Investment overview

The central point of an investment analysis into Varonis Systems (NASDAQ:VRNS) is its transition into a SaaS model. While this transition is a growth tailwind in the near term, it has long-term benefits as it drives higher contribution margins and shorter sales cycles. In other words, I view the SaaS model as a superior product vs. the on-premise product. With the transition progressing faster than expected, this also means that the point of growth recovery is going to happen earlier. I hold a bullish view on Varonis Systems for this reason.

Business description

VRNS provides a platform for managing, securing, and optimizing data. Its platform enables businesses to address data protection compliance standards in many different industries. Like many high-growth software companies, VRNS was a business that grew at a very high rate (30+%) in the initial part of the 2010s. However, growth dipped significantly in FY19 to -6% from 25.5% in the previous year due to the pandemic. Growth was further slowed down as the business went through the transition into a SaaS (software-as-a-service) model in recent quarters (LTM growth now at 6.6% vs. 21.4% in FY22 and 33.3% in FY21). On the other hand, regarding profitability, the business has never been profitable over the past decade. Positively, the business has always been in a net cash position. As such, liquidity was never a problem for the business, despite the cash burn.

Transition to SaaS model right on track

VRNS 3Q23 results suggest that the transition is well on track, as SaaS as a percentage of new business and upsell ARR have increased by 100bps from 2Q23 to 59%. This has largely outperformed management guidance for 45% of NNARR (net new annual recurring revenue). As of 3Q23, VRNS now has about 15% of its total ARR coming from the SaaS model, up from the 10% saw in the last quarter. I believe this is a major step up, and with this momentum, by FY24, the total percentage of ARR coming from SaaS should reach 35% (assuming a 5% sequential improvement). One key metric to note here is that the ARR contribution margin has increased significantly by 290bps to 11.1% from 8.2% in 2Q23. This is huge because it is evidence that the SaaS model is margin-accretive. As the mix improves over time, I expect to see VRNS accelerate its path to reaching breakeven status. The downside here is that the faster the transition, the bigger the slowdown in growth in the near term. As mentioned by management in the call, revenue growth saw a headwind of 12% due to the increased SaaS sales.

In any case, I think the acceleration in the SaaS transition is very positive. I see this as short-term pain for long-term gains. The acceleration transition timeline has significantly exceeded management’s initial guidance that it would take about 5 years for the percentage of SaaS in NNARR to reach 70-90%. However, in less than a year, that figure is already at 59%. At this rate, VRNS could possibly achieve its target by FY24 (3 years ahead). From a qualitative perspective, this speaks very well of the VRNS SaaS product relative to its on-premise product, as users are willing to switch to the SaaS model.

Reduced product gap leads to faster deployment time

Further evidence that the VRNS SaaS model is likely to be superior to its on-premise product can be seen from the reduction in deployment times, relative to the on-premise product. More specifically, management mentioned they have managed to further streamline the risk assessment and onboarding processes on cloud environments. The outcome is a more efficient sales process and an approximately 85% decrease in outstanding onboarding support tickets. These improvements have huge implications. Firstly, the cost of customer acquisition [CAC] is now much lower given that less time is needed to acquire each customer. Secondly, the same capacity of the sales team is now able to handle more customers/prospects at once, thereby increasing the growth potential. Although it is too soon to determine the exact effects, I am heartened to hear that the shift to SaaS has improved go-to-market efficiency.

Now they will benefit from quicker time to value, faster deployment, and most importantly, they will be better protected with our proactive incident response team and automated remediation for Windows on-prem and Microsoft 365. Company 3Q23 earnings call

ARR growth is in focus, but deal sizes are getting larger

I believe the outlook for ARR is getting more and more positive as deal sizes are getting larger. On a like-for-like basis, management has stated that the SaaS platform is achieving 25% to 30% higher ASPs than the on-premise version. This also further explains the higher contribution margin that VRNS is seeing. I expect this dynamic to continue and not just be a one-off event. The reason I believe this is so is because the cost to customers operating & maintaining the product is now much lower. With that cost savings, they are able to purchase more VRNS instances. In other words, the total cost of ownership is lower now, which means VRNS is able to afford more for the same dollar spent.

The number of tickets on the support side is significantly lower with SaaS versus the self-hosted offering. So when you think about SaaS, the price list has been apples-to-apples if you’re buying the same product 25%, 30% higher.

And the reason I’m saying that is because if you have an existing customer that is converting from on-prem subscription to SaaS, if they need to consume technically more of the product, basically more of the licenses, the uplift would be more than that 25%, 30%. D.A. Davidson Technology summit

The change in product strategy is another factor that contributes to larger deals, which in turn support higher ARR growth. Instead of selling licenses individually, VRNS now offers pre-packaged bundles. As a result, sales volumes and customer penetration increased. More importantly, this further incentivizes sales reps to put more effort into upselling as they can earn more commission dollars on larger deal sizes.

So in 2022, when we still had the self-hosted offering, we decided to just try and consolidate some of the SKUs and talk about selling the platform. So we offered bundles at the time.

And we had gold, silver and platinum bundles, where you consolidated some of the SKUs into one sale — one SKU. And that was very well-received by both our reps and our customers. – D.A. Davidson Technology summit

With these structural tailwinds, I have a very positive view of VRNS once the macro pressure (which is impacting the sales cycle) eases. The fact is that VRNS is executing very well on the SaaS transition front, and the pricing lift from the transition should further support faster growth as we exit this weak macro environment.

Valuation

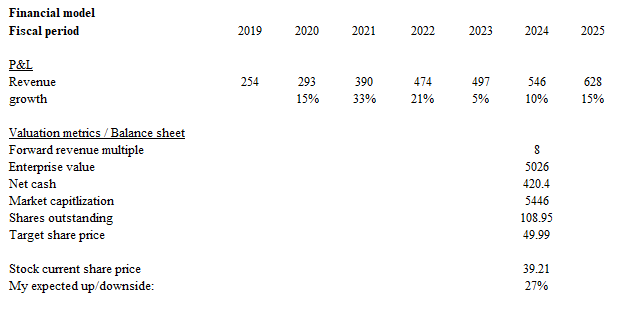

Author’s Calculations

My financial model values VRNS using forward revenue multiple as the business is still in the growth stage, where profits are not meaningful at this point. My growth expectation is that revenue should grow as expected in FY23, given that 3 out of 4 quarters are already out, and management has high visibility into 4Q growth. Post FY23, I expect revenue growth to accelerate as the headwinds from the SaaS model transition taper and VRNS benefits from the higher pricing uplift and larger deal sizes.

In terms of valuation, I believe VRNS should trade at a higher multiple because growth accelerates. From a comparative standpoint, I believe VRNS should trade nearer to where Palo Alto Networks (PANW) is trading at (9x forward revenue) over time. PANW is now trading at a premium to VRNS because of its higher growth outlook (high teens) vs. VRNS low-to-mid teens outlook. From a historical perspective, VRNS is now trading at 7.2x forward revenue, near its 10-year average. As VRNS growth recovers closer to historical levels, it makes sense that the stock should trade at a higher multiple than in recent history (where valuation was weighed down by slowing growth). All in all, as VRNS emerges from this transition, I believe the market will give credit for the acceleration in growth.

Using these assumptions, my expected target price for VRNS is ~$50.

Risk

The potential risk is that VRNS has benefited from addressing all the low-hanging fruits in the first 3 to 4 quarters of transition, which explains the faster-than-expected conversion. From here out, if the remaining customers are less inclined to convert due to whatever reasons, it could impact the transition timeline and, hence, the timing of growth acceleration.

Conclusion

Overall, my belief is that the VRNS SaaS transition is showing good progress. Despite short-term growth headwinds due to the transition, I believe this shift will enhance long-term growth. The reduction in deployment times and enhanced efficiency further validate the superiority of the SaaS model, potentially resulting in increased customer acquisition and scalability. Moreover, larger deal sizes and improved pricing dynamics are expected to contribute to higher ARR growth.

Read the full article here