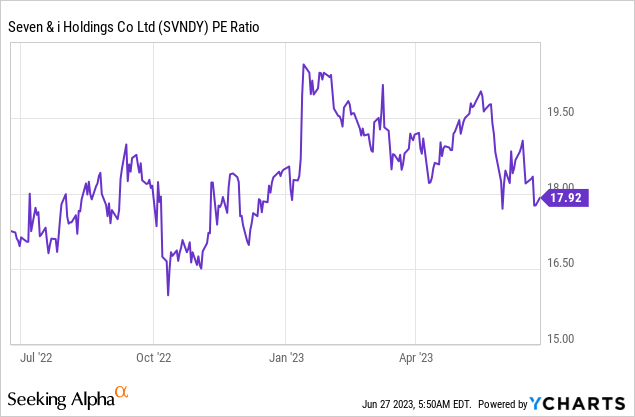

Japan’s largest convenience store chain operator Seven & i Holdings (OTCPK:SVNDY) has long been a consensus name, but if the near-term data is any indication, the weaker macro is already starting to bite. Monthly same-store sales growth numbers out of the US are already tracking well below guidance, as non-food sales weakness adds to the industry-wide fuel headwinds. Still, the company deserves credit for pushing through with its strategic initiatives across its Japan and North America convenience store base. The most notable being the realignment of its superstore business via the recent merger of consolidated subsidiaries Ito-Yokado and York, in line with the mid-term business plan update outlined at the last quarterly release. Depending on execution, incremental synergies here (mainly via operational efficiency) and from the Speedway acquisition could provide some buffer against the P&L headwinds. But with the valuation still surprisingly robust at ~18x P/E, I don’t think the macro/gasoline-related earnings risks have been discounted enough here. As a result, I would be sidelined here.

Superstore Realignment Marks a Positive Step in Strategic Roadmap

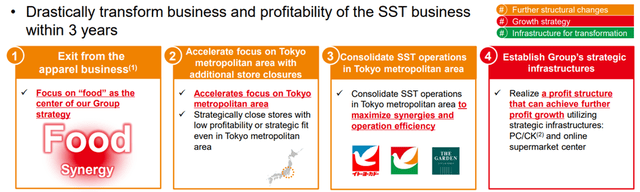

Seven & i Holdings has begun the process of realigning its superstore business, with the announcement of an absorption-type merger between subsidiaries Ito-Yokado (general supermarket) and York (food supermarket) earlier this month. Post-merger, Ito-Yokado will be the surviving company, with the transaction set to conclude effective September 1, 2023. Given management had already laid out its strategy to integrate the Ito-Yokado and York superstores in its medium-term business plan, this merger announcement won’t come as a major surprise, though the sooner-than-expected timing is certainly positive. From here, the goal will be to maximize synergies in metropolitan areas (i.e., greater Tokyo) and improve operational efficiency over the next three years. Key next steps include improving profitability by exiting less profitable lines (e.g., apparel), consolidating infrastructure (e.g., processing centers and cloud kitchens), and streamlining the existing store base.

Seven & i Holdings

While it remains early days for execution, the merger is a positive signal of intent by management. Beyond efforts to improve superstore profitability, management also has several group-level initiatives in the pipeline, including sales campaigns and the rollout of new formats and products to address new consumer demands. Also in development are efforts to move up the value chain to deliver value-added products that will be P&L accretive long-term, along with digital & delivery via 7NOW ($1bn sales targeted through 2025). Underwriting success at this stage is probably premature, though these top-line efforts, along with the ongoing cost savings initiatives (mainly via enhanced efficiency across the store base and Speedway), present long-term earnings optionality.

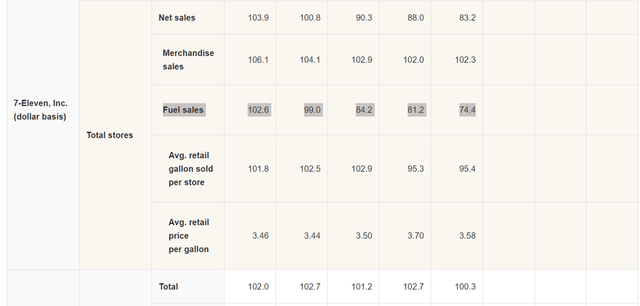

Watch Out for Fuel as Monthly Sales Numbers Underwhelm

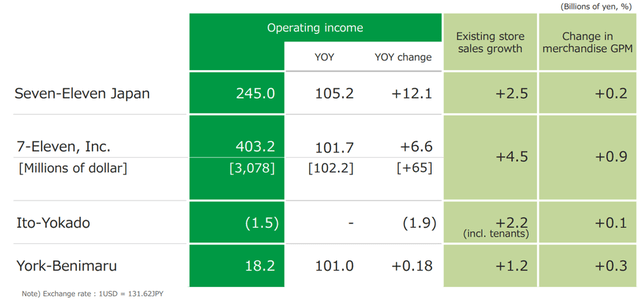

The preliminary monthly update from Seven & i for May was far from encouraging. US same-store merchandise sales were up, albeit by an underwhelming +2.3% YoY. Unsurprisingly, fuel was the key drag, down over 25% (down mid-single-digits on a sales volume per store basis), driving a high-teens percentage decline in all-store sales. Elsewhere, food items were resilient, though weakness in non-food categories like tobacco products also weighed on the overall results. With April and May’s numbers coming in below par, merchandise sales growth for the upcoming quarter looks set to fall short of guidance. To recap, management’s full-year financial forecast is still relatively high at +4.5% same-store merchandise sales growth in the US (see table below), so more downward revisions are likely on the cards.

Seven & i Holdings

The read-across from North America hasn’t been great either. Key convenience store peers Casey’s General Stores (CASY) and Murphy USA (MUSA) have been outperforming Seven & i, with same-store merchandise sales up a high-single-digit percentage YoY for their recent fiscal quarters. By contrast, Seven & i posted +2.0% YoY and +2.3% YoY same-store sales growth in April and May, respectively. Perhaps more importantly, fuel margins are on a downtrend across the board – CASY’s latest quarterly fuel margin was down to ~35c/gallon (down from 40.7c/gallon in the previous quarter), while MUSA saw a similarly large quarterly decline to 28.9c/gallon (down from 30.6c/gallon prior). With Seven & i also seeing steep declines in fuel sales, expect a similar (if not larger) compression in fuel margins in the upcoming fiscal quarter. Management could cushion the P&L impact via incremental cost synergies from the ongoing Speedway integration, along with SG&A benefits from its ‘cost leadership’ initiatives, though it’s hard to see much respite from the near-term headwinds.

Seven & i Holdings

Still Pricey Despite the Earnings Risks

The setup into Seven & i’s upcoming fiscal quarter isn’t shaping up as well as I’d like, with monthly data indicating weakness across the Japanese and North American convenience store base. In addition to lower gasoline earnings, US same-store merchandise sales growth is also being weighed down by surprising sales weakness in non-food categories. So while recent management initiatives to bolster the governance structure and unlock synergies within the store base (e.g., the Ito-Yokado/York superstore merger) and via M&A (e.g., the ongoing Speedway integration) are positives, there remain too many near-term P&L headwinds for my liking. The valuation still embeds optimism as well at the current high-teens P/E – despite same-store sales data already underperforming US peers. Pending a meaningful correction or concrete signals of a reversal in the macroeconomic outlook, I would steer clear at this point.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here