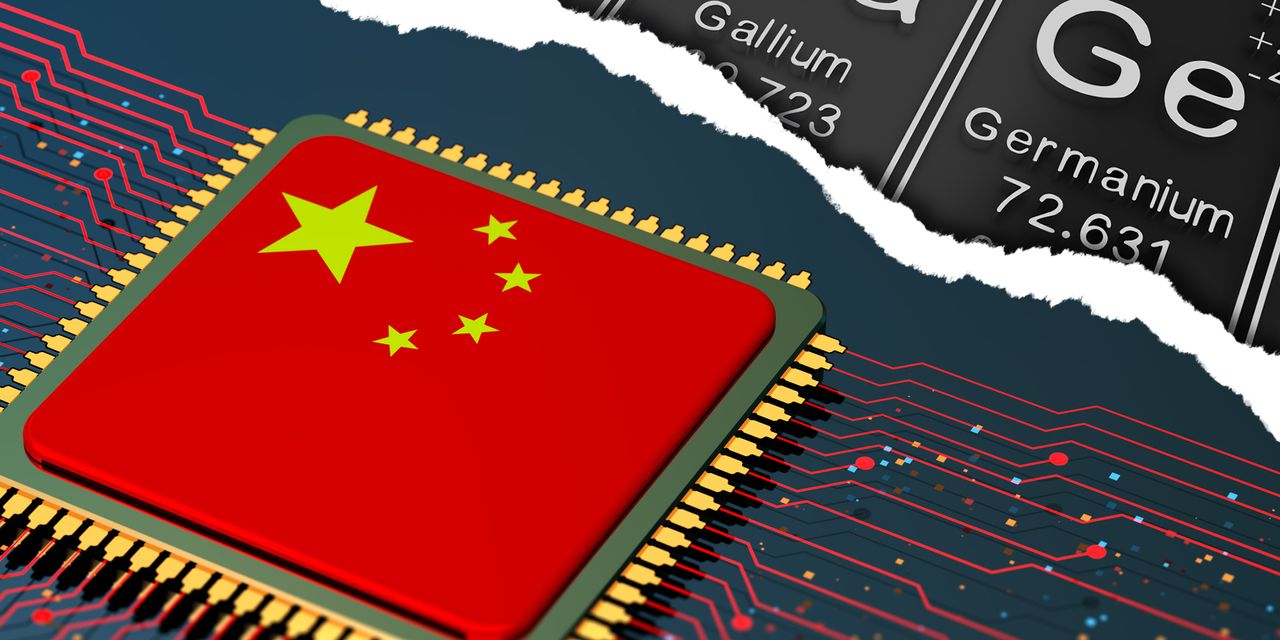

China will restrict the world’s access to gallium and germanium, requiring buyers of the two rare metals to apply for permits starting next month, in a move that highlights the country’s dominance as the provider of many materials needed to create much of the technology used by consumers around the globe.

The decision came just days ahead of a visit to China, which began Thursday and ends Sunday, by U.S. Treasury Secretary Janet Yellen to discuss economic and trade relations.

The timing of China’s announcement “could not be more apropos,” said Byron King, a geologist and editor at Paradigm Press, formerly Agora Financial.

“This is no bouquet of flowers for Janet,” he told MarketWatch. “The timing and symbolism could not be more clear to just about everybody in Asia, if not the rest of the world.”

“ “This is no bouquet of flowers for Janet…The timing and symbolism could not be more clear to just about everybody in Asia, if not the rest of the world.” ”

The Ministry of Commerce in China said it made the move to “safeguard national security and interests,” according to a translated version of the July 3 announcement.

Overall, this is a “warning flare” because among the elements in the Periodic Table, “China easily dominates the production and supply chain for most of the metals,” said King.

Why now?

The move follows U.S. export restrictions on advanced semiconductors and chip-manufacturing equipment to China, which are aimed at preventing American technology from boosting China’s military power.

China’s gallium and germanium exports restrictions are a way to “let the world know “directly or indirectly, that those are two pretty important elements that are used in the manufacturing” of computer chips, said Luisa Moreno, president of Defense Metals Corp.

DFMTF,

a junior mining company developing rare earths deposits in British Columbia, Canada.

The U.S. is investing significantly in the manufacturing of chips, so even though there may not be significant imports of these two materials right now, this could have a bigger impact in the future, she said.

China had reportedly halted exports of rare earth elements to Japan in 2010 during a dispute over islands that both countries claim. However, at the time, China denied that it had limited rare earth exports to Japan.

The Biden administration, meanwhile, is considering new restrictions on exports of artificial-intelligence chips to China, The Wall Street Journal reported on June 27, citing people familiar with the situation.

“China apparently does not like the news that the Biden administration is considering a wider semiconductor chip ban and decided to ban the export of gallium and germanium, which are used in semiconductors, 5G base stations, and solar panels,” said Louis Navellier, founder of Navellier & Associates, in a recent note.

China’s announcement came just ahead of Yellen’s trip to China so it appears that China made this move because it wants to negotiate with Yellen, said Navellier. “Although the U.S. and its allies depend on China for these critical minerals, China needs Western technology such as lithography machines to produce high-performance chips,” he said.

On Friday, in a meeting with Premier Li Qiang, Yellen said the U.S. wants to engage in economic competition that would benefit both countries over time, The Wall Street Journal reported.

What are germanium and gallium?

China’s decision has raised questions over the importance of the two elements and exactly what germanium and gallium are.

“China is employing a “capability play” since it has become a crucible of products and parts to much of the world, particularly the Western Hemisphere,” said Sandeep Rao, senior researcher at Leverage Shares.

China produces the majority of the world’s gallium – about 80%, according to the Critical Raw Materials Alliance. China is also responsible for around 60% of the world’s production of germanium.

China’s “capability play,” however, is also “a high-risk/high-loss play” since there’s “ample impetus to diversify away from reliance on Chinese production,” said Rao. He said that India and Brazil, for example, are “strong contenders for diversification targets” along cost and volume lines.

Germanium is a hard, grayish-white metalloid, which is defined as having properties of metals and non-metals, while gallium is a soft, silvery metal. Both are produced as byproducts of some base-metals production such as zinc, and both are used in computer chips, solar panels and have military applications.

They have been widely referred to as rare earth elements, but there are officially 17 rare earth elements, according to Geology.com, and the two materials are not listed among them.

Supply threat?

Still, volume-wise, the amount the U.S. imports is relatively small.

The U.S. Geological Survey reported that U.S. imports of germanium metal for consumption totaled an estimated 14,000 kilograms in 2022, while consumption that year was at an estimated 30,000 kilograms.

For gallium, domestic imports for the metal were estimated at 12,000 kilograms last year, while consumption was at a reported 18,000 kilograms.

Overall, these two materials are rare, but are not very rare, Rao said, and the amounts used in manufacturing are “quite small.”

“There should be enough supply in the near term while manufacturers review the effects of these curbs, choose other materials or diversify away from China,” he said.

But China’s restrictions can still lead to higher prices as the U.S. and others deal with supply issues.

The U.S. can try to stockpile supplies, but then prices may go out of control, said Defense Metals Corp.’s Moreno. If prices go up significantly, then companies would have to start thinking about whether the products they’re manufacturing with these materialsstill make economic sense, she said.

“It becomes tricky to deal with [these] sorts of bans or restrictions of sales of rare metals,” said Moreno.

Investing

Given that gallium and germanium are produced as byproducts of some base metals, it would be difficult to find a “pure play” way to invest in these materials, Moreno said.

She did point out, however, that Canada’s Teck Resources Ltd.

TECK,

is the biggest germanium producer in North America.

The playing field for investing in rare earths, meanwhile, appears a bit wider.

Even then, Leverage Shares’s Rao warned that investing into a single rare earth metal would be “a risky and high tactical proposition,” as various rare-earth metals have “high substitution potential by other ‘less rare’ rare earths.”

Broad sector rare-earth plays include the VanEck Vectors Rare Earth/Strategic metals exchange-traded fund

REMX,

and it gives investors exposure to rare-earth metal companies, he said.

Among single-stock rare-earth plays, existing players include Canada’s Neo Performance Materials Inc.

NOPMF,

and U.S.-based Freeport-McMoRan Inc.

FCX,

said Rao. Long-term plays include India’s National Aluminum Company Ltd.

532234,

Hindalco Industries Ltd.

500440,

Steel Authority of India Ltd.

500113,

and Tata Steel Ltd.

500470,

Read the full article here