The Macroeconomy Remains Strikingly Resilient

The Personal Income & Outlays report published on June 30 by the Bureau of Economic Analysis was the latest in a long string of data releases showing continued resilience in the macroeconomy.

- Real personal income and real personal disposable income (that is, after taxes) both increased by 0.3% in May. Wages and salaries increased by a little bit more than other sources of income—generally a good sign for continued consumer spending.

- Real personal consumption expenditures just held steady in May—not impressive, but not weak either.

- The core PCE price index—which is the measure of inflation to which members of the Federal Open Market Committee typically attach greatest weight in setting interest rate policy—increased by another 0.3% in May (and 4.6% year-over-year).

The University of Michigan’s Consumer Sentiment Survey, also released on June 30, showed a decline in the expected rate of inflation over the next year (from 4.6% in April to 4.2% in May), but a slight increase in the expected rate of inflation over the next five years (from 3.0% to 3.1%).

The Census Bureau’s New Residential Construction release on June 20 continued to show a strong recovery in housing construction, which had plummeted so dramatically in 2022 that I feared it might be the trigger for a recession. Instead, the strength in housing construction brought the probability of a recession down by about 17 percentage points according to my forecasting model.

The strengths shown in those and other releases mean that the FOMC will almost certainly resume its interest rate increases when it meets again on July 25-26. As of this writing, the CME FedWatch Tool indicates an 86.8% probability (shown in blue) of a 0.25% rate hike at that meeting—and, in fact, it shows a 32.8% chance of another 0.25% rate hike at a future meeting (most likely November) and a 5.1% probability of two more hikes.

Because the FOMC’s policy interest rates are expected to be lower than today’s rates by as early as the end of this year, the Near-Term Forward Spread remains negative, as it has been since November 10, 2022. As the prospect of a “soft landing” has improved, however, the NTFS has become much less negative: it was as strongly negative as -2.09% on May 4, but better than -1.0% negative in late June. What that means is that market participants don’t expect that the FOMC will have to be especially aggressive in bringing down interest rates—as they would if a recession were looming—so a movement in the NTFS back up toward zero is good news even if it’s still negative.

Rental Housing Market Conditions Are Surprisingly Strong

Rents were widely expected to decline for two reasons: first because they had increased so dramatically during the covid years, and second because housing permits and housing starts had grown so strongly leading up to the spring of 2022. Rents did, indeed, decline—for about four months—but, in a surprising development, they have already started to increase again strongly. Brad Hunter of Hunter Housing Economics published an article at Forbes.com showing that rents declined from September 2022 to January 2023 but have resumed their strong growth since then.

One of the reasons for strong rent growth is that strong growth in housing permits and housing starts have not resulted in equally strong growth in supply. Mitch Bollinger, Research Director for Middleburg Communities, published an article on LinkedIn focused on the time needed to complete a large multifamily construction project, which has increased by more than 60% over the past 23 years (from 11.2 months to 18.1 months). That increase in time to complete means that the number of new units ready to rent is far less, relative to permits and starts, than it would have been during previous periods of increased construction activity.

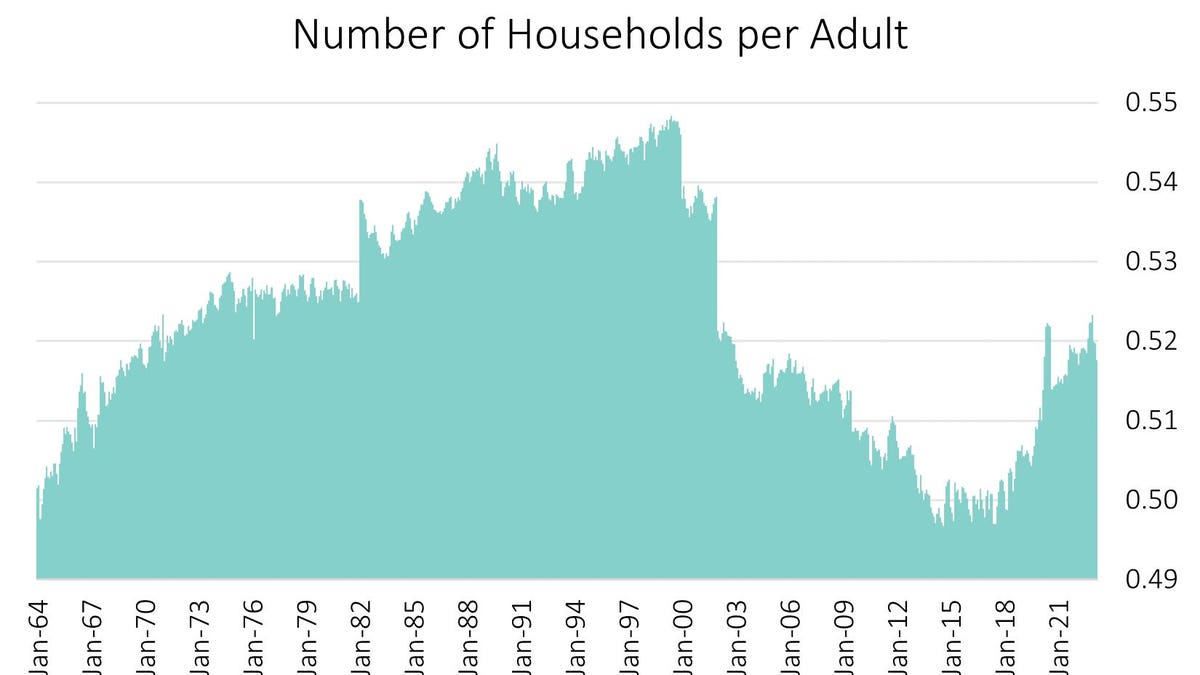

At the same time as that downward adjustment in supply growth, the surprisingly strong rent growth trajectory also seems to be benefiting from an upward adjustment in demand growth thanks to a resumption of the strong increase that has been happening since the mid-2010s in the number of households per adult. Two economists at the Economic Innovation Group have published an empirical report concluding that “exposure to remote work led to increases in housing demand,” specifically suggesting that the increasing prevalence of remote work boosted the increase in the headship rate as “individuals who worked remotely were more likely to head their own households” than otherwise comparable non-remote households.

And, of course, the additional rate increases coming from the FOMC will put more upward pressure on mortgage interest rates, as I have discussed previously. The extraordinary affordability crisis in the homebuying market will likely encourage even more households to elect renting over buying, especially given the increasing importance of job mobility.

The Most Relevant Upcoming Data Releases

The most important new information summarizing the economic situation every month is the Employment Situation, which will be released by the Bureau of Labor Statistics on July 7. I’ll be looking at the following key statistics:

- Growth in total nonfarm employment, civilian labor force, and average weekly hours of production and nonsupervisory employees in manufacturing, because they are direct inputs into my recession forecasting model; and

- Employment-to-population ratio for vulnerable groups (adults without high school diploma, youth, Blacks, Hispanics, and white women) because significant dips seem to provide early warning of troubles ahead for the broader labor market.

Given that the FOMC decided in its last meeting not to raise rates (for the first time since early 2022), I’ll be reading the minutes from that meeting—to be published on July 5—to get a better idea of different opinions held by the “hawks” and “doves” among the FOMC meeting participants.

The Consumer Price Index, which will be published on July 12, is always one of the most newsworthy releases—but by now I’m more focused on surveys of consumer inflation expectations, because the FOMC is not likely to ease up on interest-rate increases until they become sure that inflation won’t flare up again. The New York Fed’s Survey of Consumer Expectations will be published on July 10.

Read the full article here