Management of Yangarra Resources Ltd. (OTCPK:YGRAF) has stated that there is a goal to get the bank debt down to C$80 million. This is a Canadian company that reports in Canadian dollars unless otherwise noted. The bank debt did indeed decline in the just-reported first quarter, as net debt declined about C$9.5 million.

This article builds on the last one that noted a pause in the growth strategy. A result of the combination of no growth and debt reduction priorities is likely to be a larger payment in the second quarter on the bank debt because the company is not drilling at the current time due to Spring Breakup in Canada. Drilling will again resume probably in June. Meanwhile, the lower operating costs almost ensure this plan will work unless there is another nasty wildfire season (or something equivalent).

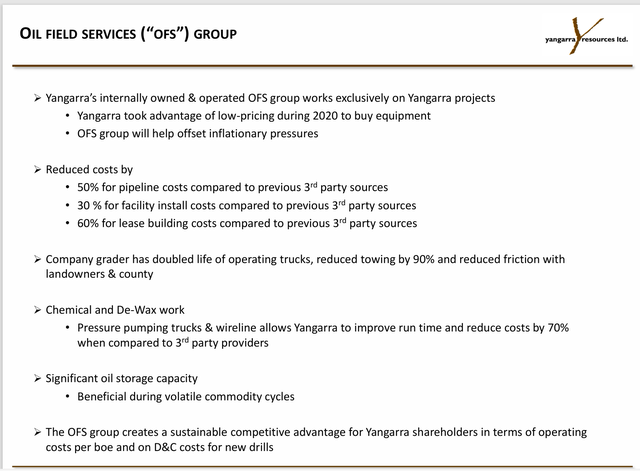

Oilfield Services Group

Small companies often depend a lot upon service companies because they do not have the resources to do things “in-house.” Evidently, this company has now gotten to the size where some things can now be done internally at a considerable cost savings.

Yangarra Resources Operating Cost Declines Summarized (Yangarra Resources Corporate Presentation May 2024)

Management has in the past mentioned purchasing equipment back in fiscal year 2020 to reduce costs. Now some more costs that are being reduced through the start of the new department and the equipment purchased are shown above.

This should enable the debt reduction that is planned by management. The wells that are drilled break even at a very low oil commodity price. Oil (CL1:COM) is far enough above that price that even with low natural gas prices, these wells should be extremely profitable with decent cash flow.

The problem here is that the pandemic interrupted the transition to an operating company from a startup. Management was, therefore, not able to drill enough of these wells before the pandemic changed the market attitude towards the situation the company was in. After the pandemic, the company was faced with repaying debt without finishing the transition to an operating company as had been planned.

This company is in far better shape than some others that had even less production (or more debt) before the pandemic. It looks as though production became high enough that cost savings were available to management to enable debt repayment without raising money through more stock sales.

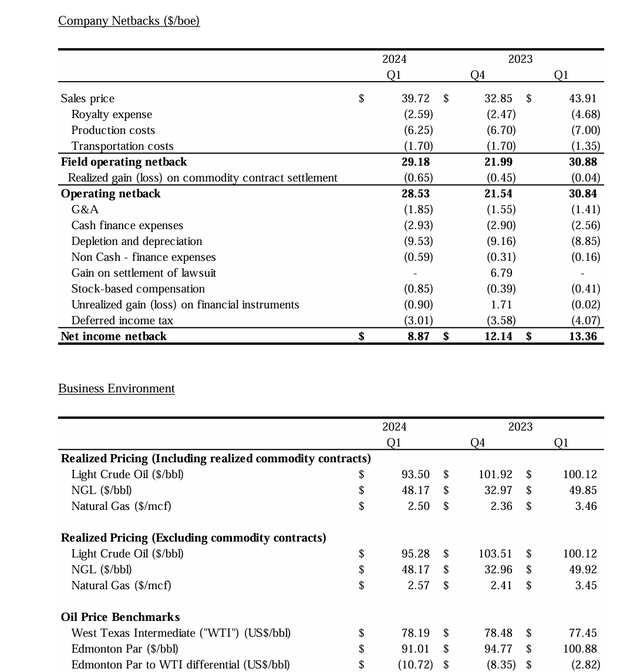

Netbacks

At the same time, management hi-graded the possible locations for wells to develop wells that raised the oil percentage of production. This allowed the average sales price to increase from the fourth quarter even though natural gas prices (NG1:COM) remained weak, and oil prices were not that different.

Yangarra Resources Operating Netback Calculation And Realized Commodity Prices (Yangarra Resources Earnings Press Release For the First Quarter Dated May 2024)

Note that management does get a slight premium to the benchmark price for oil. The company communications have commented on this process several times in the past.

In the commodities business, every extra penny is important. In this case, those extra pennies resulted in a decent net income shown above that enabled a sizable decrease in net debt.

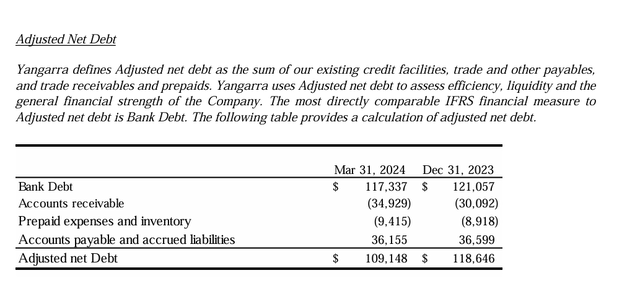

Bank Debt

In the quarterly earnings report, there is repeated switching between net debt and bank debt. The two are not the same, as shown below:

Yangarra Resources Calculation Of Adjusted Net Debt (Yangarra Resources Earnings Press Release First Quarter 2024)

Part of the net debt decrease is an increase in accounts receivable compared with the fourth quarter. Now an accounts receivable increase is likely to flow through to a debt reduction in the second quarter since the company is not drilling right now. Then, when activity resumes in June, the third quarter could again show an increase in working capital somewhere to reduce net debt once more.

A lot depends upon commodity prices. Natural gas prices can seasonally weaken unless a typically hot La Niña summer develops.

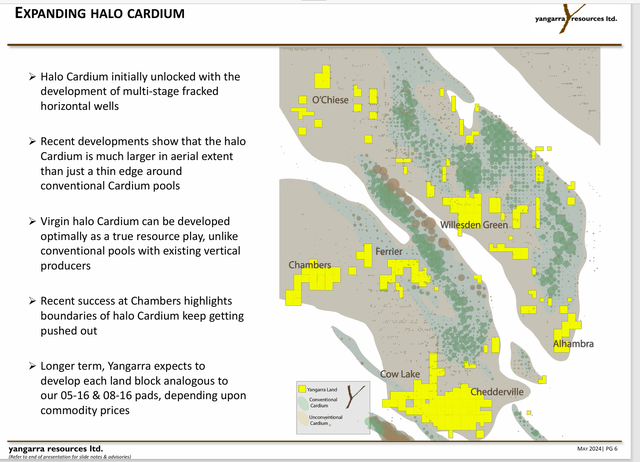

Area Of Operation

This company basically found a new interval before it was discovered by the industry in general. It therefore has a fair amount of acreage that it leased before there was an “industry mad rush” to join the company in this area of the business.

Yangarra Resources Summary Of Operations (Yangarra Resources Corporate Presentation May 2024)

Effectively, this new interval is its own “new frontier.” The basin itself has long been a significant North American producer. However, the latest technological advances have allowed intervals such as the one discussed above to be produced, whereas before it was too expensive to consider.

The industry knew where the oil was. There was just no way to produce that oil with competitive costs until the last 10 years or so. That has now led to a bunch of companies announcing “discoveries” in this interval.

The industry is still evaluating the interval for the best acreage. But this company was one of the first to deal with the Halo Cardium. It, therefore, has a kind of “first mover advantage.”

The area itself has a lot of acreage with stacked plays. Therefore, there could well be future growth from intervals that are right now not considered competitive, as long as technology continues to advance.

Summary

Yangarra Resources Ltd. management stated that they would hi-grade the opportunities while natural gas prices remain low. But this company is still very much exploring the acreage. Therefore, there could still be better acreage that has not yet been explored.

The sizable decrease in costs noted by the start of a division that brought numerous tasks in-house that were previously done by service companies should allow this company to at least maintain production while repaying debt.

The second quarter has a Spring Breakup. That generally means that more cash flow can go to repaying debt until things dry out enough that operations can resume. Management has stated that they will again begin drilling in June. Therefore, the third and probably the fourth quarters should show the most growth. In the past, if commodity prices were favorable, management was not beyond the idea of bringing more wells online in the fourth quarter (rather than the first) to expose the initial well production (at the high rates) to the winter natural gas prices.

The stock remains a strong buy, even though a small company like this with the stock trading under $1/share is a speculative idea. Management has a good start on repaying debt to reach the C$80 million bank debt goal. The debt ratio here has always been conservative. The company is profitable enough to include a slide in the earnings presentation that shows that the company made some money in fiscal year 2020 when much of the industry ran deep in the red.

Currently, the stock appears to be priced at roughly 2 times earnings per share. That low price takes a lot of the downside risk out of the stock given this management.

This management and the board have an established history of building and selling companies. Therefore, shareholders should expect this to be a growth story rather than a dividend play.

Any small company like this is best considered to be part of a basket of small companies to reduce that small company’s risk.

Risks

Any small company is usually deeply dependent upon key personnel. The loss of those personnel can prove fatal to a small company.

The upstream industry is dependent upon commodity prices that are low visibility and volatile. This company has wells that breakeven at unusually low prices. So, it rarely hedges much. That was a real eye-opener in fiscal year 2020.

The technological advances that periodically sweep the industry can stop at any time. Even though most managements do not currently see an end to continuing cost reductions and operational improvements, that attitude can change overnight.

As last year showed, mother nature can have quite an effect on these small Canadian companies. While another year like that is probably far into the future, there is never a guarantee that another challenging year like fiscal year 2022 will not happen.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here