policy and beyond.

“It is arguably among the most rate sensitive and cyclical parts of the economy and yet it’s weathering the storm here very very well,” Zandi said.

Biden has been promoting his economic plans as a way of boosting the fortunes of middle class households in towns and communities that have been falling behind in recent years. But a state-by-state breakdown of industrial employment gains shows the biggest increases have occurred in western and southern states where job growth is generally fastest anyway, compared to traditional rustbelt manufacturing hubs in the Midwest and Great Lakes regions.

Some of the biggest beneficiaries are still politically significant: Nevada, Arizona and Georgia are key swing states where Democrats have recently performed strongly. “All of a sudden manufacturing has come on stage,” said Tom Harris, a professor of economics at the University of Nevada, Reno, pointing to the fact clean energy-related production was spreading in a state that is mostly reliant on hospitality and gaming.

In areas that are deeply conservative, Biden has been needling Republican lawmakers who have been taking credit for plant openings and new industrial projects while criticising the administration’s subsidies.

“One of the biggest [new solar investments] is in Dalton, Georgia. You may find it hard to believe, but that’s Marjorie Taylor Greene’s district,” Biden said this week, referring to the firebrand conservative lawmaker. “I’ll be there for the groundbreaking.”

The manufacturing boom is not being felt uniformly, however.

On an aggregate level, employment growth across the durable goods sector, which includes products that do not wear out easily, can be used repeatedly and typically have a shelf life of at least three years, have exceeded that for the nondurable goods sector. Employment has grown 7.2 per cent in the former category since the start of the Biden administration, compared to 5.3 per cent for the latter group.

And since June of last year, all of the growth in manufacturing jobs has originated from the durable goods sector, with employment gains flat for the nondurable-related products.

The transportation industry has emerged as a clear bright spot. Nearly 200,000 jobs have been added in the past three years, representing a roughly 12 per cent jump. The bulk of that has stemmed from motor vehicles. Food-related manufacturing and those tied to other machinery have had about 90,000 new jobs respectively in that same period.

Lagging behind is the petroleum and coal industry, where employment is flat. Furniture and textile manufacturing jobs have dipped slightly.

There are also concerns the manufacturing resurgence could be cut short should the US economy buckle under the weight of the Federal Reserve’s historic monetary tightening campaign as it battles stubbornly high inflation.

The world’s largest economy has proven resilient in the face of rapidly rising borrowing costs, but the fear is it will start to weaken as the year progresses and ultimately result in higher unemployment.

Manufacturing activity has started to ebb. According to David Rosenberg, chief economist and president of Rosenberg Research, the latest data from the Institute for Supply Management this week confirmed a “recession in the industrial sector”.

However, other economists are more optimistic about the outlook in light of the support provided by the Biden administration.

“Historically, these manufacturing industries are more interest-rate sensitive than services sector industries, but I think there is enough going on with policy support and private sector investments that will be [supportive] regardless of what is going on in these areas,” said Adam Hersh, senior economist at the Economic Policy Institute, a Washington-based think-tank. “It’s really creating the demand to drive this forward.”

Construction spending for manufacturing facilities, once adjusted for inflation, has experienced what the Treasury department recently described as a “striking surge”, having doubled since the end of 2021. Among the biggest booms have been in computer, electronics and electrical manufacturing, where spending has quadrupled since the beginning of 2022.

Treasury officials and other government authorities, including the central bank, maintain the economy will skirt a painful contraction later this year or next, even though they expect growth to slow. Zandi is among those to bet against a recession, in large part because the manufacturing sector is now on a “more solid, long-term fundamental ground”.

“This time may be different because manufacturing is just in a very different place than it typically is coming into an economic downturn,” he said.

Read the full article here