Introduction

Dollar Tree (NASDAQ:DLTR) is one of America’s largest discount store operators. With a market cap of $32 billion, the company is a heavyweight in affordable shopping, which now seems to be more important than ever, given the tremendous pressure on the consumer.

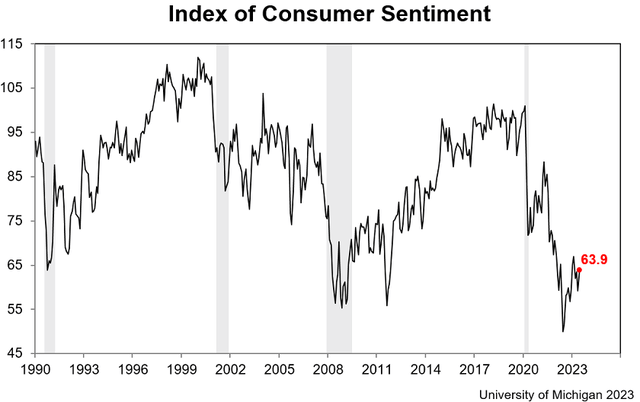

This is what consumer confidence looks like:

University of Michigan

Unfortunately, the reasons why consumer sentiment is down also pressured Dollar Tree. The company is dealing with high input inflation, which hurts its low-margin business. After all, it has limited pricing power if it wants to maintain the go-to place for affordable products.

While I do not expect sticky inflation to turn into a tailwind anytime soon, the company is working on improvements. When adding pressure from activist investors, I believe that the company will be able to turn this ship around.

In this article, we’ll discuss all of that and assess the risk/reward.

Discount Stores Are In

I like discount stores. Some tend to have great products that are often much more expensive at non-discount stores. Apparently, a lot of people agree with me.

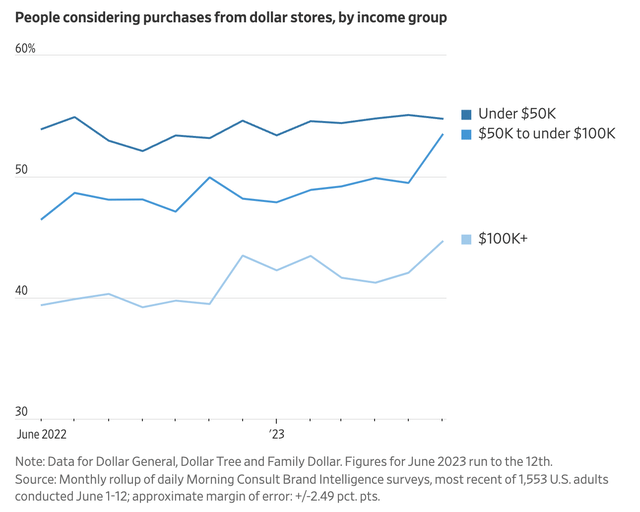

Not only people who are, unfortunately, dependent on discount stores are drawn to cheaper products, but the same also goes for higher-income shoppers.

As reported by the Wall Street Journal:

InMarket, which tracks retailer foot traffic, measured a 4% average increase in the share of dollar-store visits this year among those making more than $100,000, compared with the second half of 2022. Households with six-figure incomes are 15% more likely to say they would shop at dollar stores than they were last June, going from 39% to 45%, according to daily surveys from Morning Consult of about 50,000 Americans.

Furthermore, by looking at the chart below, we see a steep increase in the number of middle-income shoppers that purchase from dollar stores. That number is almost equal to the number of low-income shoppers.

Wall Street Journal

Personally, I’m not surprised, as inflation has done a number on most people.

This brings me to DLTR.

DLTR – Stuck Between Tailwinds & Headwinds

As I already briefly mentioned, DLTR is a giant.

As of January 28, 2023, DLTR operated 16,340 discount variety retail stores across the United States and Canada. The company envisions a long-term plan to have over 10,000 Dollar Tree stores, 15,000 Family Dollar stores, and roughly 1,000 Dollar Tree stores in Canada.

DLTR attributes its success to the convenience and value it provides, which contributes to a growing base of loyal customers.

In other words, the company sees an increasing need for very affordable items, which is good for the company but a bad sign for the economy.

Given that it operates under multiple names, DLTR executes a dual-banner strategy, aiming to deliver the best of its brands through diverse store formats that cater to customers in various geographic markets. This isn’t uncommon.

- Dollar Tree, known as the leading operator of discount variety stores, offers merchandise primarily priced at $1.25. Dollar Tree stores are located in suburban areas and cater to customers with different income levels. According to its 10-K, Dollar Tree strives to provide a delightful shopping experience by offering a compelling, fun, and fresh merchandise assortment at incredible value in clean and friendly stores.

- Family Dollar operates general merchandise retail discount stores, mainly serving lower-income customers in urban and rural locations. Family Dollar focuses on delivering competitively-priced merchandise in convenient neighborhood stores.

With this in mind, DLTR is a beneficiary of high inflation. It causes many shoppers to look for more affordable alternatives.

Hence, in its first quarter, Dollar Tree achieved $7.32 billion in sales, which is a 6.1% increase versus the prior-year quarter. Comparable sales growth was 4.8%.

Operating income came in at $419.7 million, resulting in earnings per share of $1.35 and adjusted earnings per share of $1.47.

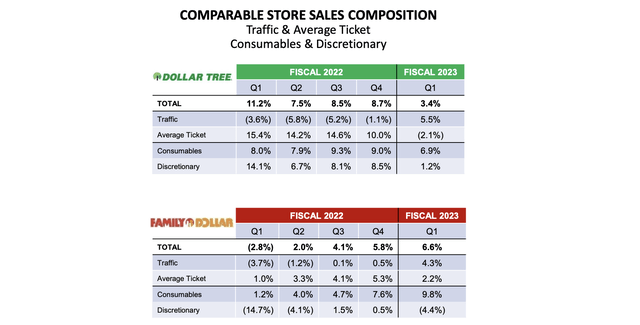

Both Dollar Tree and Family Dollar showed strong growth, with comparable sales increases of 3.4% and 6.6%, respectively.

Dollar Tree

Growth was driven by increased customer traffic, continued market share gains, and underlying unit growth. The consolidated basis saw a 5% increase in traffic, although the average ticket was slightly down.

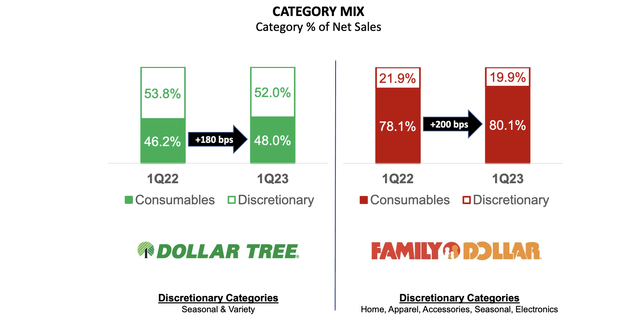

The sales mix of consumables also increased by approximately 200 basis points due to changes in customer purchase behavior influenced by the aforementioned macro conditions. For example, both Dollar Tree and Family Dollar saw significant underperformance in discretionary items (versus consumables).

Dollar Tree

Now comes the other side of the inflation coin. As much as inflation benefits DLTR because of changing consumer behavior, it is a major drawdown for its margins.

Gross profit decreased by 4.7% to $2.23 billion, primarily due to a contraction of 340 basis points in gross margin. The decline in gross margin was driven by factors such as merchandise cost, a shift in sales mix towards lower-margin consumable merchandise, elevated levels of shrink (read: people stealing stuff), and higher distribution costs.

However, these impacts were partially offset by lower freight costs and markdowns. As trucking suffers from lower orders, transportation becomes cheaper.

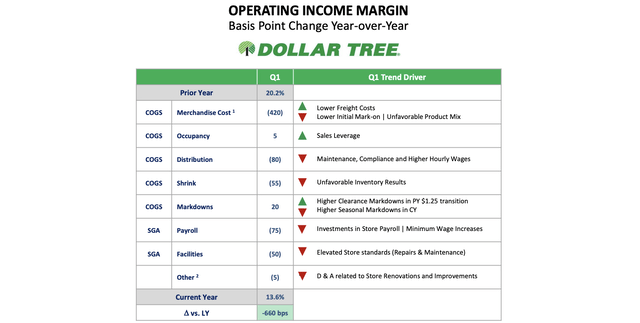

Looking at the operating margin overview from Dollar Tree stores, we see that lower freight costs weren’t able to offset lower mark-in costs and an unfavorable product mix.

Dollar Tree

With that said, DLTR is now working to improve its business to become even stronger the moment headwinds turn into tailwinds.

DLTR Is Working On A Turnaround

During its first-quarter earnings call, the company mentioned improvements that led to the aforementioned market share gains and positive comps growth.

For example, the company focused on growing private brand penetration, with plans to improve merchandise presentation, packaging, and quality control standards.

Especially the expansion of private brands presents margin opportunities.

Furthermore, the CEO stated that the addition of $3 and $5-plus items to stores was on track, with over 400 stores already featuring Dollar Tree Plus assortments.

Essentially, what used to be a joke (dollar stores will soon be two-dollar stores) is now a reality, as none of these stores can just ignore inflation.

Dollar Tree expanded its product assortment to include frozen and refrigerated products priced at $3, $4, and $5, which showed significant sales impact and doubled the average ticket in stores offering these products.

Family Dollar aims to add 16,000 new cooler doors in 2023, contributing to its highest market share in nearly four years.

This strategy sounds simple, but I think it’s a great move. The company keeps its focus on cheap products and widens the product selection for its customers. I think it’s a win-win.

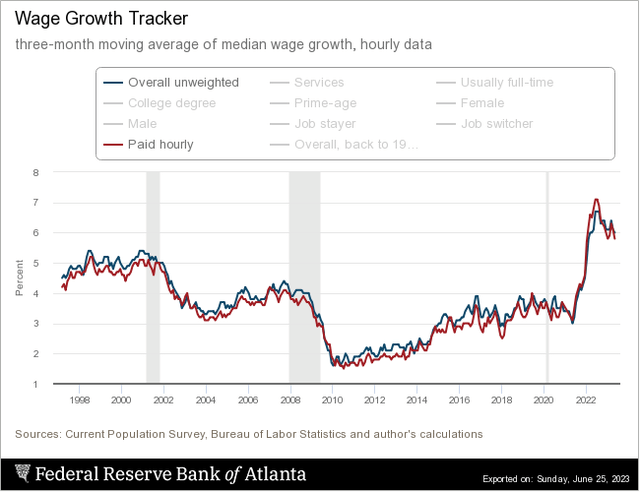

The company is also focused on improving wages and benefits to create a better environment for employees. I noticed this trend a lot, as competition for good labor is tough. It would be beneficial for the company (with more than 65,000 employees) if wage growth were to cool down. For now, wage growth normalization seems to be something that will take a while.

Federal Reserve Bank of Atlanta

Furthermore, on June 21, Bloomberg published an article focused on activist investors pushing for a quicker turnaround at DLTR.

The overhaul depends in part on improving supply-chain capabilities, modernizing technology systems and boosting wages, Chief Executive Officer Rick Dreiling said Wednesday. But a lot of it comes down to old-fashioned retail basics such as upgrading stores that Dreiling said have been starved for investment.

Bloomberg

Mantle Ridge, which bought a stake in ODFL in 2021, is also the company that made Dreiling the CEO of DLTR. He was the former CEO of Dollar General (DG).

Now, DLTR is focused on five ways to further improve its business:

- Merchandising: Dollar Tree is reducing the number of items it sells while increasing the range of higher-priced goods, bringing its prices in line with Dollar General.

- Wages: Raising pay will address staffing issues and ensure that stores can open on time and operate for longer hours.

- Supply chain: Dollar Tree is implementing a system where employees can quickly unload products from delivery trucks, reducing unloading times from four hours to one hour.

- Information technology: Outdated computer coding in Dollar Tree’s systems is being updated to modernize the company’s operations.

- Capital expenditures: The turnaround effort requires significant investment, and spending will remain high until 2026 before normalizing, according to the Chief Financial Officer.

Especially the last part (capital spending) brings me to the next part of this article.

Outlook, Balance Sheet & Valuation

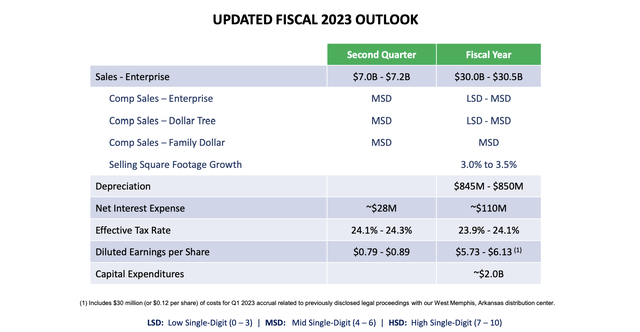

Capital expenditures in 1Q23 were $350.4 million, with the full fiscal year expectation of approximately $2 billion. The company aims to allocate around 40% of capital expenditures to business continuity and the remaining portion to growth, optimization, and productivity improvement.

In terms of cash flow, the company repurchased approximately 1 million shares for $151.1 million in the first quarter. Cash and cash equivalents totaled $872.8 million compared to $1.2 billion. Free cash flow improved to $402 million from $285 million in the previous year.

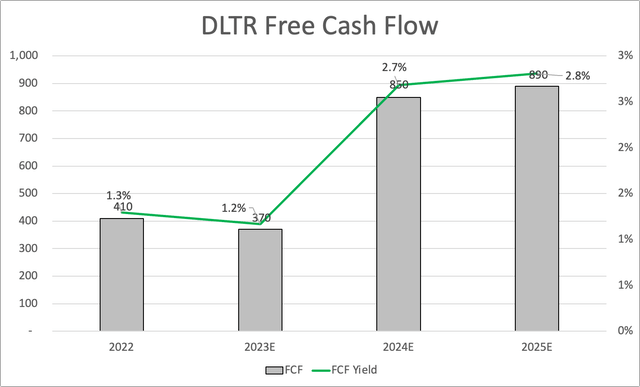

Looking at analyst estimates, the company is expected to grow free cash flow to roughly $900 million in the next three years. Please note that the company does not pay a dividend. Free cash flow will be used to repurchase shares and reduce debt if needed.

Leo Nelissen

Looking forward, the company expects a low to mid-single-digit comparable store sales increase for the year, with selling square footage growth of 3% to 3.5%.

Management revised its diluted GAAP EPS outlook for fiscal 2023 to a range of $5.73 to $6.13, which includes the expected contribution from the 53rd week and a $0.12 legal reserve taken in the first quarter.

Dollar Tree

With that said, the company is expected to end this year with $2.8 billion in net debt, which translates to a 0.9x net leverage ratio, which is very healthy.

The company has a BBB credit rating.

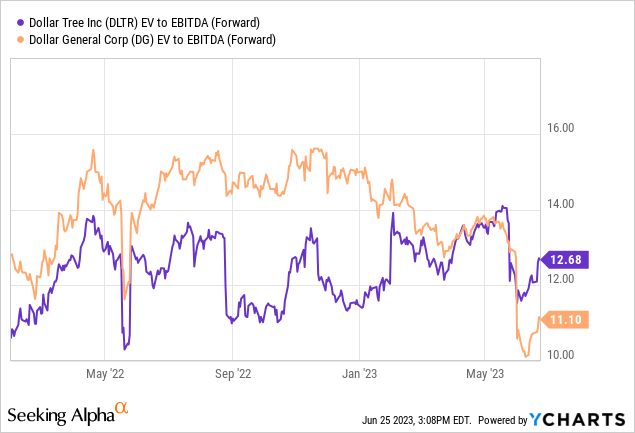

Valuation-wise, the company is trading at 12.7x NTM EBITDA, which is above the valuation of its peer Dollar General. This valuation is fair. It’s not overvalued and not undervalued. It’s essentially the longer-term median.

The current consensus price target is $157, which is 9% above the current price. I believe that is fair.

Furthermore, analysts expect the company to grow EBITDA to $3.1 billion in 2025, which would imply 12% growth versus 2023.

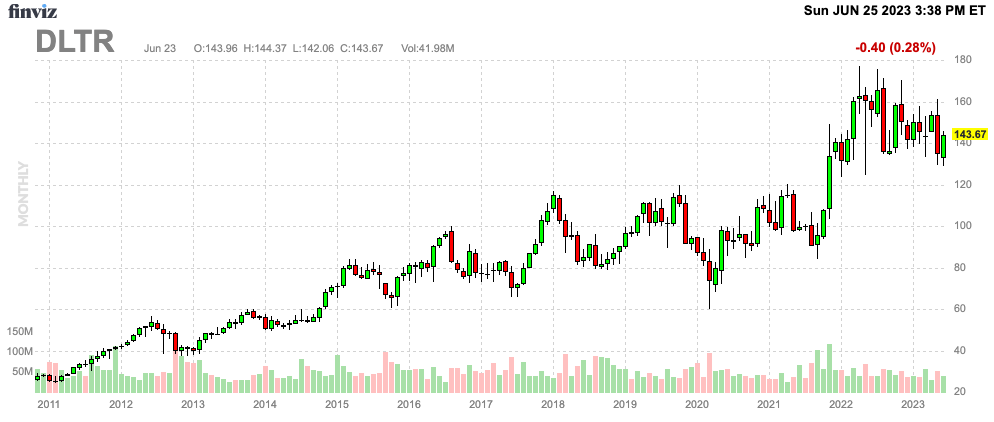

Given macroeconomic challenges, I do not believe that DLTR will take off anytime soon.

The share price will likely continue to hover between $130 and $170 until we get data that supports a sustainable uptrend in consumer sentiment.

FINVIZ

Once that happens, I expect DLTR’s investments in its business to pay off handsomely, which should lead to accelerating free cash flow and a strong stock price performance.

For now, I remain neutral.

Investors looking to buy discount store exposure will likely benefit from buying future corrections at prices close to the lower bound of the $130 to $170 range.

Pros & Cons

Pros:

- Strong market position as one of America’s largest discount store operators.

- Increasing demand for discount stores across income levels.

- Positive sales growth and market share gains.

- Strategic improvements to enhance the business and margin opportunities.

Cons:

- Margin pressure due to high inflation and rising input costs.

- Uncertain consumer sentiment impacting stock price.

- Significant investments are required for business improvements.

- Competitive retail environment.

Takeaway

Dollar Tree faces challenges due to high input inflation and limited pricing power in its low-margin business.

However, the company is taking steps to improve its position. DLTR benefits from the growing demand for affordable products, attracting both low-income and higher-income shoppers.

By expanding its product assortment and private brand penetration, DLTR aims to capitalize on changing consumer behavior. The company is also focused on upgrading stores, supply chain capabilities, and technology systems.

Activist investors are pushing for a quicker turnaround, emphasizing the importance of retail basics and necessary investments.

While DLTR’s margins are affected by inflation, its long-term potential remains strong. With a healthy balance sheet, solid credit rating, and fair valuation, DLTR is positioned for future growth.

However, amidst macroeconomic challenges, I remain neutral, suggesting that investors consider buying during future corrections to improve the risk/reward.

Read the full article here