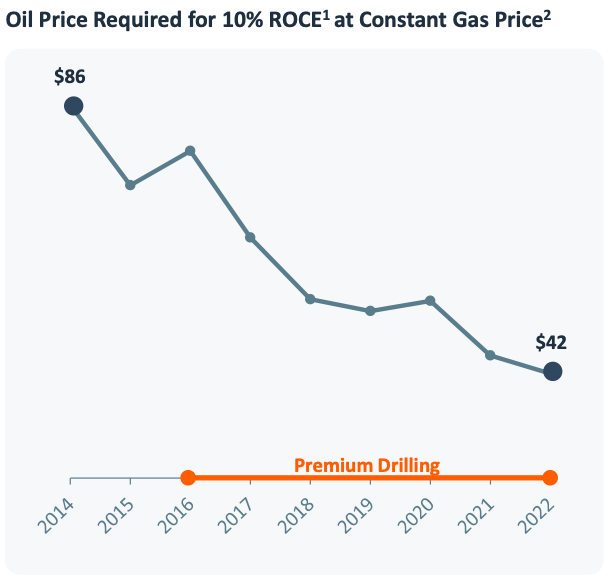

Hydrocarbon explorer, EOG Resources, Inc. (NYSE:EOG) has significantly underperformed the market over the last five years. This is despite generating the equivalent of 30% of its market cap in free cash flow (FCF), and distributing the equivalent of 16% of its market cap, in dividends. There is good reason to believe that the company can continue its 25-year history of strong, growing regular dividends. Managers are, in effect, paid to create value, and in that regard, have grown returns on capital employed (ROCE) from 14.9% in 2018, to 34% in 1Q23. With rising margins, the oil price required to earn a 10% ROCE has fallen by half since 2014, further highlighting the improving and robust profitability. The firm is trading at a 6.68 price/earnings (P/E) multiple, has a 0.44 gross profitability, and enjoys a 10.16% FCF. In short, EOG Resources is a good long term investment bet.

A Stock Market Laggard

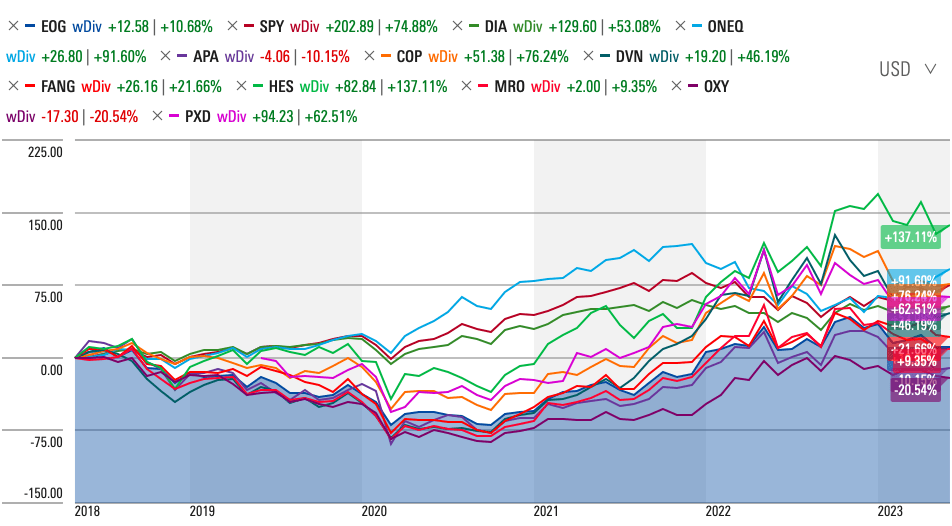

Over the last five years, EOG Resources share price has declined by over 9%, compared to a rise of almost 60% for the SPDR S&P 500 ETF Trust (SPY), over 38% for the SPDR Dow Jones Industrial Average ETF (DIA), and over 81% for the Fidelity Nasdaq Composite Index ETF (ONEQ). EPOG Resource’s average peer group share price rose over 27% in that period. The peer group consists of APA Corp. (APA), ConocoPhillips (COP), Devon Energy Corp. (DVN), Diamondback Energy, Inc. (FANG), Hess Corp. (HES), Marathon Oil Corp. (MRO), and Pioneer Natural Resources Company (PXD). The firm’s dividend issuance has allowed the firm to deliver positive total shareholder returns (TSR) of nearly 11%, compared to nearly 75% for the SPDR S&P 500 ETF Trust, more than 53% for the SPDR Dow Jones Industrial Average ETF, and nearly 92% for the Fidelity Nasdaq Composite Index ETF. The peer group TSR rose by nearly 47%.

Source: Morningstar

The Capital Cycle Favors Energy

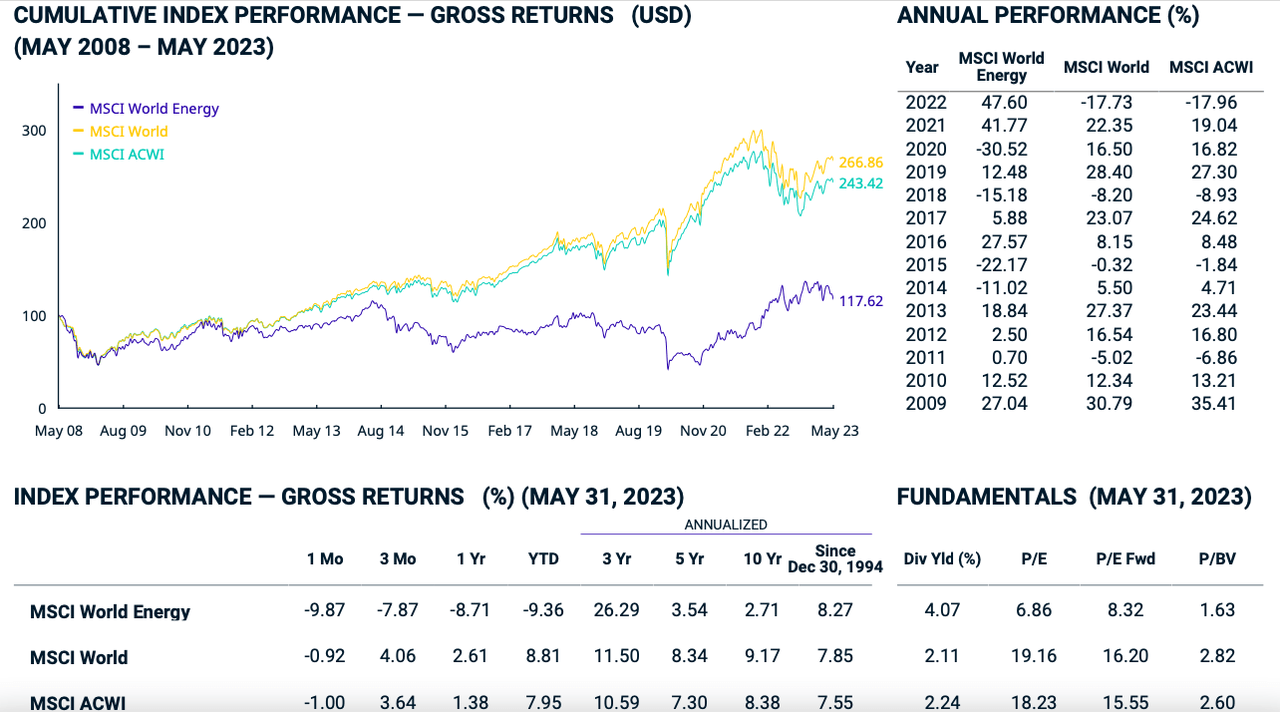

While EOG Resources performance trails that of its peers, the peer group performance, at a 5-year TSR of 46.79%, still trails that of various broad market indices. When we look at the MSCI World Energy Index, which gives us a global sense of how the industry has performed, we see that its gross annual returns over the last five years were 3.54% compared to 8.34% for the MSCI World and 7.3% for the MSCI ACWI. In the post-Great Recession period, the energy index has beaten the broad market in just four years.

Source: MSCI World Energy Index

The history of the oil & gas industry is one of booms and busts, a history defined by the ebb and flow of capital. Without pricing power, managers are forced to blindly follow the direction of prices. In boom times, all managers overestimate future free cash flows (FCF), and, in commodity markets, fueled by competition, managers tend to raise too much capital, both in terms of equity and debt, and overinvest in growing their productive capacity. When those anticipated FCF do not materialize, estimates are revised down, ratings contract, the firm is forced to clean up its balance sheet, and capital exits the market until profitability returns to the market. This ebb and flow of capital has been referred to as the “capital cycle”, or, the “asset growth effect”.

Capital discipline has often been absent from the industry because the incentives that drive asset growth at the company level lead to excess supply at the industry level, leading to price collapses, and returns being driven down toward the cost of capital and below. Not only are fundamentals punished for what turns out to be bad decisions, but the market is harsher toward firms in a growth phase, that underperform forecasts, than it is toward normal value traps.

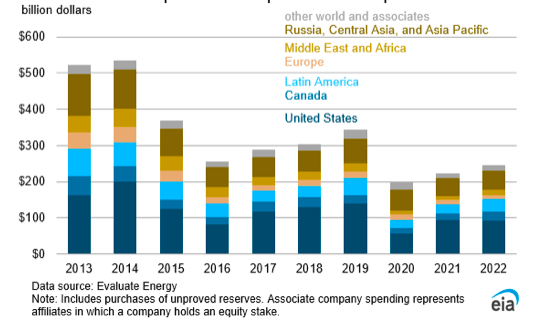

The last few years of industry underperformance have come at a time when capital discipline has risen across the industry, as the industry has put the excesses of debt growth, and capital expenditure expansion, behind it. In the last decade, exploration and development costs incurred have halved globally.

Source: U.S. Energy Information Agency

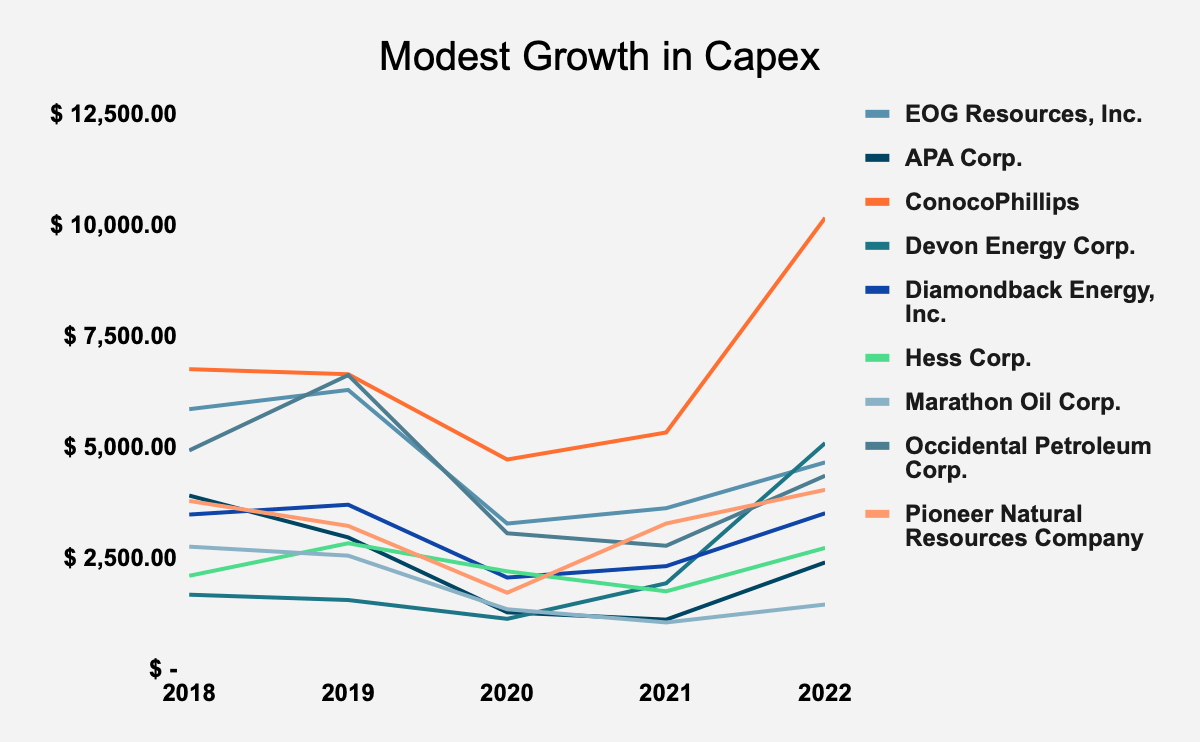

This trend is visible in the capex numbers of EOG Resources and its peers, who, aside from ConocoPhillips, have preserved capex below their 2019 peak.

Source: Company Filings and Author Calculations

Not only is the industry spending less, investors have shied away from the industry, and managers have been under pressure to shift spending toward renewables. Engine No. 1’s victory at Exxon Mobil (XOM) is an example of the latter, while Stichting Pensioenfonds ABP, the Netherlands’ pension fund for government employees, selling its positions in profitable energy companies, and the Government Pension Fund of Norway’s net zero goals, show that, despite the industry’s capital discipline improving along with its profitability, capital has not returned to the industry.

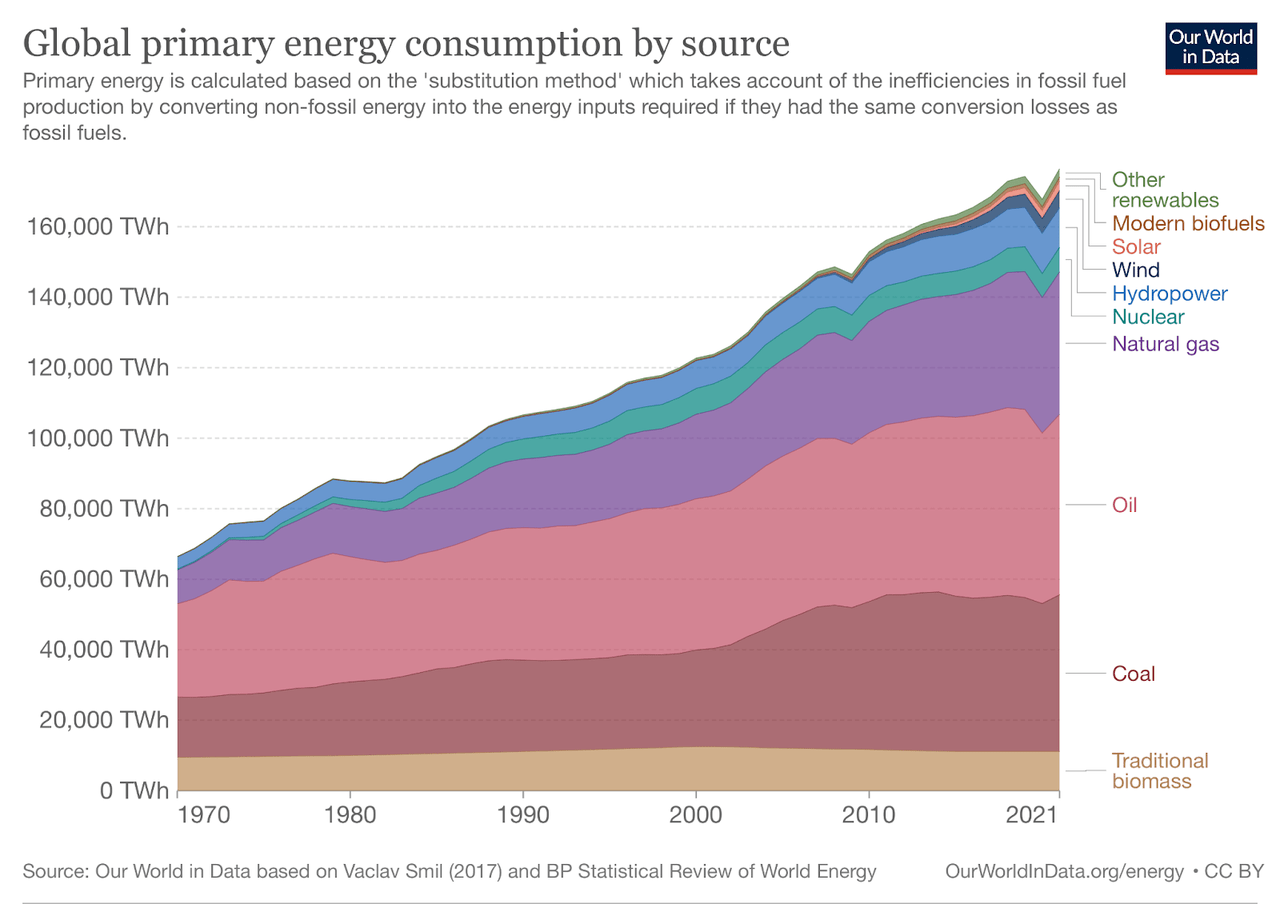

Investors have also been influenced by a doomsday scenario that imagines a rapid transition away from oil & gas. Yet, this ignores that the usage has been defined by inertia, rather than rapid transition. Since 1970, fossil fuel use has declined from 80% to 77% in 2021, hardly a rapid transition.

Source: Our World in Data

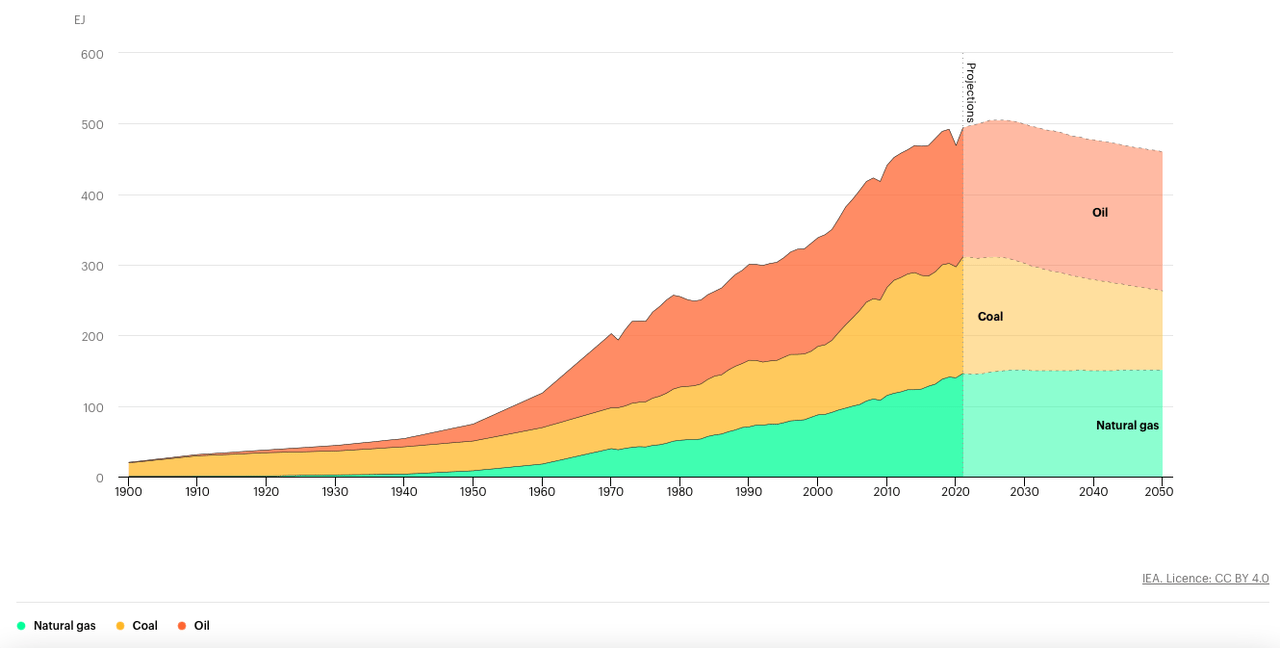

The International Energy Agency (IEA), which refers to the share of fossil fuels in the global energy mix, “stubbornly high”, believes that this share will only decline below 75% in 2030, and to just above 60% in 2050. The peak will be in 2025, if the Stated Policies Scenario (STEP) occurs. This, in other words, is the ideal scenario given current policy and technology trends.

Source: IEA

What we have then is a very attractive scenario for investors: capital expenditure is declining, while demand is fairly stable in the long run, providing support for high prices, and high rates of profitability, in an industry so out-of-fashion it remains very cheap.

Observing EOG Resources’ revenue results, we see that, despite an industry under the veil of a doomsday scenario, its revenue has grown from $17.28 billion in 2018 to $25.7 billion in 2022? compounding at 8.27% a year. According to Credit Suisse’s (CS) “The Base Rate Book”, in the 1950-2015 period, the mean and median 5-year sales CAGR were 6.9%, and 5.2% respectively. In 1Q23, revenue was $6 billion, compared to $3.98 billion in 1Q22. Thus, the firm actually grew faster than this reference group.

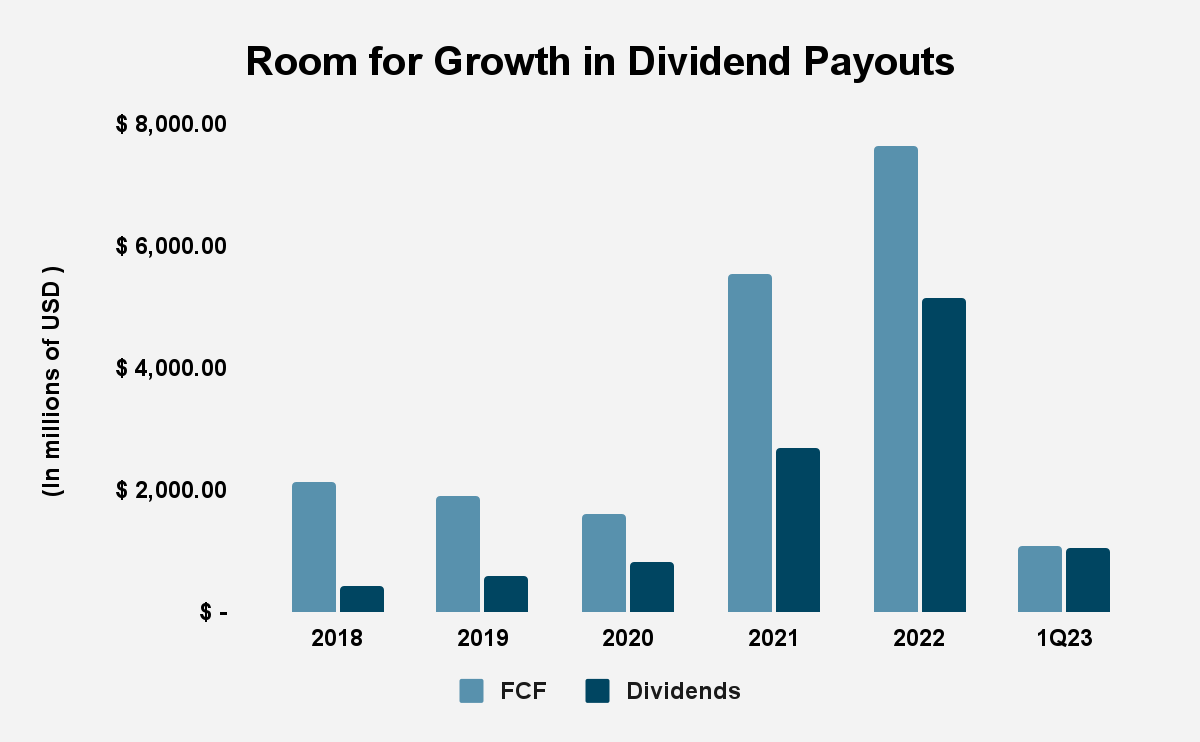

There is Room for Growth in Dividends

Given how important dividend payments have been to the firm’s TSR, it’s essential for us to begin our analysis by asking if EOG Resources can continue to make dividend payments and whether there is any room for growth.

The explorer is committed to returning at least 60% of its annual FCF to shareholders, primarily through regular dividends. The firm also uses FCF to buy back shares and to pay special dividends. Since 2018, FCF has grown from $2.1 billion to $7.6 billion in 2022, compounding at 29.2% a year. In 1Q23, the firm generated $1.1 billion in FCF, compared to $2.4 billion for the same period in the year prior. Since 2018, the firm has earned $19.9 billion in FCF, or 30% of its market cap.

Annual regular dividends have grown from $0.81 per share in 2018 to $3.075 per share in 2022, compounding at 30.58% a year. In the year-to-date, the firm has paid out $1.65 per share in regular dividends. Dividend payouts amounted to $438.05 million in 2018, rising to $5.15 billion in 2022, compounding at 63.7% a year. In 1Q23, the firm paid out $1.1 billion in dividends. Since 2018, the firm has paid out $10.75 billion in dividends, or 16% of EOG Resources’ market cap. This tells us that the company should be able to sustain its remarkable, 25-year history, of stable and growing regular dividends, which have compounded 22% per year since 1999.

Source: EOG Resources, Inc. Supplemental Financial and Operating Data and Annual Filings

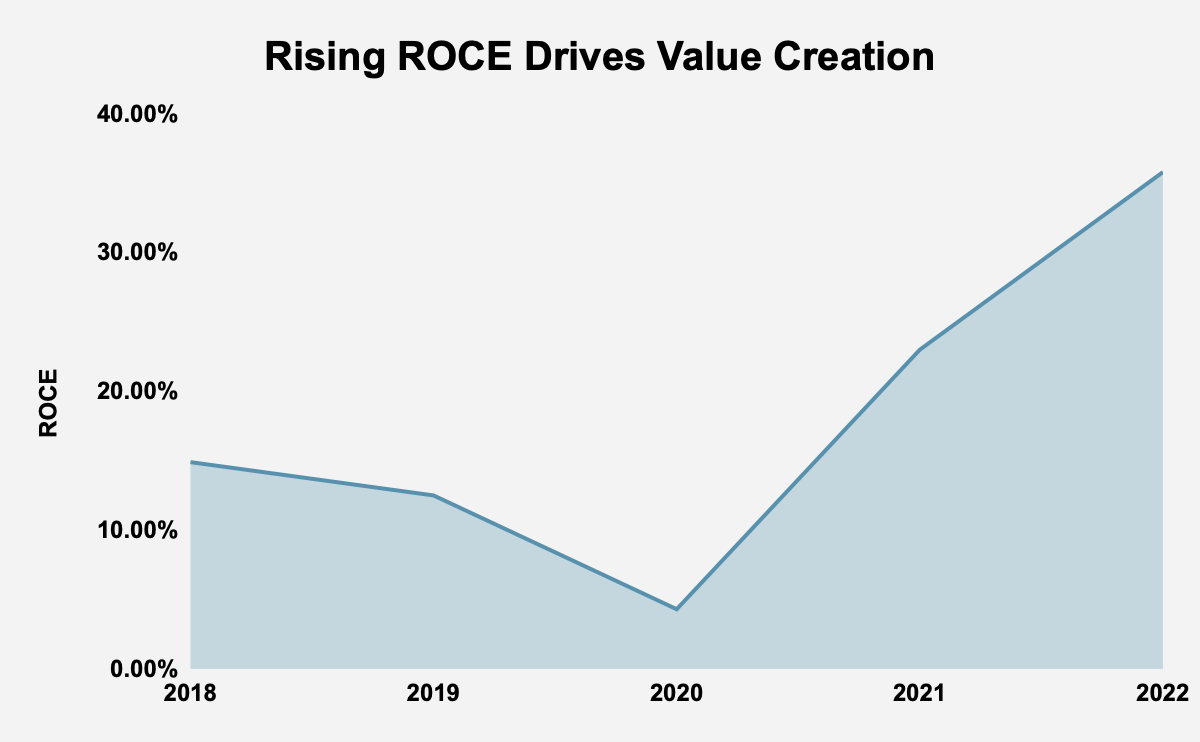

Management Is Paid to Grow Value

Incentives drive outcomes. Berkshire Hathaway (BRK.A, BRK.B) vice chairman, Charlie Munger is quoted as saying,

“Well, I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it. And never a year passes but I get some surprise that pushes my limit a little farther.”

If he admits to often underestimating the power of incentives, it is no wonder that most businesses do not structure executive compensation in such a way as to ensure that value creation is the outcome of managerial action. EOG Resources is one of those few enlightened enterprises, tying executive compensation to ROCE, and therefore, regarding managers for capital allocation excellence. According to the 2023 Proxy Statement, long-term incentives, which are issued by way of performance units and restricted stock, are tied to stock market performance against industry and broader market benchmarks, and strong ROCE performance. This ensures that managers are focused on value creation. The results are evident: ROCE has risen from 14.9% in 2018, to 34% in 1Q23. The firm has a minimum target ROCE of 25%. In the long run, valuation follows returns, and this trend of rising ROCE suggests that future firm value will increase.

Source: EOG Resources, Inc. Supplemental Financial and Operating Data

Robust, Peer-Leading Profitability

The firm has a target ROCE of 25%, but, importantly, the oil price required to achieve just 10% ROCE has fallen from $86 in 2014 to $42 in 2022, at constant gas prices.

Source: EOG Resources, Inc. 1Q23 Earnings Presentation

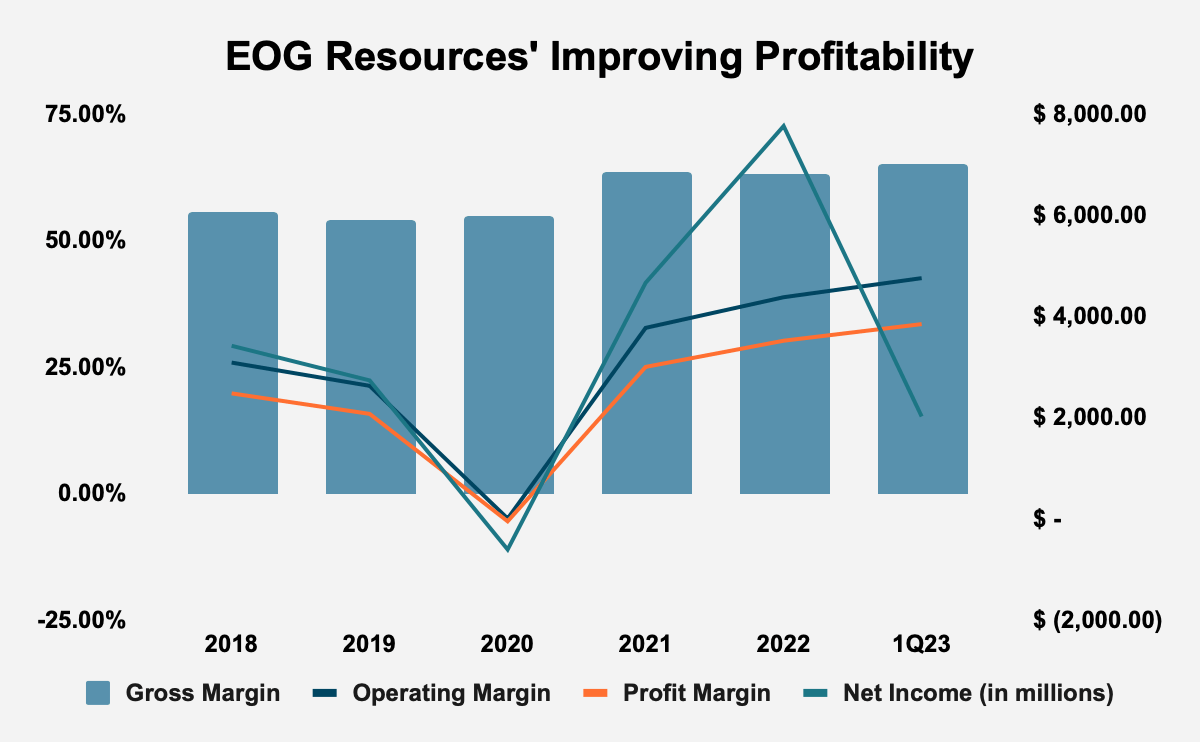

The above has been achieved thanks to higher margins, which have driven the record high ROCE performance that we have already seen. With gross, operating and profit margins all improving, it is clear why net income has risen from $3.42 billion in 2018 to $7.76 billion in 2022, compounding at 17.81% per year. According to “The Base Rate Book”, in the 1950-2015 period, the mean and median 5-year earnings CAGR were 7.3%, and 5.9% respectively. In 1Q23, net income was $2 billion, compared to $390 million in 1Q22.

Source: EOG Resources, Inc. Filings

In short, EOG Resources profitability can endure meaningful price falls, and will obviously benefit from any price increase. Quite simply, the profitability is robust.

In terms of returns on invested capital (ROIC), the firm’s ROIC for the trailing period, at 34.6%, is ahead of that of its peers, whose average is 19.94%. The explorer also has a gross profitability of 0.44, which is higher than the 0.33 threshold for attractiveness discovered by Robert Novy-Marx, and higher than the peer group mean gross profitability of 0.28. gross profitability, which scales gross profits by total assets, is an important indicator of profitability as well as being a powerful stock screen. EOG Resources’ operating margin, at 43.19%, is higher than that of its peer group, which is 32.21%.

|

Company |

Market Cap (in billions) |

Gross Profitability |

ROIC |

Operating Margin |

|

EOG Resources, Inc. |

$ 62.47 |

0.44 |

34.60% |

43.19% |

|

APA Corp. |

$ 10.05 |

0.38 |

26.20% |

43.98% |

|

ConocoPhillips |

$ 121.56 |

0.38 |

28.40% |

32.86% |

|

Devon Energy Corp. |

$ 30.26 |

0.46 |

33.00% |

41.73% |

|

Diamondback Energy, Inc. |

$ 22.71 |

0.27 |

19.00% |

64.12% |

|

Hess Corp. |

$ 40.41 |

0.30 |

14.00% |

33.82% |

|

Marathon Oil Corp. |

$ 13.56 |

0.33 |

18.00% |

47.11% |

|

Occidental Petroleum Corp. |

$ 50.00 |

0.21 |

16.10% |

35.68% |

|

Pioneer Natural Resources Company |

$ 46.43 |

0.34 |

25.10% |

40.00% |

|

Peer Group Average |

$ 397.45 |

0.28 |

19.94% |

32.21% |

Source: Company Filings and Author Calculations

Valuation

EOG Resources has a P/E multiple of 6.68, compared to 25.17 for the S&P 500, and 7.17 for its peers, reflecting the industry’s undervaluation, and the firm’s own undervaluation compared to the market. We have already seen that its gross profitability, at 0.44, is higher than the 0.33 threshold for attractiveness and its peer group’s gross profitability of 0.28. With $6.35 billion in FCF over the trailing twelve months, and an enterprise value of $62.47 billion, EOG Resources has an FCF yield of 10.16%. This is significantly higher than the market’s FCF yield of 2.3%, according to New Constructs, and higher than the peer group mean FCF yield of 12.18. This suggests that the firm is producing FCF at a cheaper price than both the market and its peers.

|

Company |

Ticker |

Gross Profitability |

P/E Ratio |

FCF Yield |

|

EOG Resources, Inc. |

EOG |

0.44 |

6.68 |

10.16% |

|

APA Corp. |

APA |

0.38 |

5.19 |

10.67% |

|

ConocoPhillips |

COP |

0.38 |

8.02 |

15.43% |

|

Devon Energy Corp. |

DVN |

0.46 |

5.14 |

9.23% |

|

Diamondback Energy, Inc. |

FANG |

0.27 |

5.19 |

9.64% |

|

Hess Corp. |

HES |

0.30 |

20.06 |

4.26% |

|

Marathon Oil Corp. |

MRO |

0.33 |

5.33 |

26.38% |

|

Occidental Petroleum Corp. |

OXY |

0.21 |

6.41 |

23.01% |

|

Pioneer Natural Resources Company |

PXD |

0.34 |

7.03 |

14.63% |

|

Peer Group Average |

0.28 |

7.12 |

12.18% |

Source: Company Filings and Author Calculations

Overall, EOG Resources has a more attractive relative valuation, attractive profitability, and is producing FCF at a lower price than the rest of the market.

Conclusion

EOG Resources has been a stock market laggard over the last few years. This has been despite the firm generating nearly a third of its market share in FCF and paying out the equivalent of 16% of its market cap in dividends. The explorer has shown itself to be a real cash machine with strong, reliable dividends that we can expect to grow over the next few years.

Tying executive compensation to ROCE has ensured that management is focused on value creation. Indeed, as we have seen, ROCE has risen sharply over the last five years. This gives us confidence in our belief that future firm value will grow as well. Higher margins have grown such that the oil price required to achieve just 10% ROCE has fallen by over half since 2014. Higher margins, of course, mean higher profitability, and net income, as well as ROCE, have both benefitted.

The firm appears to be attractively valued on a P/E basis, with a high gross profitability, and attractive FCF yield of over 9%. The confluence of these things makes EOG Resources a good bet for the future.

Read the full article here