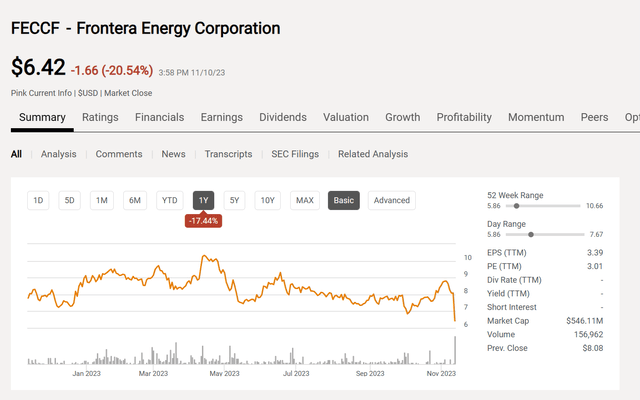

Frontera Energy (OTCPK:FECCF) had a third quarter report that was badly received by the market. The result was a stock price tumble as shown below:

Frontera Energy Common Stock Price History And Key Valuation Measures (Seeking Alpha Website November 11, 2023)

The reason is that management announced that they were looking at strategic options for their Guyana investment that is partnered with CGX Energy (OTCPK:CGXEF). CGX Energy stock responded far worse losing more than 40% of the stock value at the same time because the Guyana Partnership and related business is the only thing that the subsidiary has. If the offshore business is sold, then a major part of the value for that subsidiary is gone.

Fronterra Businesses

Fronterra, on the other hand has ongoing businesses in Colombia, and Ecuador. Revenue produced cash flow that will likely exceed long-term debt. In short, without the Guyana business, this company is in fairly decent shape. The business itself probably has above average risk in those countries. But the proposition is not unreasonable.

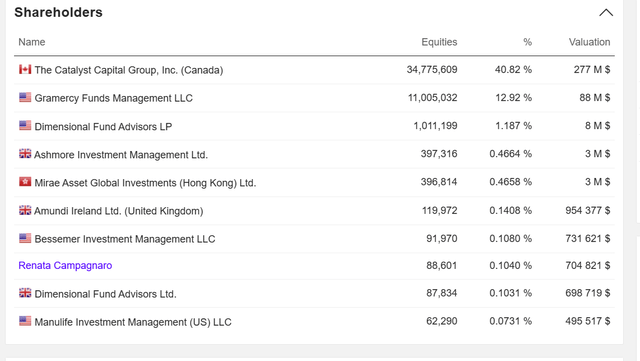

Controlling Shareholder

Fronterra Chart Of Major Shareholders (www.marketscreener.com November 11, 2023)

What is a little unusual here is that the main controlling shareholder is the Catalyst Capital Group. Right away that raises the risk of the investment because a fund that controls a business like this needs to be partnered with insiders that know what they are doing. The evidence so far points towards a bunch of investors that want to “make a killing” in Guyana without really understanding what they are getting into. The stock price reaction today demonstrates that the market has serious doubts about the strategy.

Since CGX Energy is controlled by Frontera, any problems at the parent company level are magnified at the subsidiary level so CGX Energy had a worse day.

This points to a situation that the typical investor should avoid. Honestly, lottery tickets probably have a better chance. The neighborhood in Guyana features big companies that know exactly how to deal with an upstart like this. The result may not be pretty. The strategy could work. But I do not like the chances at all and neither does Mr. Market right now.

The Problem

Both companies combined are too small for such a large project in Guyana offshore. This is magnified by the fact that there is a second major project that consists of building some facilities onshore (a deep-water port that CGX is working on) to service boats and the developing industry in general. The financing requirements are absurd for companies this size. Generally the financial resources are either costly or just plain do not exist. That led to the following:

” In parallel with the third-party laboratory confirmation of our significant light oil and sweet medium crude discovery at Wei-1, the Joint Venture, with support from Houlihan Lokey, is reviewing strategic options for its potentially transformational Guyana exploration business, the Corentyne block, including a potential farm down, as it progresses its efforts to maximize value from its potentially transformational investments in Guyana. “

Source: Fronterra Energy Third Quarter 2023, Earnings Press Release

Any time you see strategic options mentioned, you likely have a problem. In this case the problem is a very unconventional strategy. The two companies have so far spent in excess of $200 million with probably another $20 million for sure and really have no way of going further.

Now the hope is to sell the two successful wells and the acreage for a “big profit”. But not that many companies are interested. The ones that are could put these companies at a serious bargaining disadvantage.

TotalEnergies (TTE) and APA Corporation (APA) have drilled at least twice as many wells as the two drilled by Frontera and CGX. They are still spending money in Suriname right next door to Guyana, to figure out what they have. There is an excellent chance that Frontera and CGX have discoveries, but no proof that the discoveries are large enough to be commercial.

There is inferences that the discoveries are on trend (in line) with the Exxon Mobil partnership in Guyana. But geology is a tricky thing. There is no reason that what has been discovered is insufficient where Frontera and CGX are, while resuming viability in the next lease or even two leases away. That would make the two wells drilled attractive Exxon Mobil (XOM) only (or maybe another neighbor or two).

Even if it got to the point where an FPSO is justified, John Hess, CEO of Hess Corporation (HES) has long stated that an FPSO cost (for everything) exceeds $10 billion. Again, neither CGX Energy nor Frontera is big enough for financing such an idea.

There is a very good chance that the shareholders are in over their heads and the market realized this yesterday.

Conference Call

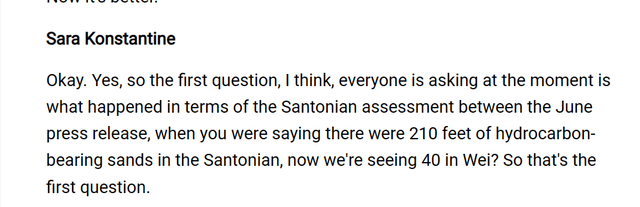

More doubts reasonably crept in during the conference call.

Analyst Question Expressing Doubt About Frontera Company Strategy (Frontera Energy Third Quarter 2023, Earnings Conference Call)

The answer to this was long and therefore not in the article. But it basically indicates that the communication was handled badly and therefore sowed more doubts for Mr. Market. It is not that the answer was unreasonable as much as the whole process demonstrated a lack of industry knowledge in how to properly handle the situation in the first place.

When you are undertaking a risky operation like offshore exploration and development, you want to set the market at ease with people that know what they are doing and how to handle conference calls so that analysts see that confidence and knowledge. Clearly that did not happen here.

The other thing is that management in the various communications mentioned some unexpected costs and transferred a small interest in this Guyana offshore business to Frontera from CGX. That was how “payment” was made to Frontera for the CGX share of the business unexpected costs. A few more of those transfers for unexpected costs, and CGX will not have an interest in the project it operates.

The next few questions from the same analyst demonstrated that management is far from communicating a comprehensive plan in a number of ways. That probably means they do not have one and intend to “wing it”. A presentation could have been made that would have delineated strategies and alternatives. But there was no presentation either.

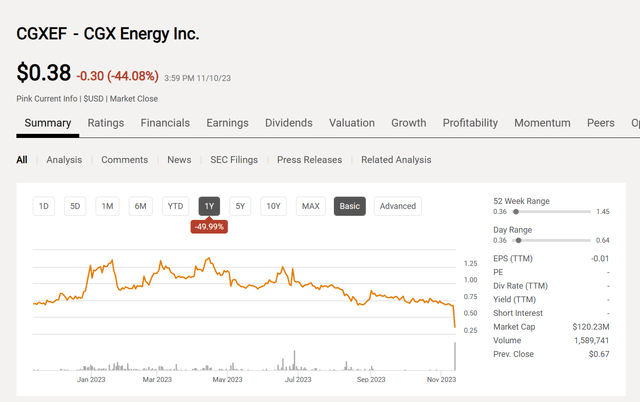

CGX Energy

Meanwhile the stock of CGX Energy had a worse day.

CGX Energy Common Stock Price History And Key Valuation Measures (Seeking Alpha Website November 11, 2023)

CGX Energy is affected by a conference call that the controlling company conducts. Clearly the stock was affected in a major way due to concerns about the joint venture with the parent company.

This stock trades on the TSX Venture Exchange. That alone should alert investors to the high-risk nature of this particular holding. Adding to that risk is the fact that the parent company, Frontera, controls enough stock so that the stock available to trade is somewhat less than the market value of the stock shown above. That makes manipulation of the stock price easier.

This means that a public common shareholder has no say in the operations of the company. Frontera has a natural conflict of interest in running this company due to the joint venture nature of the offshore Guyana business. Shareholders should therefore expect management to favor Frontera over CGX in any close calls and maybe in some “not so close” calls that can legally happen.

But the other thing is that the strategic attempt announced by Frontera eliminates or reduces a possible revenue source in the future. The company already must issue shares to raise cash and any financing needs until a revenue source appears. Any attempt by Frontera that would cause CGX to incur debt would place the company (with no revenues) in a very bad bargaining position.

The Deep-Water Port is still another huge project that a small company like this really has a very small chance to conclude successfully.

Therefore, in addition to the Frontera conflict of interest, there is a risk that financing needs would dilute common shareholders so much the at least part of the initial investment value would be lost.

Summary

Both CGX Energy and Frontera Energy appear to be run by people with limited knowledge of the industry in a very unconventional way. The investment in Guyana is the “tail that wags the dog”. These investors are speculating that they can “make a killing” but the market clearly has its doubts about the strategy as shown by the stock price reaction to the conference call and earnings announcement.

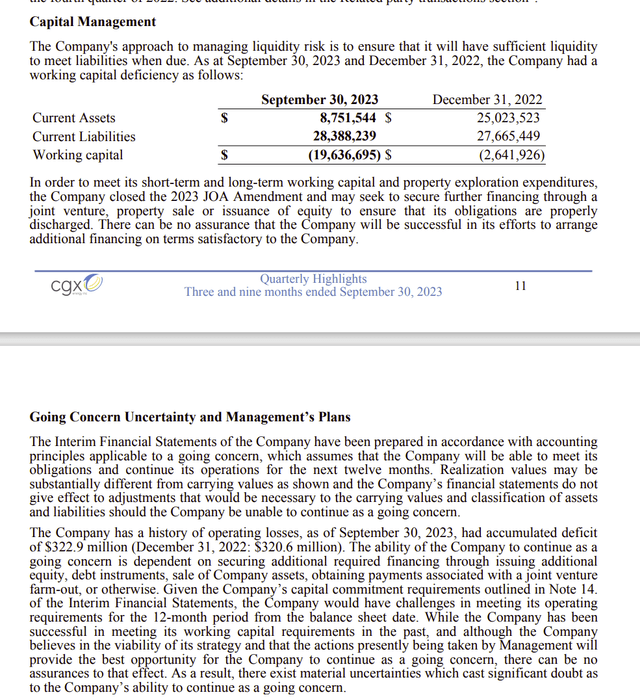

CGX Energy Going Concern Doubts Statement By Management (CGX Third Quarter 2023, Financial Report)

Any investor in CGX needs to read the financial statement totally and a lot of historical statements at a bare minimum when there is a going concern issue. With Frontera being run by investors, the chances of “cutting losses and running” are much greater if that needs to happen down the road.

In summary, the whole situation is a complete unconventional mess that is an extremely advanced situation by some very well trained and knowledgeable investors (if even then). For everyone else this is a strong sell with a “do not disturb sign ever” posted for a very long time on this idea for really either company.

Even Frontera has material disputes that should be read in their third quarter and previous reports. Getting involved in foreign countries means partnering with people who know what they are doing to minimize business friction. This is true in even business friendly countries. That appears to have been done at a very cursory level here. Management may yet succeed. But there are so many better ways to get this done then what is going on here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here