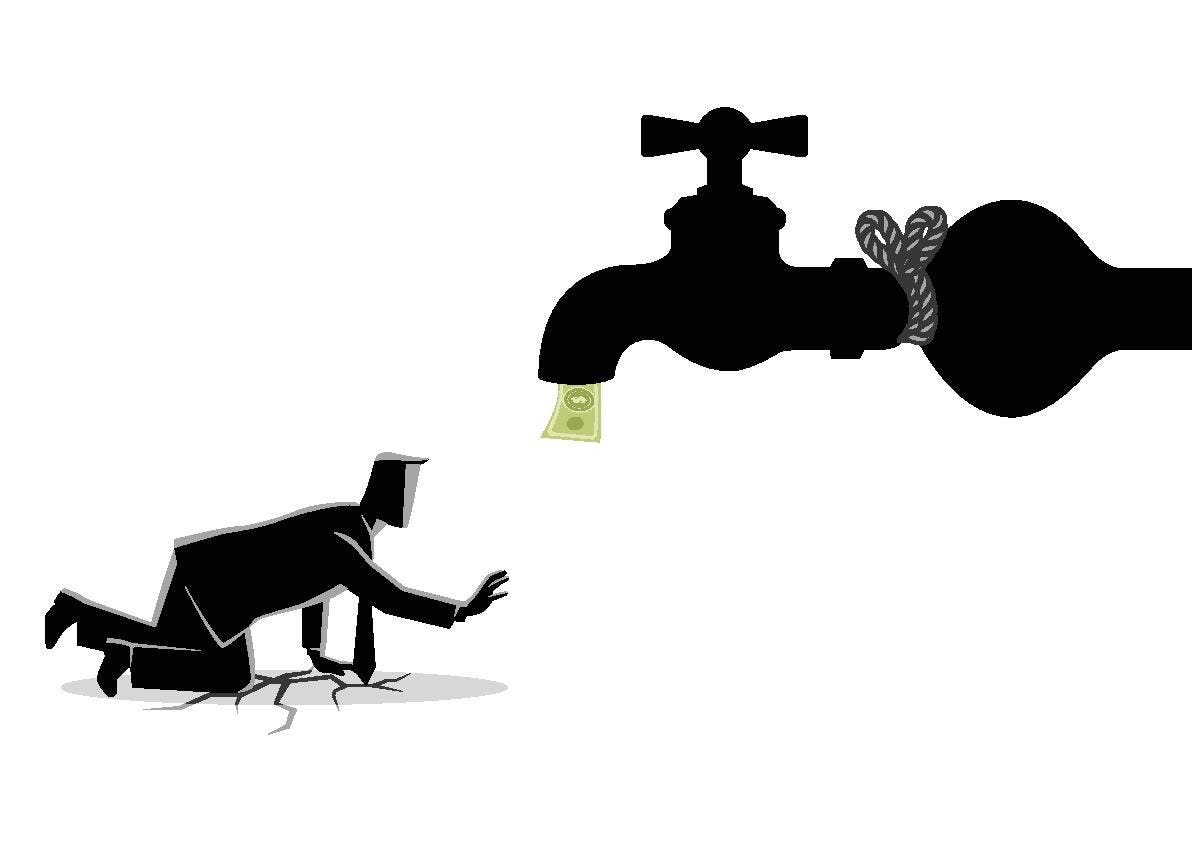

It’s down from a torrent to a trickle. What’s an entrepreneur to do?

The 10-year U.S. Treasury-bond rates are approaching 5%. The days of wine, roses, and the cheap money that has been easily available for the last 15 years may be ending.

Although a few on Wall Street are expecting a peak and a decline in rates soon, certain factors cast doubt on this prediction. China’s reduced purchases of U.S. bonds, and the increasingly higher federal debt and interest costs raise questions about this rosy scenario.

Unless you want to gamble that money will soon flow freely and become cheap again, these unfolding trends mean that capital will have a real cost as it did pre-2008, and that venture financing will become more challenging in all types of entrepreneurship, including Unicorn-Entrepreneurship and social entrepreneurship.

Here are 6 essential steps to find smart financing when capital is tight.

#1. Change Your Mind-Set.

Many entrepreneurs think that the only viable financing for their growth venture is angel capital followed by venture capital (VC) and an initial public offering (IPO). The assumption is that you come up with a brilliant idea, join an incubator, write a great pitch, present it to angels, get seed capital, take off, get VC, and exit via an IPO or strategic sale. Outside the worlds of VC hype, pitch competitions, incubator marketing, and Silicon Valley, this is a fantasy scenario for nearly all because:

· VCs only fund about 100/100,000 ventures, fail on ~80.

· VCs finance after Aha – entrepreneurs need to know how to get there.

· Top 2% of VCs, who are said to earn about 95% of VC profits, are mainly in Silicon Valley.

#2. Imitate Finance-Smart Entrepreneurs to Takeoff with Control.

Due to VC hype, not enough attention has been paid to the real financing strategies used by billion-dollar entrepreneurs (The Truth About VC):

· 99% of billion-dollar entrepreneurs launched without VC to prove their strategy.

· 94% took off without VC to prove their strategy and leadership skills, and to stay on as CEO.

· 76% never used VC to build billion-dollar companies and kept more of the wealth created.

#3. Develop Finance-Smart Business Strategies to Reduce Your Needs

There are two types of capital. Internal capital is the cash flow from the business strategy, and external capital is financing from external sources. By getting paid before they had to pay, Michael Dell and Joe Martin used reverse cash flow – they got paid before they had to pay and had more capital with a higher growth rate, unlike other ventures that need more capital with a higher growth rate. Other billion-dollar entrepreneurs from Sam Walton and Bob Kierlin (Bootstrap to Billions) to Gaston Taratuta built giants without VC by using finance-smart skills and strategies, and the right mix of internal and external capital, to grow more with less.

#4. Find the Smart-Linking Sales Strategy to Sell More with Less.

Smart entrepreneurs do not develop their business plans, financial plans, and sales plans in separate vacuum chambers. They link their business plan and finance plan with a focused sales plan to sell more with less. This is what billion-dollar entrepreneurs like Richard Burke of UnitedHealthcare (Bootstrap to Billions) did.

#5. Use Entrepreneur-Smart Financing to Grow More with Control.

All entrepreneurs can benefit by knowing how to structure the right financing, the right sources, the right instruments, the right structure, and the right method to find money at each stage, and then use this limited financing with skills and smart strategies to reach their goals.

#6. Learn Finance-Smart Skills to Take Off with Less.

The most neglected skill in entrepreneurial education is to build a growth venture with limited capital that can help 100% of entrepreneurs. Unfortunately, business schools are busy focusing on the VC-based strategy that helps about 20/ 100,000 ventures.

MY TAKE: If money is scarce, finance-smart skills help grow more with less. If money is not scarce, finance-smart skills help grow more and keep more with more. Either way, skills help.

Read the full article here