Disclaimer: The text below is an advertorial article that is not part of Cryptonews.com editorial content.

Despite great advertising and highly functional services, most tokens and exchanges often struggle to gain initial traction and attract users. With a few buyers and sellers at first, the market will experience low activity, wide bid-ask spreads, and sudden price fluctuations. All these things enhance the asset’s volatility, thus making it hard and costly for end users to participate in trading. That’s why a lot of recently listed token projects and new exchanges turn to designated market makers.

For token issuers, it is also important to decide where to make their assets available for trading before the token generation event (TGE) takes place. This decision includes considering whether to list the tokens on centralized exchanges (CEXs) or decentralized exchanges (DEXs). Listing on a DEX often happens sooner, but there is much less liquidity available to buy and sell on decentralized venues compared to their centralized counterparts.

No token can flourish in the absence of enough liquidity. Meanwhile, no crypto exchange can function without crypto liquidity providers. This also requires working together with a reliable market maker in order to keep spreads at low levels and boost trading interest among investors.

In this piece, we compiled a list of renowned crypto market making firms that supply liquidity to decentralized exchanges. We selected our top 5 favorites based on certain numerical and qualitative criteria developed to provide you with all necessary data for making informed decisions.

| Year founded | Team members | Number of exchanges | Online dashboard | Profit-sharing | |

| Gotbit | 2017 | 160+ | 120+ | + | + |

| Wintermute | 2017 | 70+ | 80+ | + | – |

| DWF Labs | 2022 | 25+ | ? | – | – |

| GSR Markets | 2013 | 300+ | 60+ | – | – |

| Jane Street | 1999 | 2,000+ | ? | – | – |

Let’s have a closer look at the market makers from the table above to find out more about their expertise in the DeFi sector.

Gotbit Hedge Fund

Gotbit Hedge Fund tops our list for its unparalleled diversity of unique DEX integrations. While this long-established firm is committed to support token issuers across 70+ centralized venues, it also provides liquidity to 50+ decentralized exchanges, easily connecting to them with multiple L1 and L2 blockchains. Gotbit Hedge Fund is also engaged in executing MEV strategies using DEX arbitrage trading bots, flashbots, and backrunning algorithms for liquidating positions of VCs and Foundations. What makes the company stand out from the competition is its ability to integrate to the project as an internal market making team. Gotbit Hedge Fund works according to the “two and twenty” fee model and prospers only if its client does. This approach also ensures that the founders don’t have to give away a large portion of their revenue to the intermediary and take at least 80% of profits, while with other market makers founders get 0% of profits. Gotbit Hedge Fund has a persuasive portfolio of improving crypto markets for 370+ assets and exchanges.

Other distinguishing features include:

- Proprietary AI tools and trading algorithms built by award-winning developers;

- Large trading desk that creates, oversees, and modifies customized market makings strategies;

- The only Market Maker using MEV for client’s needs;

- 24/7 customer support in chat;

- OTC trading desk;

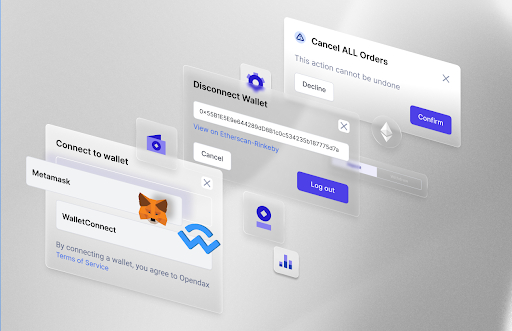

- Transparent dashboard which can be accessed around the clock to track performance and manage project’s treasury;

- Live Reports in the dashboard and strategic calls with clients;

- No ownership of MM accounts, meaning that funds under control of the client;

- Great expertise in increasing utility of project to drive in demand

Wintermute

Due to its extensive knowledge of decentralized finance, Wintermute covers DEX markets in the same competent manner as CEX markets. The firm has a skilled DeFi team who work hand in glove with projects to provide assistance whenever possible, for example, in connecting tokens from different chains to Ethereum. Wintermute’s primary focus is early equity rounds – it helps newly launched tokens get listed on premier exchanges and provides them with guidance on all aspects of liquidity in the long run. The market maker offers 200+ assets in spot markets at affordable, individualized pricing, while also offering derivatives.

Other distinguishing features include:

- Algorithmic approach to market making;

- Weekly reports of statistics and insights of trading activity;

- Transactions can occur outside of an exchange, regardless of the amount being traded;

- OTC trading desk;

- The professional NODE platform designed for seasoned investors with access via both browser and API and zero execution fees.

DWF Labs

DWF Labs trades over 800 asset pairs, including both spots and derivatives, across 40 trading platforms, including premier decentralized exchanges. It communicates with DEXs through a virtual order book that is modeled after blockchain transactions and depends on the condition of the AMM and concentrated liquidity pools. As a market maker, DWF Labs is focused on creating volumes and supplying deep liquidity as a service. Headquartered in Singapore, the firm operates under the umbrella organization Digital Wave Finance and can act as a long-term strategic investor to the most promising Web3 projects.

Other distinguishing features include:

- 24/7/365 coverage service;

- Blue chip’s markets focus;

- Numerous partnerships across various sectors;

- OTC trading;

- Token listings and advisory services.

GSR Markets

GSR Markets partners with builders and token issuers in the DeFi ecosystem by investing in projects, providing liquidity, and managing infrastructure. The firm contributes to the DEX markets in 4 ways – liquidity seeding, market access, market liquidity, and treasury management – assisting projects throughout their journeys from token launch to diversification and hedging activities. GSR has developed strong on-chain engineering and trading features thanks to its connection with popular DEXs and service providers on various protocols. To date, the market maker has 18 DeFi integrations, including dYdX, Uniswap, and Curve.

Other distinguishing features include:

- Ensuring performance metrics set in the contract through the use of pre-defined bid-ask spreads and order book KPIs;

- Accessible risk management techniques serving as additional hedging opportunities;

- Yield-enhancement strategies for big cryptocurrency miners;

- The system monitors performance of assets very closely, making the overall market making activity more clear and adaptable;

- Daily market reports, insights, and analytics.

Jane Street

Viewing crypto trading as a “clear growth area”, Jane Street has actively explored decentralized exchanges throughout the past year. The firm, which is widely renowned for its leading role in established financial markets like ETFs, now supplies liquidity to multiple digital assets from Bitcoin and Ethereum to meme coins. In 2021, Jane Street joined the list of entities contributing real-time market data to the DeFi Pyth Network. Later on, it funded another decentralized project called Bastion, a lending protocol in the NEAR ecosystem. The latest DEX that gained access to the market maker’s liquidity was Vertex launched on Arbitrum in April 2023.

Other distinguishing features include:

- Among traded assets are ETFs, cryptocurrency, and options;

- A powerful combination of quantitative analysis and emerging technologies like ML and programmable hardware;

- Robust price discovery;

- A wide range of asset classes across 200 trading venues in 45 countries;

- Additional services like liquidity management and pricing.

Recap – Best Crypto Market Makers Serving Decentralized Exchanges

To summarize the insights provided in this review, we gathered the most common questions about market makers that collaborate with DEXs in one place. This FAQ-style section contains brief but still informative answers to ease your search for desired data.

Which crypto market maker boasts the biggest number of DEX integrations?

Gotbit Hedge Fund is capable of providing liquidity to projects across 50+ decentralized exchanges.

Which crypto market maker implies a profit-sharing model?

Out of reviewed market makers, Gotbit Hedge Fund and Flowdesk offer their clients to share a profit from market making activities.

Do crypto market makers remain stable following the 2022 crypto winter?

All in all, crypto market makers have proved to resist the 2022 crypto winter repercussions. The only exception is Wintermute that has recently had significant difficulties, including a $160 million hack in September 2022 and a $55 million exposure to Sam Bankman-Fried’s bankrupt FTX cryptocurrency exchange.

Which crypto market maker provides best-in-class transparency?

Each crypto market maker from our list puts big emphasis on creating transparent and reliable experience. However, Gotbit Hedge Fund stands out due to its strategic calls and full-fledged dashboard.

Read the full article here