The WBA Investment Thesis Remains Robust Here

We previously covered Walgreens Boots (NASDAQ:WBA) in February 2023, suggesting that the stock was a great buy at that time, due to the highly competent leadership, top and bottom-line expansion, and consistent dividend growth.

WBA 4M Stock Price

TradingView

Unfortunately, the WBA stock continued to slide since then, while plunging after the underwhelming FQ3’23 earnings call.

The company recorded a bottom line miss for the latest quarter, while lowering its FY2023 adj EPS guidance to $4.025 (-19.6% YoY) at the midpoint, thanks to the tightened discretionary spending and lower contribution from the COVID-19. This was against the previous FY2023 adj EPS guidance of $4.55 (-9.1% YoY) at the midpoint.

WBA further worsened the pessimistic sentiments, with the management’s unsatisfactory FY2024 commentary, with the “adjusted operating income growth expected to outpace adjusted EPS,” suggesting another year of impacted profitability.

The rising inflationary pressure likely had also contributed to this cadence, since the company recorded declining gross margins of 18.6% (-1.6 points QoQ/ -1.6 YoY) and expanding operating expenses of $7.12B (+5.1% QoQ/ +2% YoY) by the latest quarter.

Combined with the elevated interest rate environment triggering the increase in its interest expenses to $173M (+22.6% QoQ/ +66.3% YoY), it was unsurprising that the minimal expansion in its top-line to $35.41B (+1.5% QoQ/ +8.6% YoY) had not helped to contain the burgeoning costs.

However, we believe these issues do not affect only WBA, with CVS Health (NYSE:CVS) experiencing similarly impacted margins and normalization post-pandemic-vaccines, naturally explaining the decline in both stock prices thus far.

In addition, WBA had shown much restraint in its inventory management at $8.16B (-6.7% QoQ/ -4.2% YoY) by the latest quarter, thanks to its highly efficient micro fulfillment centers.

The company had also sustainably deleveraged its balance sheet with long-term debts of $8.84B (inline QoQ/ -17.1% YoY). With the $5.5B opioid related claims also written off in FY2023, there may be more clarity in its near-term execution.

Meanwhile, WBA is also set to complete its transformational cost management program savings of $3.3B much earlier by the end of 2023, against the original goal of 2024.

Therefore, due to the management’s prudence and stellar cost efficiency thus far, it is unsurprising that the goal has been further raised to $4.1B instead, with at least $800M to be completed in 2024.

This cadence is impressive indeed, given WBA’s acquisition of VillageMD, Summit, Shield, and CareCentrix, without having to rely on additional debt and/ or dilute shareholders as CVS has, with the latter reporting long-term debts of $56.45B (+15% QoQ/ +8.4% YoY) in the latest quarter.

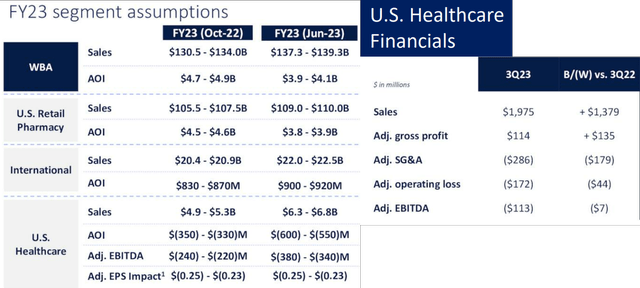

WBA’s US Healthcare Segment

WBA

However, investors may want to pay attention to VillageMD and Summit Health in the near term, since they largely contributed to WBA’s weaker adj EBITDA performance in the US Healthcare segment at -$113M by the latest quarter (-1614% YoY). This cadence also pulled down the company’s total adj EPS by approximately -$0.24 at the same time.

Then again, we are not overly worried for now, since the segment’s overall sales continues to grow to an annualized sum of $7.88B (+20.8% QoQ/ +22% YoY) by the latest quarter, with the underperformance mostly attributed to lower patient visits and new clinic expansions.

WBA has already taken immediate steps to reduce the cash burn as well, by prioritizing “better engagement and lower cost of care” through “new virtual and asset light models,” instead of rapidly expanding its clinic footprints.

Lastly, we expect to see more cost and capex optimizations, as the management eliminates another 450 Walgreens locations in the near term, or the equivalent of 3.4% of its existing 13K locations globally.

These efforts are promising indeed, since it may optimize WBA’s operating expenses, while triggering the expansion of its bottom line once the macroeconomic headwinds lift by 2025, if not earlier by the end of 2024.

So, Is WBA Stock A Buy, Sell, or Hold?

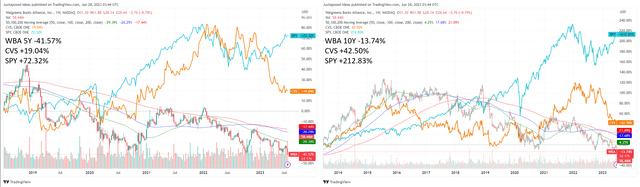

WBA 5Y and 10Y Stock Returns Including Dividends

TradingView

While we had previously rated WBA as a Buy, it appears that Mr. Market did not agree with our assessment, since the stock continued to underperform against CVS and the wider market since February 2023.

The same trend had been visible for the past ten years, with WBA generating total returns of -13.74%, against CVS at +42.5% and the SPY at +212.83%, with 5Y total returns of -41.57%, +19.04%, and +72.32%, respectively, even after adjusted for dividends.

WBA 1Y Stock Price

TradingView

Given the massive pessimism embedded in its stock prices, it seems that WBA may be a value trap at these levels, with it now drastically moderated to its July 2010 levels.

We suppose part of the bearish sentiments is attributed to its perceived dividend safety, due to the impacted cash from operations of -$20M in FQ3’23. This number is a drastic difference compared to the $746M reported in FQ2’23 and $1.62B in FQ3’22. This cadence may be worrying indeed, attributed to its supposed dividend aristocrat status.

However, we believe WBA’s dividends remain safe, with the management’s FY2023 EPS guidance suggesting an adj. net income of up to $3.47B (-20.4% YoY) based on its current share count of 863.8M.

Based on its historical FCF margin of 1.6% in FY2022 and annualized revenues of $138.2B (from the past three quarters), we may see the company generate approximately $2.21B of cash flow (+2.3% YoY), sufficient to cover the annualized dividend payout of $1.66B by the latest quarter.

Therefore, we believe that income investors need not worry about a dividend cut, a cadence we have previously observed with many other income stocks, such as Intel (INTC) and Paramount (PARA). In addition, these depressed levels offer opportunistic investors with an improved forward dividend yield of 6.08%, compared to its 4Y average of 4.30% and sector median of 2.42%.

Then again, while we may rate the WBA stock as a Buy for long-term income investors looking to dollar cost average here, they must also weigh their priorities while balancing a (preferably) well-diversified portfolios, due to the underwhelming total returns thus far.

Read the full article here