Veris Residential, Inc. (NYSE:VRE), incorporated in 1994, is a REIT primarily engaged in the acquisition and management of Class-A multi-family properties mainly located in the Northeast.

Although the REIT is in a turnaround process, its leverage/liquidity issues along with the very unattractive dividend yield and fair valuation make it too risky to buy right now. If you are looking for an objective analysis of VRE, in this post I will present both the good and bad things about the company to help you understand why it’s best if you just add it to your watchlist for now.

Portfolio

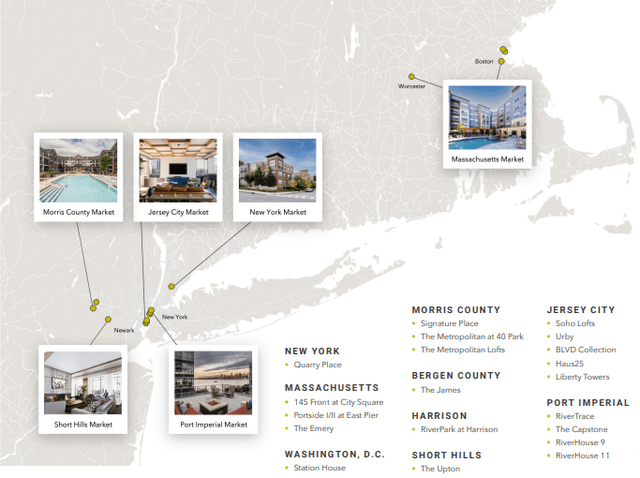

As of the third quarter, the REIT owned or had interests in 30 properties which consisted of 24 multifamily rental properties containing 7,681 apartment units. It also owned developable land parcels and non-core assets comprised of four parking/retail properties and two office properties.

The portfolio is spread across New Jersey, Boston, Suburban New York, and Washington, D.C.:

Investor Presentation

Though the properties are not as diversified as those of other larger REITs, they have the benefit of being in attractive locations and offering resort-like amenities, such as state-of-the-art fitness centers, dog parks, lounges, clubrooms, and rooftop swimming pools. Moreover, they are 6 years old on average, which implies less maintenance expenses than those older assets of many residential REITs require.

You should also know that in the last 3 years, Veris dispositioned more than $2 billion of non-strategic assets, including 25 office properties and two hotels, as part of its effort to become a pure-play multifamily REIT, announced back in 2021.

Performance

First, during the third quarter, occupancy and retention rates were 95.5% and 55%, respectively; sufficiently high for a residential REIT.

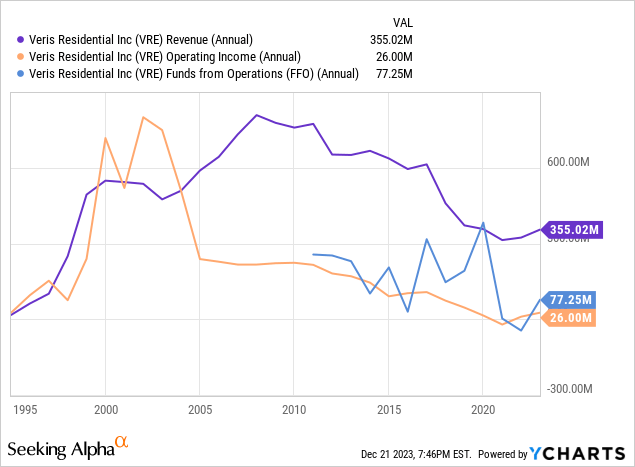

However, the company’s operating performance has been very erratic, making forecasts less predictable:

The above chart doesn’t tell the whole story though. That’s because revenue, operating income, and funds from operations capture losses incurred by non-core assets which Veris intends to get rid of. The same-property cash NOI coming from the multifamily portfolio has experienced a lot of growth. The last quarter’s figure annualized is 109.25% higher than the average annual one of the last 3 fiscal years.

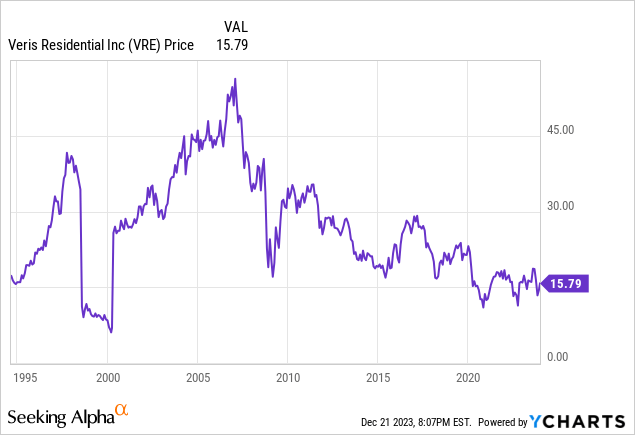

As you should expect, the long-term historical operating performance has been followed by a falling stock price:

Is this deserved? Probably. Is this reflective of future performance? This is where it gets tricky as a price trend can be reasonably used to predict the future only if the possible drivers behind the trend are likely to remain present. A turnaround story is unfolding as you are reading this, so the above chart should be taken with a grain of salt.

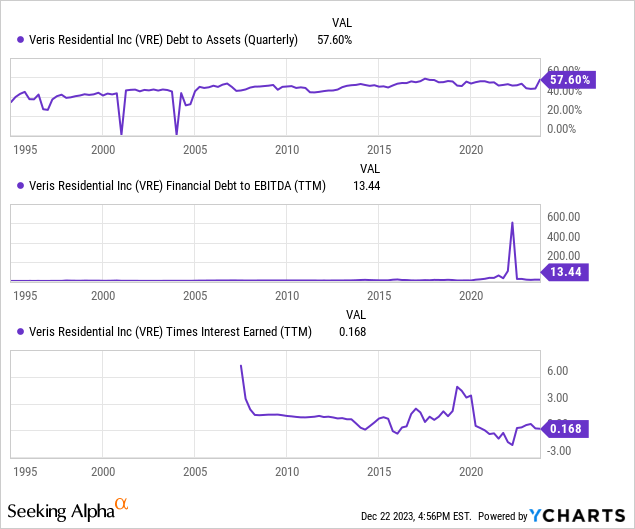

Leverage

As for Veris Realty’s financial health, things look just as bad. It currently finances its assets with 57.6% debt, has a debt-to-EBITDA ratio of 13.44x, and the interest coverage sits at 0.16 times.

So, even though leverage isn’t dangerously high, it is high in relation to the REIT’s profitability, which in turn suggests inadequate liquidity.

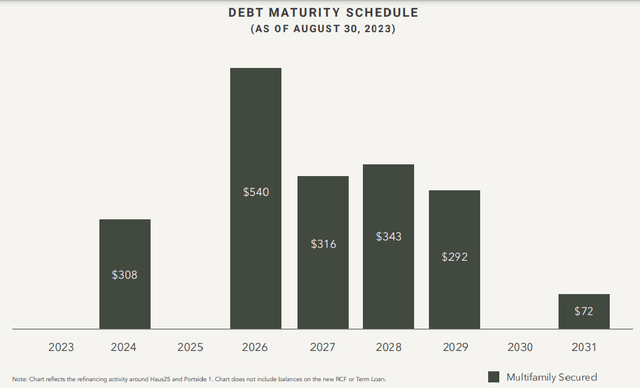

In contrast to this grim situation stands the weighted average interest rate of the company’s debt at 4.49%, which is very attractive. And so is its near-term maturity schedule, with 16.1% of its debt maturing next year and nothing coming due in 2025.

Investor Presentation

Unfortunately, the low cost of debt and no threatening maturities in the short term cannot overshadow the liquidity issue.

Dividend & Valuation

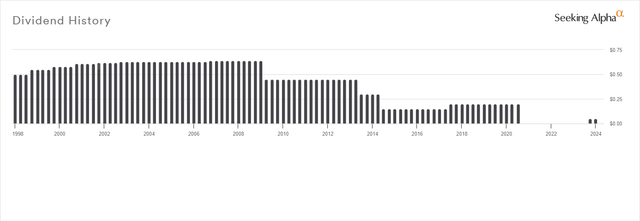

Veris Residential currently pays a quarterly dividend of $0.05 per share, which suggests a very unimpressive forward yield of 1.26%. The low distribution is not surprising, considering that profitability is suffering. And the same applies to the fact that the REIT started paying a dividend again only recently at a much lower figure than before after suspending it in 2020. The fact that the REIT has been continually lowering it in the past is also consistent with its cash flow problems:

Seeking Alpha

What’s surprising, however, is that VRE is trading at a 4.98% implied cap rate, which more or less makes it fairly valued. I would expect that the market would offer the stock at a discount to NAV. Also, consider that it’s actually overvalued on a peer-relative basis with the median implied cap rate being around 6% for residential REITs.

Risks

This brings me to the first risk related to buying shares at fair value or, worse, at a premium. The lack of a margin of safety can result in a lack of conviction in your investment decision, which in turn could lead to realizing a loss if the price falls even more at some point.

At the same time, it’s not helpful that the company isn’t profitable enough to cover its interest obligations. Even if that and its ever-increasing debt never force it into defaulting, the market could reprice the shares accordingly if the situation doesn’t improve.

Another but less important risk relates to the portfolio’s geographical concentration. REITs are partly attractive to investors because they can offer a very broad exposure to markets across the country. And justifiably so as this helps hedge risks of population changes, unemployment rates, and changes in rent prices.

Verdict

Therefore, I must assign a hold rating to VRE for now and come back to it if and when the problems I covered above are resolved. Something not unlikely as we saw in the portfolio section above; Veris Realty has already taken steps to become a pure-play multifamily REIT and this might do it for it. We’ll have to wait and see as I think it’s way too risky to buy shares right now. But VRE definitely deserves an addition to your watchlist.

For now, you may want to take a look at an analysis of Equity Residential (EQR) that I wrote not too long ago if you are interested in multifamily property exposure. Although it is 12.85% up since then, the margin of safety is still attractive and the dividend yield is much higher than Veris Realty’s.

What do you think? Do you own VRE or intend to nevertheless? Let me know below and I’ll get back to you as soon as I can. Thank you for reading.

Read the full article here