Thesis

The US Treasury 2 Year Note ETF (NASDAQ:UTWO) is an exchange traded fund. The fund is new, having IPO-ed in 2022. This ETF is a welcomed addition to the constant maturity bond space:

The two-year constant maturity Treasury represents the yield of the most recently auctioned two year Treasury securities.

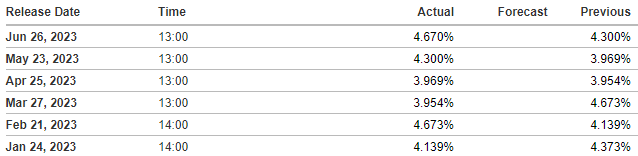

Let us go back for a second to the mechanics of the department of the treasury – in order to fund the government, the department issues Treasuries across the tenor curve. Two year Treasuries are auctioned every month:

2-Year Auction Results (Investing.com)

After every auction the newly issued Treasury security is called ‘on-the-run’, meaning it is the current 2-year bond used as a benchmark. Investment banks and broker dealers use the ‘on-the-run’ Treasury bond to price investment grade corporate debt and other capital markets securities. They are also the most liquid Treasury securities, meaning they are the easiest to buy and sell. This is because they are the most actively traded, so there is always a large pool of buyers and sellers.

UTWO simply aims to purchase the current ‘on-the-run’ 2-year Treasury and then sell it a month later and roll into the new one. Can an investor do this themselves? Absolutely. Ignoring bid/ask spreads, an investor can purchase and sell every month the ‘on-the-run’ treasury note. Is it worth doing it via an ETF for 0.15% annual fee? We think so.

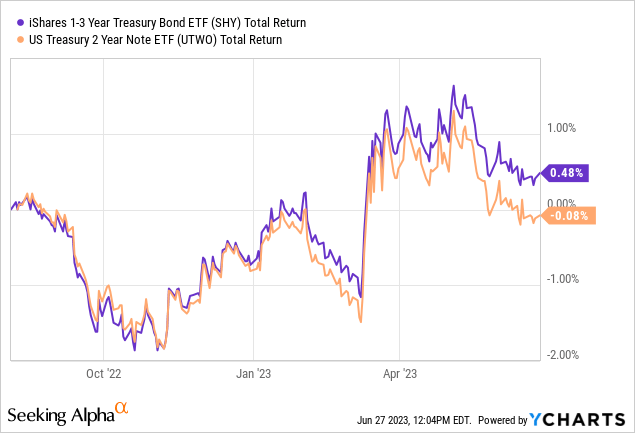

Versus its competition, UTWO offers a constant duration and exposure to a specific point in the yield curve. The very liquid iShares 1-3 Year Treasury (SHY) has a similar duration of 1.8 years. Their total return profiles are slightly different:

Why should you care about UTWO? Use Cases.

1. Treasury Ladder Build

If you feel yields are closing in on their highs, as an investor you can start building a treasury ladder. Until now you had the option to use the popular iShares ETFs, but they did not represent distinct points in the curve. For example now you can buy (UTWO), (UTEN) and (UTWY) to get a nice treasury build via the 2-year, 10-year and 20-year points.

2. Building Block for a Complex Trade

The more interesting use case here is UTWO as a building block for more complex trades. There are numerous quant models that analyze historic correlations between the various points in the yield curve and certain equity sectors. Investors can now go long or short the 2-year point in the curve to take advantage of that view. Historic correlations are mostly run using CMS curves (constant maturity curves), therefore UTWO fits the bill there.

3. Yield generating vehicle

Versus its underlying instrument which only pays interest semi-annually, UTWO disburses income monthly, yield which closely matches prevailing two-year dividend yields. When rates move down there will also be a capital gain to be had from this instrument, versus holding a two year note outright.

4. Simplicity

You own only one government bond via this structure, and it will always be the on-the-run one, thus the most liquid.

Should I use UTWO or buy a 2-Year Treasury outright?

Buying a Treasury bond outright locks you in a set yield and you get a set stream of interest cash-flows and your principal back at maturity. Irrespective of what rates do, you are locked in the respective yield. If rates go to zero tomorrow, you will experience a gain in the price of the bond, but if you hold on to it, you will end up getting the same stream of interest and principal.

Conversely, UTWO gives you a mark to market approach to rates. In the same theoretical example where rates would go to zero UTWO would appreciate in price. The new dividend yield on the fund would start to be lower (to match the on the run one), and an investor would realize a capital gain when selling the name. So via UTWO, relatively speaking, you are getting capital gains when rates decrease, whereas an outright purchase generates more of a dividend income stream.

Conclusion

UTWO is a new addition to the exchange traded fund space. The ETF is from the same series that targets certain points in the yield curve, such as UTEN and UTWY for the 10-year and 20-year points respectively. This build is done via a monthly roll into the most recently issued bond (via auctions). The fund pays monthly distributions that try to match the prevailing auctioned bond yields. UTWO has very similar analytics to SHY, but represents a nice clean building block for more complex trades (correlation trades, yield curve trades). We think we are close to peak rates, so the fund should provide a nice dividend yield and slight capital appreciation in the next twelve months.

Read the full article here