Investment thesis

Our current investment thesis is:

- VSCO owns two leading brands in the industry but is facing increased competition and declining relevance as consumer tastes change and the industry pivots away from its image.

- Financial performance has moved in line with this, with revenue declining consistently and margins facing erosion.

- Management’s revitalization plans do not instill confidence and our analysis implies further issues are to come.

- VSCO is unattractive relative to peers and its valuation looks racey based on the poor outlook.

Company description

Victoria’s Secret (NYSE:VSCO) is a leading American retailer of women’s lingerie, apparel, and beauty products. With a strong brand presence and a global footprint, Victoria’s Secret operates through its physical stores, e-commerce platforms, and catalog sales.

The company is a spin-off from L Brand, which was a combination of Victoria’s Secret and Bath & Body Works (BBWI).

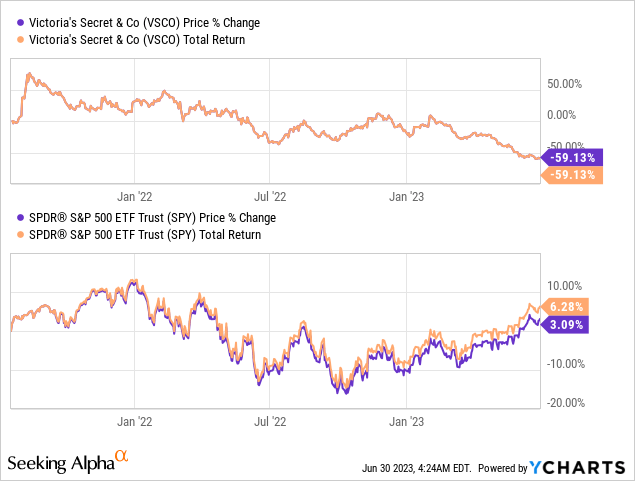

Share price

VSCO’s share price has been a catastrophe, declining over 50% since it was spun-off. This is a reflection of weakening financial performance and continued struggles to improve the brand.

Financial analysis

VSCO Financials (Capital IQ)

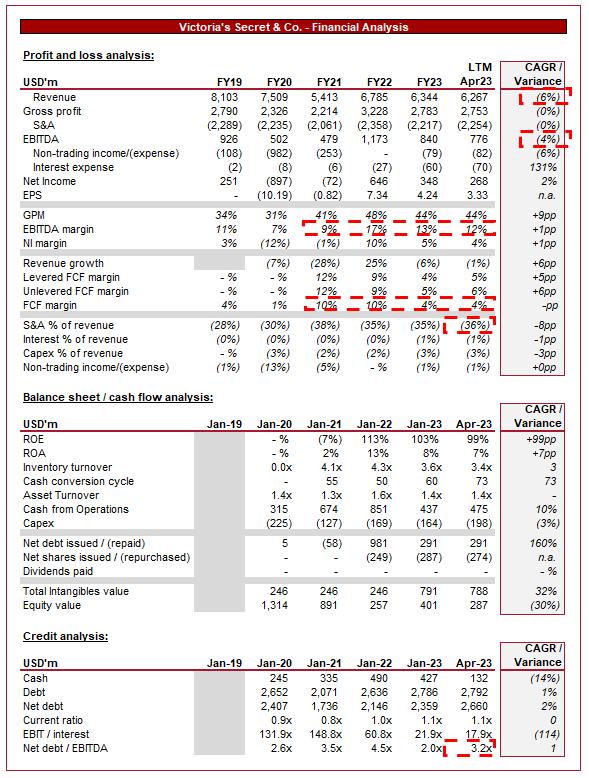

Presented above is VSCO’s financial performance in the last 4 years.

Revenue & commercial factors

VSCO has been unable to achieve consistent revenue growth since becoming a standalone business, partially due to the impact of Covid-19, but also concerns around the sustainability of VSCO’s positioning in the retail industry. More recently, VSCO has experienced 5 successive quarters of negative growth Y/Y, the most recent of which was (5.2)%.

Business model and competitive positioning

VSCO offers a wide range of products, including lingerie, loungewear, sleepwear, swimwear, and beauty products, catering to various customer segments. The objective is similar to other retailers, where scale and new customers are won through expanding the product offering into related products.

VSCO follows a vertically integrated business model, encompassing the design, manufacturing, marketing, and retailing of its products. The company operates through a mix of company-owned stores, franchise partnerships, and e-commerce stores, combining to offer consumers a convenient and readily-available way to shop for their products.

The company focuses on creating a distinct brand image associated with femininity, sensuality, and fashion-forward designs. Its target audience is primarily younger adults, seeking to be fashionable beyond just a utility.

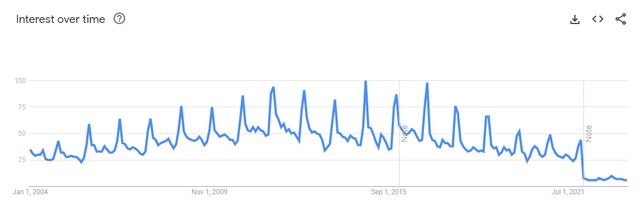

The primary issue with VSCO is the declining interest in the brand. VSCO has been a staple in the retail industry for an extended period of time. In recent years, however, the company has faced increased competition in its segment, with newer brands doing a better job of marketing to consumers, taking market share. As the following illustrates, interest in the brand has gradually but consistently declined for several years.

Interest in Victoria’s Secret (Google Trends)

In response, VSCO announced a strategic growth plan to revitalize the business and strengthen its core competencies. This involves the following.

- Strengthen the core – VSCO is looking to grow market share by evolving its brand proposition, allowing the business to attract a loyal customer base. Practically, we assume this will mean improved marketing and a pivot of the brand perception (increasing product range, etc).

- Ignite growth – VSCO is planning to improve its global footprint through international partners, as well as the development and acquisition of new brands. This is a “clear-cut” actionable plan and is a reasonable avenue for supporting an improvement in organic growth.

- Transform the foundation – The objective is “building a modern, high performing, agile, empowered, enabled organization to deliver efficiencies and to invest in our people and culture”.

2 out of 3 of these are what we call “consultant talk”. They sound great but the reality is that they are highly ambiguous and do not provide any actionable criteria upon which to judge progress and to achieve the improvement. The biggest concern we have is how the brand will be sufficiently improved to become attractive again. This does not feel addressed.

Retail industry

Changing attitudes and tastes is a critical factor in the retail industry. This makes the industry notoriously difficult. In recent years, we have seen marketing toward body inclusivity and diversity, influencing consumer demands for more inclusive sizing options and diverse representations in marketing campaigns. This is an area of expansion for VSCO, as part of the first criteria above. This looks to be falling flat, however, described as “the retailer finally advertises to us mere mortals, but the result is bland and performative”. The problem is that a host of brands are already operating within this segment and lack the baggage that comes with the VSCO brand. VSCO has historically rejected this segment and is now entering with its tail between its legs.

The growth of online shopping and the shift in consumer behavior toward digital channels has accelerated the need for robust e-commerce platforms and seamless omnichannel experiences. This is an area of strength for VSCO, as consumers are able to combine channels to their benefit, such as purchasing online and picking up in-store.

Leveraging social media influencers and brand collaborations have become crucial in reaching and engaging with younger consumers. VSCO’s social media presence is large, with over 75m followers on Instagram but the company is seemingly unable to penetrate the market (Despite S&A spending increasing to 36% of revenue from 28%). This could be a strategic issue as although they continue to have celebrity models, the lack of partnerships, and exclusive limited projects could be hampering the business.

Economic & external consideration

Current economic conditions represent near-term headwinds. With high inflation and elevated rates, consumers are experiencing a squeeze on finances, contributing to reduced discretionary spending. VSCO is not the cheapest option in the market and is targeted beyond utility, leaving the business susceptible to a revenue slowdown. We suspect this is a contributing factor to the revenue regression in recent quarters.

We expect these issues to remain in the coming quarters, as rates remain high to bring inflation down to a sustainable level. This implies that continued growth issues are ahead. Based on the current levels of decline, (2)-(5)% looks like a reasonable estimate.

Margins

VSCO’s margins have fluctuated somewhat during the last few years, seemingly normalizing in the 11-13% range. This looks to be a solid performance, although the business is facing a deterioration as increased discounting follows slowing demand.

Balance sheet & cash flows

VSCO currently has a ND/EBITDA ratio of 3.2x. This is an elevated level but within the range of sustainability. Our view is that a 4x level is a sustainable maximum, but does imply a shrinking capacity for debt. This is compounded by the slowing demand and thus the expected EBITDA decline. Management is seemingly funding distributions through issuing debt, an error in our view given the current conditions. Especially because it contradicts the capital allocation strategy per the strategic plan.

Further, inventory turnover continues to decline into Apr23, suggesting the slowdown in demand is still below the level Management is forecasting, again implying the bottom has yet to be reached.

Outlook

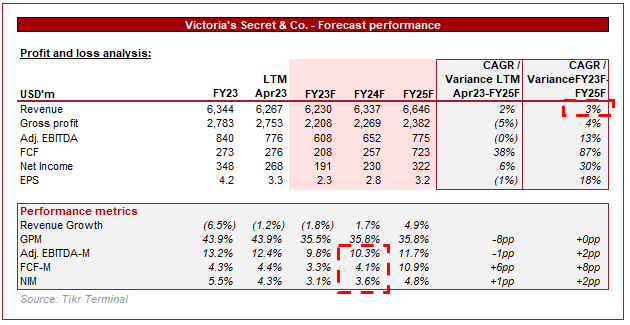

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a (1.8)% decline in FY23F, with a 3Y growth rate of 3%. This (2)% level likely prices in a recovery in the second half of the year, which is not overly optimistic. This said, we suspect VSCO will come in below this.

Margins are also expected to contract, declining to below 10%. This is a reasonable estimate given the revenue issues faced.

Valuation

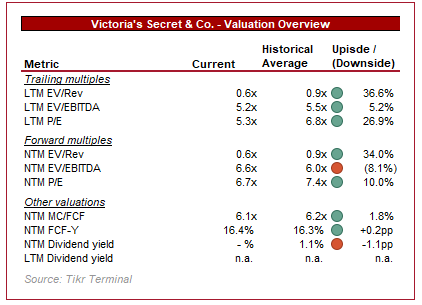

Valuation (Capital IQ)

VSCO is currently trading at 5x LTM EBITDA and 7x NTM EBITDA. This is a discount/premium to its historical average.

This level may look attractive on an absolute basis but it must be considered relative to other factors. When compared to peers, VSCO is currently ranked 39 out of 40 by Seeking Alpha, receiving a Strong Sell Quant rating. VSCO’s peers are trading at an average NTM EV/EBITDA multiple of 9x. Given VSCO’s underperformance, a discount is already warranted, but when including the risk of further revenue deterioration, its relative valuation looks expensive.

Compared to its historical average, we believe a discount is certainly warranted, primarily due to the lack of growth, margin erosion, and continued commercial weakness. Currently, there is a lack of material discount, implying the stock is overvalued.

Final thoughts

VSCO is a historically important brand that has a global presence. Its struggles in recent years have not been overcome and we do not buy into Management’s overhaul plans. Fashion is an incredibly difficult industry to operate within due to changing tastes and VSCO has found itself sidelined. We do not see a material improvement in its commercial profile, with competition only increasing over time as new entrants innovate and challenge its position.

VSCO is trading at a low multiple on an absolute basis but we do not consider the business attractive. Its valuation faces a rapid deterioration risk as its earnings decline.

Read the full article here