Investment thesis

Our current investment thesis is:

- COCO has done a fantastic job of cornering the coconut water segment, gaining significant market share through successful marketing and a keen focus on the health aspect. The brand is now synonymous with the segment, positioning the business well to expand its product range.

- We believe demand for coconut beverages will remain strong, owing to the health benefits, variety of use cases, and good demand across demographics.

- There is an expectation that continued innovation is conducted to maintain its >10% growth rate but we are comforted by its FCF yield of 5%. Even if growth slows, margin/FCF improvement will be sufficient.

Company description

Vita Coco (NASDAQ:COCO) is a leading brand in the beverage industry, specializing in coconut water products. Founded in 2004, the company has rapidly grown to become a prominent player in the health and wellness sector. Headquartered in New York, Vita Coco has a global presence and distributes its products across various markets.

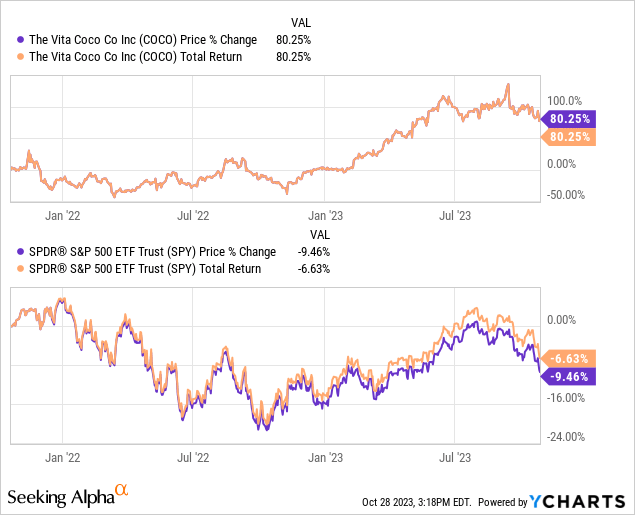

Share price

COCO’s share price has got off to a great start, returning over 80% during a period of difficulty for the markets. Investors are incredibly bullish on the financial development thus far and the overarching outlook for the business.

Financial analysis

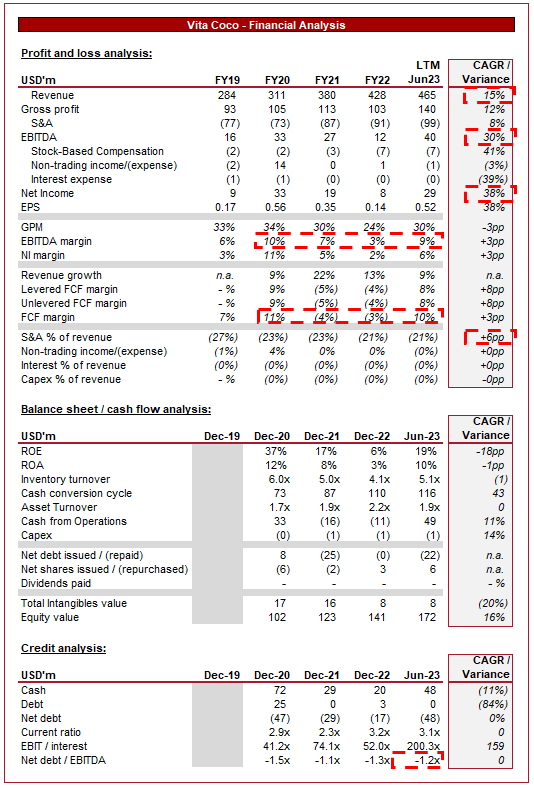

Vita Coco financials (Capital IQ)

Presented above is COCO’s financial results.

Revenue

COCO’s revenue growth has been strong since FY19, with a CAGR of 15% into LTM Jun23. Although this is a small sample, the wider trajectory of the business has been incredibly positive, particularly in the last 5-10 years.

Business Model and commercial development

COCO primarily produces and markets natural coconut water products. The brand emphasizes its commitment to providing consumers with a healthy, hydrating, and natural beverage option, free from artificial additives.

Coconut water is known for its natural hydration properties and electrolyte content, making it a popular choice among health-conscious consumers. It has grown in popularity consistently for an extended period, as the following graph illustrates.

Coconut water (Google Trends)

The growing Western emphasis on health-conscious lifestyles has driven demand for natural and functional beverages like coconut water (“Better for you” beverages). We do not see this as a short-term trend, as it is based on an improved understanding of the adverse health implications of certain foods. Further, in many cases, consumers are not forgoing a significant amount of taste.

COCO offers a range of flavors and packaging options, catering to different tastes and preferences. The key, however, is the broad use case of coconut water. This variety allows the brand to appeal to a broader consumer base, making its focus on coconut commercially viable on a global/large scale.

Formats (Vita Coco)

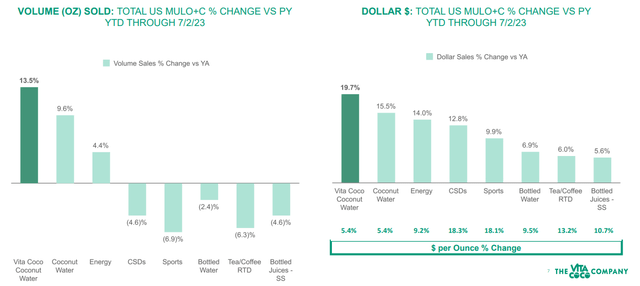

Additionally, growth in the segment is disproportionately robust relative to other beverage segments (and less dependent on pricing). It has performed better than Energy and Sports, two segments that have performed exceptionally well in recent years. Compounding this is that COCO’s growth exceeds the segment, implying continued market share growth despite its existing leading position.

Beverage Industry (Vita Coco)

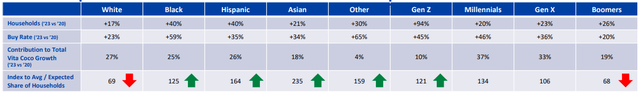

Finally, growth for COCO is strong among all ethnicities and ages, adding further evidence to its universal nature and genuine development into a mainstream beverage option in society. This underpins the continued strength of the coconut water growth trajectory.

Penetration (Vita Coco )

It is easy to suggest this is a trend or fad but we do not believe this to be the case. The product is healthy and tastes good, it has a broad use case, and all demographics are interested in the product. Will it be as popular as Water, Coffee, or Soda, probably not, but will it carve out a significant segment of its own, we believe so.

COCO’s marketing efforts focus on the health and wellness aspect, expanding its strategy beyond this by featuring endorsements from celebrities and influencers. The coconut water segment experienced a large influx of entrants as interest in this increased, with COCO’s strategy propelling the company ahead of its peers. The brand’s distinct packaging and visual identity are now synonymous with coconut water, with many replicating its distinct blue and green tone.

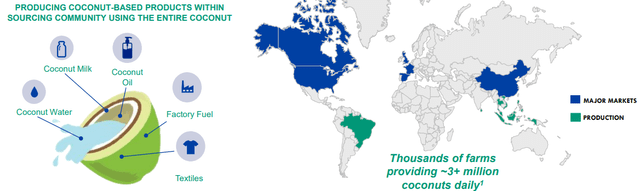

COCO has developed a strong international presence through brand development, supported by a geographically diversified supply chain, ensuring it can efficiently source a sustainable quantity of coconuts.

Supply chain and markets (Vita Coco)

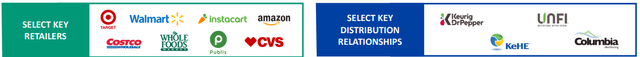

The company accesses consumers through its partnership with leading retailers and distributors globally, ensuring it has the broadest exposure to individuals, which is critical marketing in itself.

Retailers and distributors (Vita Coco)

Naturally, the next steps for the business will involve product development. Management estimates that the “better for you” hydration category is worth upwards of $30bn. Across the Sports Drinks, Flavored Water, and Juice sub-segments, the Vita Coco brand is positioned perfectly for success.

The company will benefit from the ongoing trend towards healthier beverages/natural ingredients to position itself as a healthier alternative, underpinned by the great taste of coconut. The key will be whether Management can find an angle for differing flavors while maintaining the foundations of healthiness (Many of its peers mix coconut water with flavors such as Chocolate).

Most recently, COCO launched an alcoholic canned beverage in partnership with Diageo (DEO), Coconut milk, and also “PWR LIFT”, a Sports Drink alternative that is high in protein with no sugar.

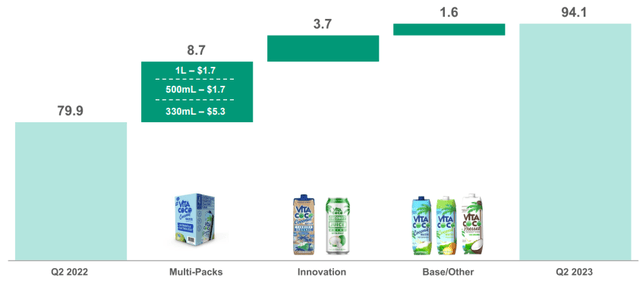

As the following bridge illustrates, product development is contributing materially to top-line growth.

Q2 revenue bridge (Vita Coco)

In conjunction with product development, continued expansion globally will support organic growth. We are comfortable that the brand buildout in recent years will support successful entry.

Vita Coco operates in a highly competitive landscape that includes both established and emerging brands in the beverage sector. Key direct competitors include ZICO, Coca-Cola’s Innocent (KO), and Amy & Brian.

Margins

COCO’s margins are slightly underwhelming currently, although are on an upward trajectory. In the most recent quarter, the company achieved an EBITDA-M of 15.1%, owing to revenue growth, inflationary pressures subsiding, and operating cost leverage.

We suspect that as input costs decline further and increased scale is achieved, COCO will be able to maintain this 15% level at a minimum.

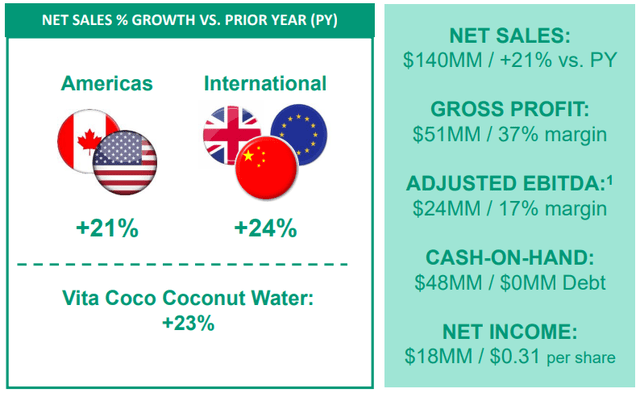

Q2 results

Q2 (Vita Coco)

Presented above is COCO’s most recent quarterly results.

The company continues to post impressive revenue growth, with +21% in the Americas and +24% Internationally. As discussed previously, much of this is driven by product innovation, which should continue to drive growth in the coming years with increased investment.

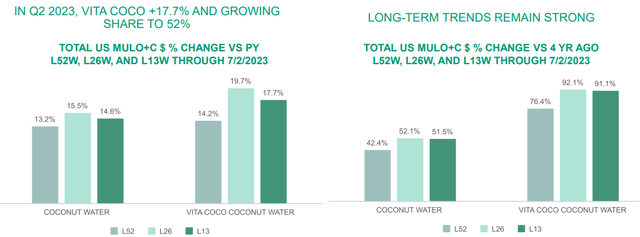

Supporting this, however, is the underlying strength of coconut water. Market share continues to grow well, with trends broadly unimpacted by economic conditions.

Market share and revenue growth (Vita Coco)

Outlook

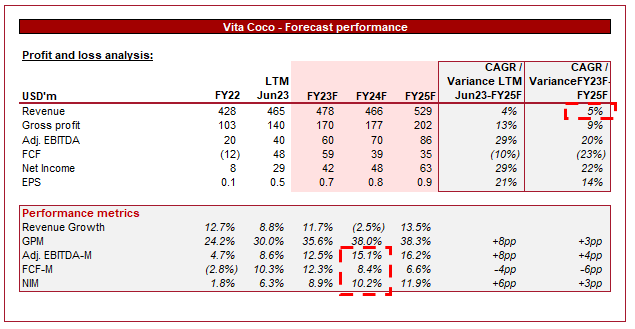

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a slowdown in growth, which is likely a conservative view given the growth contribution from innovation. We suspect the business will land at a rate higher than this, although will mean Management considers M&A as part of its broader innovation strategy. Further, margins are expected to improve, in line with our expectations and Q2.

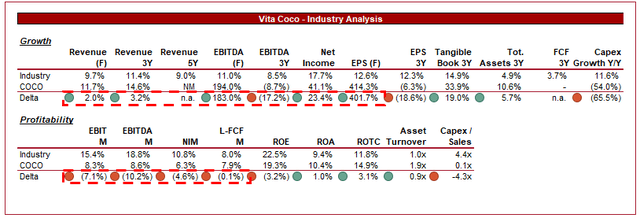

Industry analysis

Beverages (Seeking Alpha)

Presented above is a comparison of COCO’s growth and profitability to the average of its industry, as defined by Seeking Alpha (11 companies).

The company’s growth is naturally its strong suit, exceeding the industry across a number of metrics. Contrasting this is margins, which are lacking compared to the industry and realistically will continue to do so.

With peers such as Coca-Cola and Pepsi (PEP), it is unlikely COCO will achieve sufficient scale to exceed their level. This said, an EBITDA-M of c.15% is still highly attractive.

Valuation

COCO is currently trading at 33x LTM EBITDA and 22x NTM EBITDA. Given the short trading history of the business, its historical averages are not very useful.

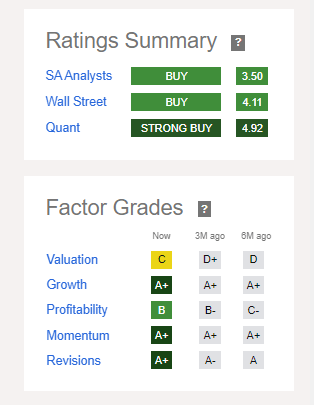

Grade factor (Seeking Alpha)

Seeking Alpha is highly bullish on the stock, rating its valuation a “C” and the stock as a whole a “Strong Buy”. This is due to its LTM PEG of 0.4, implying investors are not pricing in the impressive growth of the business. When layering in margin and FCF improvement, the stock looks primed for further share price gains in the coming 12 months. Underpinning this in our view is its FCF yield of 5%, an attractive level that will grow disproportionately to peers.

We believe the downside is somewhat protected by the fact one of the Beverage majors would be highly interested in acquiring the business should there be a substantial decline.

Final thoughts

COCO’s development in the last few years has been highly impressive, particularly because it was not taken over by a large peer but instead chose to go-it alone. Management has built a truly global brand, which is built on the perception of quality and healthiness.

We believe growth should continue in the coming years, primarily due to the strength shown by the wider coconut segment. Organic growth is robust while there is sufficient scope for new products to maintain its trajectory.

At a FCF yield of 5% and a <0.8 PEG, we consider COCO a buy.

Read the full article here