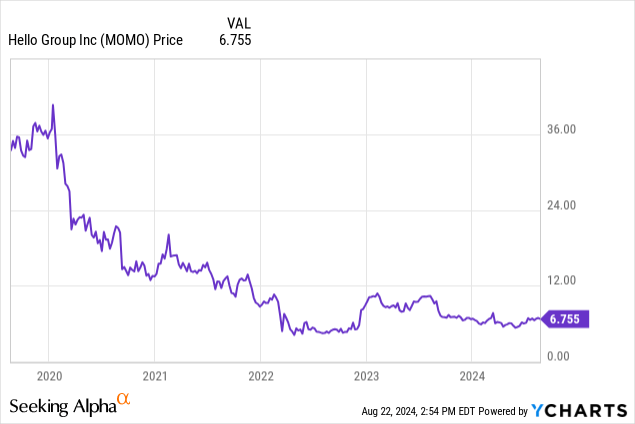

In 2020, I wrote an article about Momo, Inc, in which I wrote about the company as a social media play which was experiencing impressive growth and trading at a relatively low P/E. I labeled the company a strong buy at the time, and unfortunately, the stock didn’t do so well, declining as the company’s growth more or less ended, although the company continued at profitability.

Today we’ll be looking at the company, which has renamed itself as Hello Group (NASDAQ:MOMO), looking at the company at the even cheaper current price, but without serious growth prospects we saw before. Is the company still something to consider? Hopefully, we’ll find out.

Understanding Hello Group

Hello Group is, as mentioned before, built around social media offerings. The biggest offering they have is Momo, a popular social media network in China which reports over 100 million monthly users. The company also offers SoulChill, a social media networking app for the Middle East, which faces a lot of competitors, but has managed to already create a user base of over 5 million.

On the dating app side of things, Hello Group offers an influential Asian dating app in the form of TanTan, which they describe as the “world’s most popular Asian dating app.” They also offer an international version in the form of TanTan Tribe.

The company has other brands as well, including photo-sharing app TieTie, and the Apple Vision Pro-based social app inSpaze. Hello Group also has designs on motion pictures in the form of subsidiary Momo Pictures.

Consolidated Balance Sheet

|

Cash and Equivalents |

$834 million |

|

Total Current Assets |

$1.34 billion |

|

Total Assets |

$2.48 billion |

|

Total Current Liabilities |

$566 million |

|

Long-Term Borrowings |

$268 million |

|

Total Liabilities |

$918 million |

|

Shareholder Equity |

$1.56 billion |

(source: first quarter results from Hello Group IR website)

Hello Group has a strong balance sheet, with a lot of cash on hand for a company its size. That’s important, too, because the company has interest-bearing investments putting use of the cash which isn’t immediately necessary for day-to-day operations.

The company has little debt, and its income more than makes up for it. Perhaps the most interesting aspect of the balance sheet is the price/book for the ADS (American Depository Shares), which comes in at 0.82. That means the company, which has been quite profitable and in a market with lots of potential, is trading at a discount to its underlying value.

The Risks

Having a stock that generates a fair bit of cash by way of interest on its cash reserves, Hello Group is sensitive to interest rates. If the interest rates start coming down, the amount of money they make will similarly go down.

Currency risk is also a potential factor. While Hello Group is an international business across Asia, the company’s business is overwhelmingly done in China’s Renminbi. Seeing the Renminbi is not a freely convertible currency, potential changes in supply and demand and regulation could impact the company’s solid cash position.

Investing in China at all carries some geopolitical risks, and tensions between the United States and China could end up spilling over into Hello Group’s status as a US-traded stock.

Finally, and potentially a serious concern, is that Hello Group isn’t growing like you’d like to see from a player in the global social media market. Hello Group is generating quite a bit of earnings, but with the company spending less on advertising right now, growth just isn’t there. That might change in the future, of course, but for now, it’s not worth considering the company if your goal is growth.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (Q1) |

|

|

Net Revenue |

$2.29 billion |

$1.84 billion |

$1.69 billion |

$355 million |

|

Operating Income |

($375 million) |

$236 million |

$325 million |

$64 million |

|

Net Income |

($457 million) |

$215 million |

$276 million |

$7.9 million |

|

Diluted EPADS |

($2.26) |

$1.06 |

$1.38 |

4¢ |

(source: 20-F from 2022, 2023, 2024, and most recent quarterly statement from 6-K from SEC)

Hello Group’s statement of operations is something of a mixed bag. The company’s revenue is not only not growing anymore, but has been shrinking some in recent years. Despite this, the net income is on the rise, and the company has shown the ability to make quite a bit of money off its businesses.

In the first quarter, interestingly enough, the trend was reversed, as the company beat its revenue estimate by over $11 million but missed on earnings by 25¢. That’s concerning, and it is important to keep an eye on whether this is part of a broader trend or just an outlier. Hello Group tried to explain the decline in earnings as a withholding income tax. The company has beaten estimates a lot more than it has missed them, so while this is an extreme miss, I don’t think it’s worth throwing out the estimates going forward.

Estimates are that the company is going to come in with a revenue of $1.47 billion and earnings of 92¢ for the year. That would give us a P/E ratio of 7.5, not bad even if it is off the juicy earnings enjoyed in 2023. Next fiscal year, the estimates are for revenue of $1.50 billion and earnings of $1.28. That would be a forward P/E of 5.39, very cheap even with the recent revenue decline.

Looking Forward to Q2

Next month, Hello Group will be coming out with its second quarter earnings. The estimates are that they will come in at $369 million in revenue and earnings of 28¢. Assuming this comes in roughly as expected, it would be a very good sign that the company is, despite the Q1 problems, still on track.

Then We Have the Dividend

Hello Group doesn’t pay regular quarterly dividends, but has been paying sizable dividends based on its earnings on an annual basis. The company paid 54¢ this year, compared to 72¢ last year. It’s inconsistent then, unfortunately, but at the 54¢ mark the yield would be 7.8%, a very nice yield that would be pretty sustainable if the estimates for future earnings pan out.

Conclusion

There are a lot of things to keep an eye on with the Hello Group, especially after missing its Q1 earnings per ADS by 25¢. That raises concerns, but at its core the company is still trading below book value and at single digit P/E ratios, something that could make a value investor drool.

At this point, and at these prices, I have to rate Hello Group a buy. It was a strong buy before, but that was when the company was growing. The company says that the lack of growth is a result of not spending on advertising, and if they could turn that around and get to growing again without sacrificing the strong profitability of the company, investors could really have something.

Another thing that I would like to see is a more consistent dividend. Hello Group could be an income stock darling if we could count on them paying out like they have been recently, but the way they pay out, we just don’t know what’s coming.

Read the full article here