Here comes the third quarter, next stop, the rest of the year. Judging by Friday’s early stock action, the first half could end on a positive note.

That’s as the S&P 500

SPX,

is set to close out the last three months with a near 7% gain, the best quarterly performance since the final quarter of 2021. Of course that pales against an 11% gain for the Nasdaq Composite

COMP,

the tech index’s best since the third quarter of 2020.

In short, the losers of last year — tech — have been winning in 2023 so far. But Sean Simonds, UBS equity strategist, says investors should not expect the AI narrative that has driven gains for the quarter to continue in the next.

According to their machine-learning model, the AI narrative as a dominant factor for S&P 500 returns has “diminished significantly since May, with fundamentals and the growth backdrop becoming more important considerations,” Simonds told clients in a note. See below for his chart on why they are less keen on techs going forward.

So where to invest in the third quarter? Our call of the day from Piper Sandler drills down into stock names they recommend buying and selling.

“We continue to believe investors should have a quality tilt to their portfolio for the road ahead. The reason being, we expect narrow leadership and cycles of uncertainty will continue into the back half of the year,” said a team led by Michael Kantrowitz, chief investment strategist.

“Our recommendation for ‘quality’ often frustrates investors as there is no

single definition of quality,” said Kantrowitz, who said in response they have sharpened up their model to search for themes that will best represent quality headed into the last half of the year. Those are: cash flow profitability, earnings per share growth, positive revisions to EPS estimates and lower beta, meaning the stock is less volatile than the broader market.

Their stocks that have moved into the “most attractive” rankings of that macro select model over the last month are shown in the below chart, with a decile rank of 1 or 2. Among those names are Green Brick Partners

GRBK,

Civitas Resources

CIVI,

Cytokinetics

CYTK,

Camden Property

CPT,

and Atmos Energy

ATO,

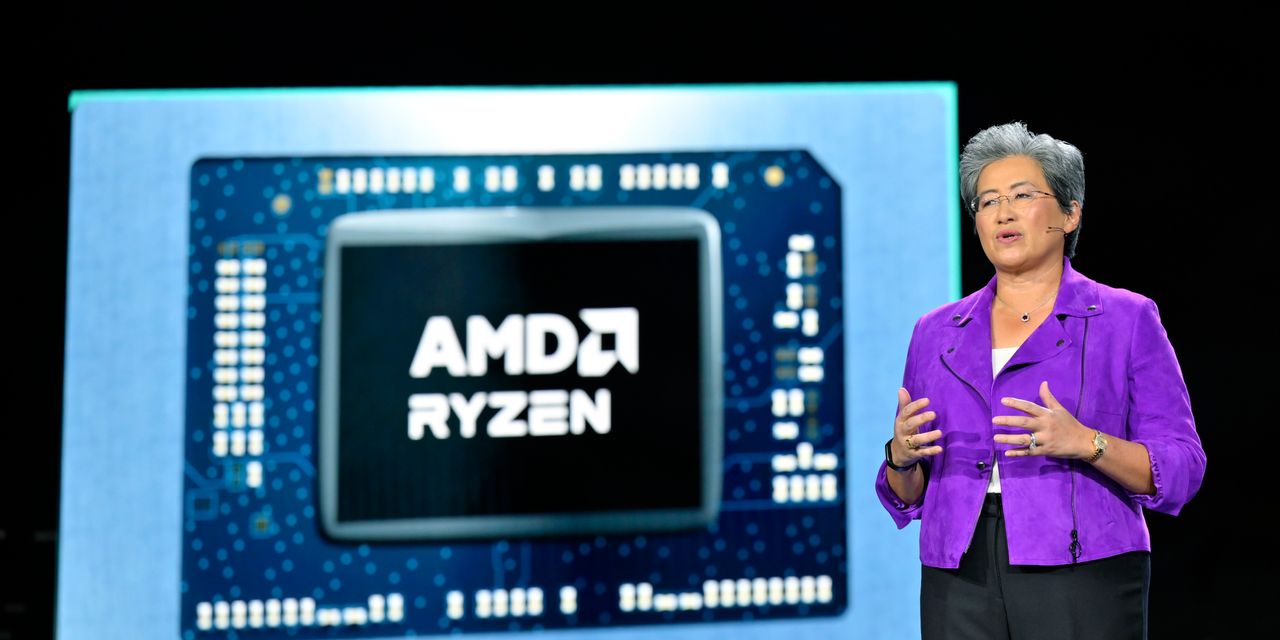

As for the selling side, Kantrowitz and the team note that less than 2% of stocks in the S&P 500 have an average “sell” rating from Wall Street analyst, even though 52% of stocks on average underperform than outperform.

Seven factors go into their model: valuation, risk, governance, possible accounting manipulation, sentiment, profitability and operating efficiency, with the goal of identifying stocks with the most red flags in sectors relative to their peers.

The sell list below includes stocks in the S&P 1500 that have shifted into “at risk” rankings over the last month, with a 9 or 10 decile rating. Among those names — Tesla

TSLA,

Mattel

MAT,

PacWest Bancorp

PACW,

Valley National

VLY,

and Advanced Micro Devices

AMD,

The markets

Led by tech

COMP,

stocks

DJIA,

SPX,

are climbing after a PCE inflation update, with bond yields

TMUBMUSD02Y,

TMUBMUSD10Y,

slipping. The dollar index

DXY,

is off 0.4%.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

U.S. consumer spending growth slowed to 0.1% in May, with the personal-consumption expenditures (PCE) price index, which is the Fed’s preferred inflation gauge, rising slightly, as expected.

China’s official manufacturing activity gauge improved in June, but contracted for the third straight month, a sign of more wobbles from the global growth.

Nike stock

NKE,

is down over 2% after the sports retailer’s fourth-quarter profit disappointed amid markdowns and weaker demand for its sports gear.

XPeng’s stock is up 7% after the China-based electric vehicle maker launched its G6 Ultra Smart Coupe SUV, with China deliveries due to begin in July.

Genfit

GNFT,

is up more than 20% after the French biotech and partner Ipsen announced positive results from a late-stage trial of a treatment for a rare liver disease.

Tesla

TSLA,

will report second-quarter sales and production in the next few days, as the stock struggles to keep the momentum going. Here’s what analysts expect.

More than a hardware play. Why Citi says investors should buy Apple stock

AAPL,

The best of the web

Dylan Mulvaney breaks silence on Bud Light ‘bullying and transphobia,’ with some choice words for Anheuser-Busch

AI for good? Using chatbots to annoy telemarketers and scammers. (subscription required)

One big question over pricey new weight-loss drugs from Novo Nordisk and others: Can users ever stop?

The chart

UBS equity strategist Sean Simonds offered up the below chart as rationale for why the bank has cooled on tech stocks:

“Of the top 10 stocks in the Nasdaq 100 (contributed 30% of the 36% gains in the index ytd), UBS analysts have neutral ratings on 57% (on a market cap weighted basis) and buy ratings on 43%. Given this close call, and the break with real yields, at a broad market level we are not chasing tech,” said Simonds.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

MANU, |

Manchester United |

|

MULN, |

Mullen Automotive |

|

SPCE, |

Virgin Galactic |

|

BUD, |

Anheuser-Busch InBev |

Random reads

What Brits are giving up in face of nosebleed inflation.

U.K. tourist may have carved name on Rome’s Colosseum wall, and could go to jail.

Cancel culture has taken all the fun out of Hollywood, says Joan Collins.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

Read the full article here