Consumer sentiment (University of Michigan) posted a sharp gain in July, but it wasn’t because consumers became happier with current economic policy. Only 20% view policy as “good” while 47% say it is “poor” (the balance say “fair”). This has been the case for all of last year. Still, consumer spending remains reasonably solid, especially on services. However, sales have not shown up strong on Main Street. In July, 4 percentage points more reported sales declining than reported sales on the rise (27% down vs 23% up). Even worse, the spread on expected real sales volumes was net negative 10%. Hardly optimistic!

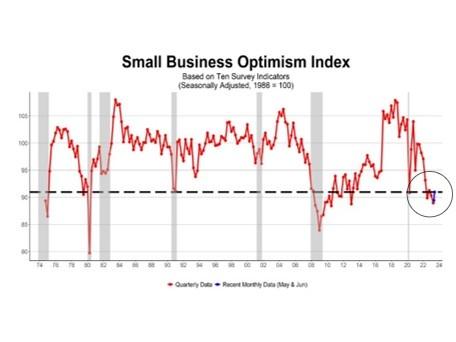

Overall, the NFIB Index of Small Business Optimism has been “in the dumps” all year (Chart 1). The Index fell to 90 in June 2022 and has barely averaged 91 since then. The average over the last 49 years is 98, so for a year the Index has been in recession territory.

Optimism varies substantially by industry (Table 1), depending on economic conditions and regulatory policy differentials (Fed, EPA, etc.). Construction owners are the most optimistic, in spite of record high interest rates imposed by the Fed which is a big negative for new construction starts. But the other fundamentals for the industry (employment, income growth, and rising house values) are very solid and houses, new and old, are in short supply. Professional service owners are by comparison fairly immune to economic fluctuations, have been able to raise their prices, and are still short on workers. Manufacturing, however, is very sensitive to business conditions. Recently victimized by supply chain problems, the sector has recovered and is enjoying pricing power (new cars selling well above sticker price). Recently, however, production activity has retreated (ISM), indicating a likely reduction is expected in consumer spending. Transportation firms round out the group with an Index of 100 or more.

Non-professional service firms come in 5th in the rankings, basically identical to the overall average of 98.8. Overall, firms in that sector have been doing fairly well, as consumers shift their spending from goods to services. Close behind at 98.1 are the wholesale firms, which suffered years of shortages before recovering. Agriculture firms have enjoyed increases in their selling prices but have faced large increases in their input costs (fertilizer etc.). Near the bottom, retail firms (94.8) apparently see worse times coming, which will be transmitted to the wholesale firms that supply them. At the bottom, at 91.6, are firms in real estate and finance. They are the firms that transmit Fed policy to the public, higher mortgage rates, higher interest on loans, lower asset prices, which reduce borrowing and spending, and thus bring selling prices down. Is a recession now on the horizon?

Going forward, headwinds to growth and success controlling inflation are growing. Government debt is growing and is larger than our GDP (income). Interest on the debt is soaring and new debt issued is at much higher rates. Interest cost now rivals other outlays such as defense spending and will soon crowd out other discretionary spending. How much longer the consumer will keep the economy growing has become more uncertain, making managing for small business owners a real challenge.

Read the full article here