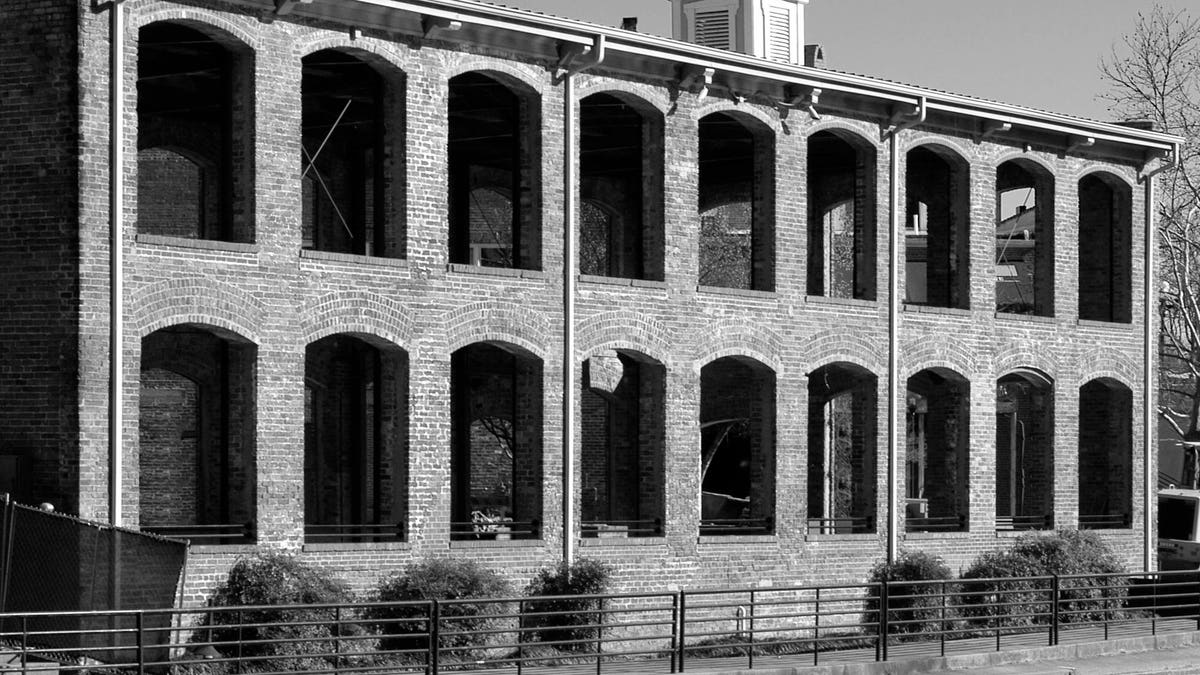

If the U.S. is to turn around its critical dearth of rental housing units, experts are agreed adaptive reuse projects must be part of the answer. According to a new Adaptive Reuse Report from RentCafe, there is good and bad news on that front.

First, the bad news. The number of buildings that underwent conversion in 2021 and 2022 was not as great as the numbers from 2019 and 2020.

The good news is robust interest continues to exist in leveraging adaptive reuse projects – many involving office conversions — to both generate more apartments and revitalize downtown districts hard hit by the move from offices to work-from-home arrangements. RentCafe reports a total of 10,090 apartments were converted last year. Moreover, 122,000 rental apartments conversions are in the pipeline, 45,000 of them resulting from office repurposing.

Adaptive reuse projects creating new apartments would likely be larger in number if greater clarity existed around the future of office space. There’s general lack of agreement about how much office space will be needed in the future.

While remote work has been effective for many employees and employers, a growing number of companies and organizations are mandating staffs appear in person increasing numbers of days per week. This trend leaves doubt about numbers of office buildings that may be candidates for conversion. However, the trendline is encouraging. The number of apartments resulting from adaptive reuse projects should exceed 120,000 in upcoming years, RentCafe reported.

Trends shift

While office conversions have cooled the last two years, hotel-to-apartment transitions have spiked recently to a five-year peak.

Office conversions are still the most common, representing 34% of all adaptive reuse projects. But hotel conversions are gaining, to reach 29% of all projects. In 2022, 2,954 apartments were created as a result of hotel conversions, an increase of 43% over the 2,060 apartments generated in 2021.

The reasons are not hard to fathom. Hotel-to-apartment conversions are far easier to achieve than those from office buildings or the next most common sources: factories, healthcare buildings, warehouses, entertainment centers, schools, religious buildings and storage. Also contributing were such factors as the pandemic-era decline in demand from travelers, particularly for overnight stays in such high-profile tourist cities as San Francisco and New York.

When hotel occupancy levels fell in these world capitals, redevelopers were given opportunity that didn’t exist before to convert hotels.

Top cities

RentCafe also found some cities were much more likely to see adaptive reuse projects completed in 2022 than others. Los Angeles, Calif.; Kissimmee, Fla.; and Alexandria, Va. crowned the roster of cities witnessing apartment conversions.

The City of Angels, with 1,292 converted apartments and 13% of the conversions, was home to approximately twice the converted apartments as runner-up Kissimmee, Fla., with 648, and 6%. L.A.’s approval of an updated Downtown Adaptive Reuse Ordinance will make additional buildings eligible for incentives that will work to encourage still more conversions.

Of Kissimmee’s total, the vast majority (85%) resulted from the conversion of former hotels into in-demand rental apartments. RentCafe reported Kissimmee and other cities in the Sunshine State’s Osceola County financially support property owners and developers interested in adaptive reuse efforts.

The third-place finisher, Alexandria, Va.. saw 435 apartments created. All were carved from former office buildings. Baltimore, Md. and St. Louis, Mo. were fourth and fifth, with 395 and 354 units respectively.

New and notable

Among the more notable recent projects was Notable Apartments, in Lakewood, Colo. A formerly vacant office building, it has been repurposed into a 218-unit apartment building featuring studio, one- and two-bedroom units. A sanctuary for artists, including musicians, Notable provides practice and performance space and a spacious art studio.

Read the full article here