Nvidia zoomed past growth expectations in its third quarter — tripling revenue, according to the Wall Street Journal. So why did the chip-maker’s stock lose 1.7% in after-hours trading following its boffo earnings announcement?

One possible explanation: Investors anticipate this quarter is as good as it can get for Nvidia shares.

That’s what happened to the video communications company Zoom back in October 2020 — months after it reported 355% revenue growth for its fiscal quarter ending in August of that year. Since then, Zoom stock has lost 89% of its value and its revenue growth has slowed to 3%.

Perhaps the analogy between videoconferencing during the Covid-19 pandemic and graphics processing unit chips during a generative AI boom is not a perfect fit. However, after Nvidia stock soared 249% this year as of November 21 — compared to the S&P 500’s 19% jump — investors are beginning to wonder how long the company can keep exceeding such high growth expectations.

Nvidia’s Outstanding 2023 Third Quarter Fiscal Performance

The general rule of stock market investing is to buy shares in companies you think will exceed investor expectations and raise guidance. The media is not unanimous on whether Nvidia did that.

Here are the highlights of the graphics processing unit-maker’s third quarter report, according to CNBC:

- Q3 revenue up 206% to $18.12 billion, nearly $2 billion more than analysts’ consensus.

- Q3 adjusted earnings per share up 46% to $4.02 per share — 65 cents per share more than the analyst consensus.

- Q4 revenue guidance of 231% growth to $20 billion — about $2 billion more than the analyst consensus, according to the Journal. To be sure, Nvidia’s revenue guidance fell short of $21 billion — the highest such forecast, Bloomberg reported.

Investors may have taken issue with Nvidia’s uncertainty about its China revenue. That’s because the Biden administration imposed export controls preventing Nvidia from selling its fastest GPUs to China.

In October, the Commerce Department blocked Nvidia from selling China-specific chips it developed in 2022 until it had obtained a license from the department — jeopardizing about $5 billion of Chinese orders for chips to be delivered in 2024. the Journal noted.

On Tuesday, Nvidia told investors those export controls had no meaningful impact in the third quarter but could lower its long-term sales to China.

The company’s China sales will “decline significantly” in the fourth quarter, according to a shareholder letter from Nvidia CFO Colette Kress. She added, “We do not have good visibility into the magnitude of that impact even over the long-term.”

To be fair, Nvidia announced November 21 its progress in developing GPUs that could be sold in the Chinese market while complying the export controls. Analysts said the chip designer has developed “three chips for the Chinese market and plans to release them soon,” according to Reuters.

Those chips — while delivering “a sharp reduction in overall performance” — may appeal to Chinese customers while being more palatable to U.S. regulators,” wrote Bernstein analyst Stacy Rasgon in a November investor note.

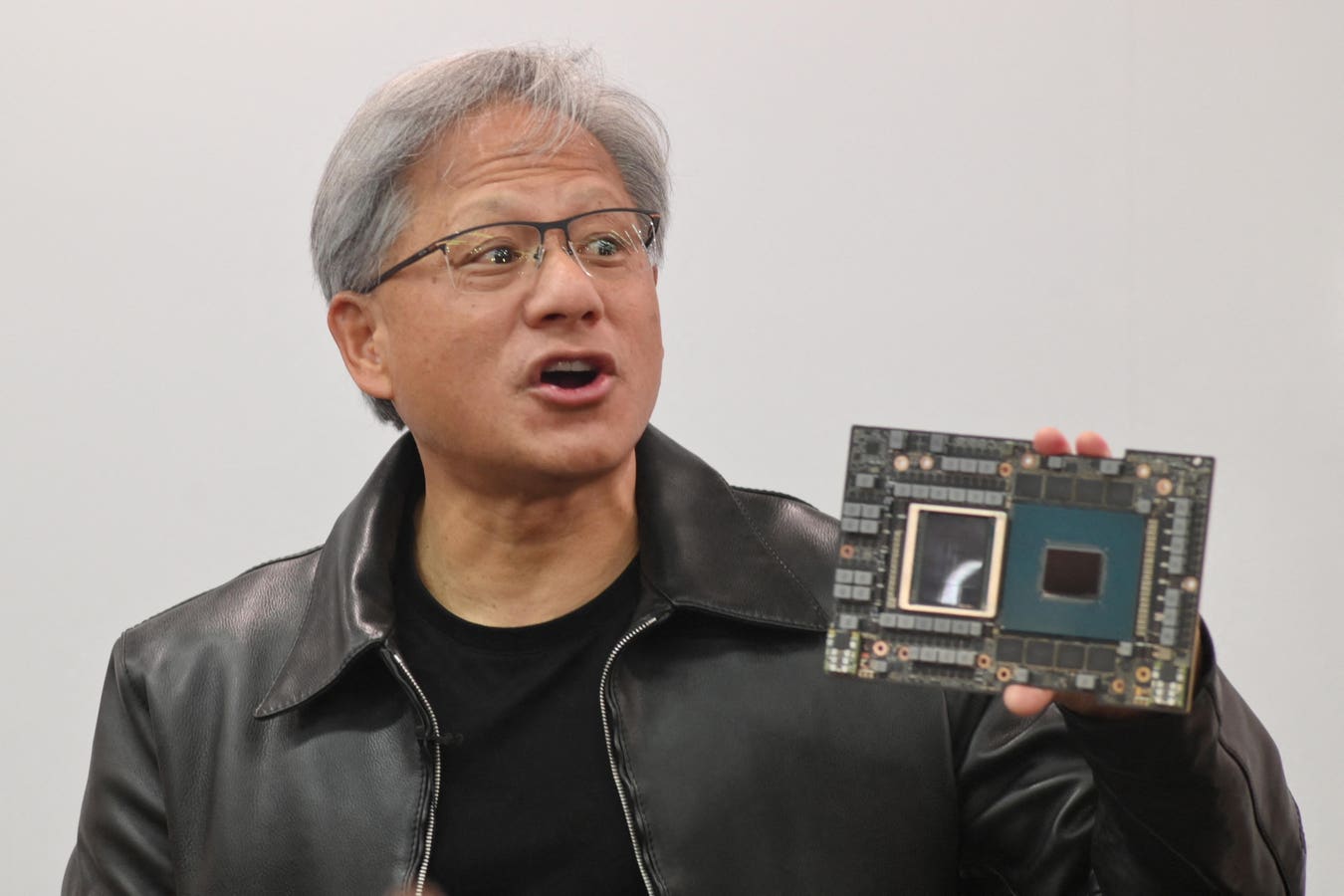

Nvidia is optimistic about its growth prospects. CEO Jensen Huang “pushed back strongly” in response to questions about whether the company’s data center growth has peaked.

Huang told investors Nvidia is adding more chip supply. The expanding adoption of AI hardware by software providers, governments and corporate customers gives him confidence GPU demand from “data centers can grow through 2025,” Bloomberg reported.

Does Zoom Video’s Sad Trajectory Presage Nvidia’s?

How long can Nvidia keep growing faster than 200% a year? I do not know. However, I would be shocked if that growth rate continues for, say, the next five years.

Should Nvidia one day report slower than expected revenue and lowered guidance, its stock will almost surely plunge.

That is what happened to Zoom — the videoconferencing provider’s stock trades about where it was in April 2019 when the company went public at $65 a share.

Zoom’s stock peaked at $559 in October 2020 — following a 355% surge in Zoom’s revenue for fiscal second quarter 2021 (ending in July 2020). The shares have since lost 89% of its value.

The astounding growth was due to a “usage surge during the work-from-home and school-at-home boom spurred by” the Covid-19 pandemic, according to Investor’s Business Daily.

My guess is slowing growth contributed to the decline in Zoom stock from that peak. Indeed in November 2020, Zoom forecast 300% growth for its fiscal year 2021 to $2.5 billion — very high but a noticeable slowdown from the 355% growth the company enjoyed in FY quarter ending in July 2020.

Growth at Zoom has since nearly nearly flat lined. For the fiscal third quarter ending October 2023, Zoom revenue grew a mere 3% to $1.14 billion while earnings increased to $1.09 a share. Zoom predicted $1.13 billion in revenue for the fiscal fourth quarter — meeting investor expectations, noted IBD

IBD

Zoom expressed confidence in the company’s performance. “In Q3, revenue came in ahead of guidance as we bolstered Zoom’s all-in-one intelligent collaboration platform with advanced new capabilities like Zoom AI Companion and continued to evolve our customer and employee engagement solutions,” CEO Eric Yuan said in a news release.

Zoom certainly is not Nvidia. As I learned from interviewing Yuan, he started the videoconferencing platform knowing it was entering a crowded market. He believed he could create a company that would delight employees and customers.

During the pandemic, Zoom lived up to that promise and it benefited greatly from the resulting surge in demand for its services. As the pandemic ended, Zoom did not find a new growth curve.

This raises a fundamental question for Nvidia investors: Will the chip designer — which now dominates the AI GPU market — have built a new source of 200% growth after the current surge in demand for generative AI GPUs slows down?

What’s Next For Nvidia Stock?

Analysts do not see Nvidia slowing down in 2024.

“GPU demand continues to outpace supply as Gen AI adoption broadens across industry verticals,” Raymond James’ Srini Pajjuri and Jacob Silverman wrote in a November 20 note. They added, “We are not overly concerned about competition and expect NVDA to maintain >85% share in Gen AI accelerators even in 2024,” CNBC reported.

Despite competitive challenges, with its even-more advanced H2000 AI chips expected in 2024, Nvidia will maintain its hold on “more than 85% of the market for generative-AI chips next year,” according to the Journal.

If the GPU designer can do a better job than Zoom did at creating a fast-growing future after the current generative AI demand boom slows down, investors may continue to benefit from owning Nvidia stock.

Read the full article here