We believe Intuitive Surgical stock (NASDAQ

NDAQ

MDT

ISRG

Looking at stock returns, ISRG, with 23% returns this year, has fared better than MDT stock, up 13%, and the broader S&P500 index, up 13%. There is more to the comparison, and in the sections below, we discuss why we believe ISRG stock will offer better returns than MDT stock in the next three years. We compare a slew of factors, such as historical revenue growth, returns, and valuation, in an interactive dashboard analysis of Intuitive Surgical vs. Medtronic: Which Stock Is A Better Bet? Parts of the analysis are summarized below.

1. Intuitive Surgical’s Revenue Growth Is Better

- Intuitive Surgical’s revenue growth has been much better, with a 12.4% average annual growth rate in the last three years, compared to 1.3% for Medtronic.

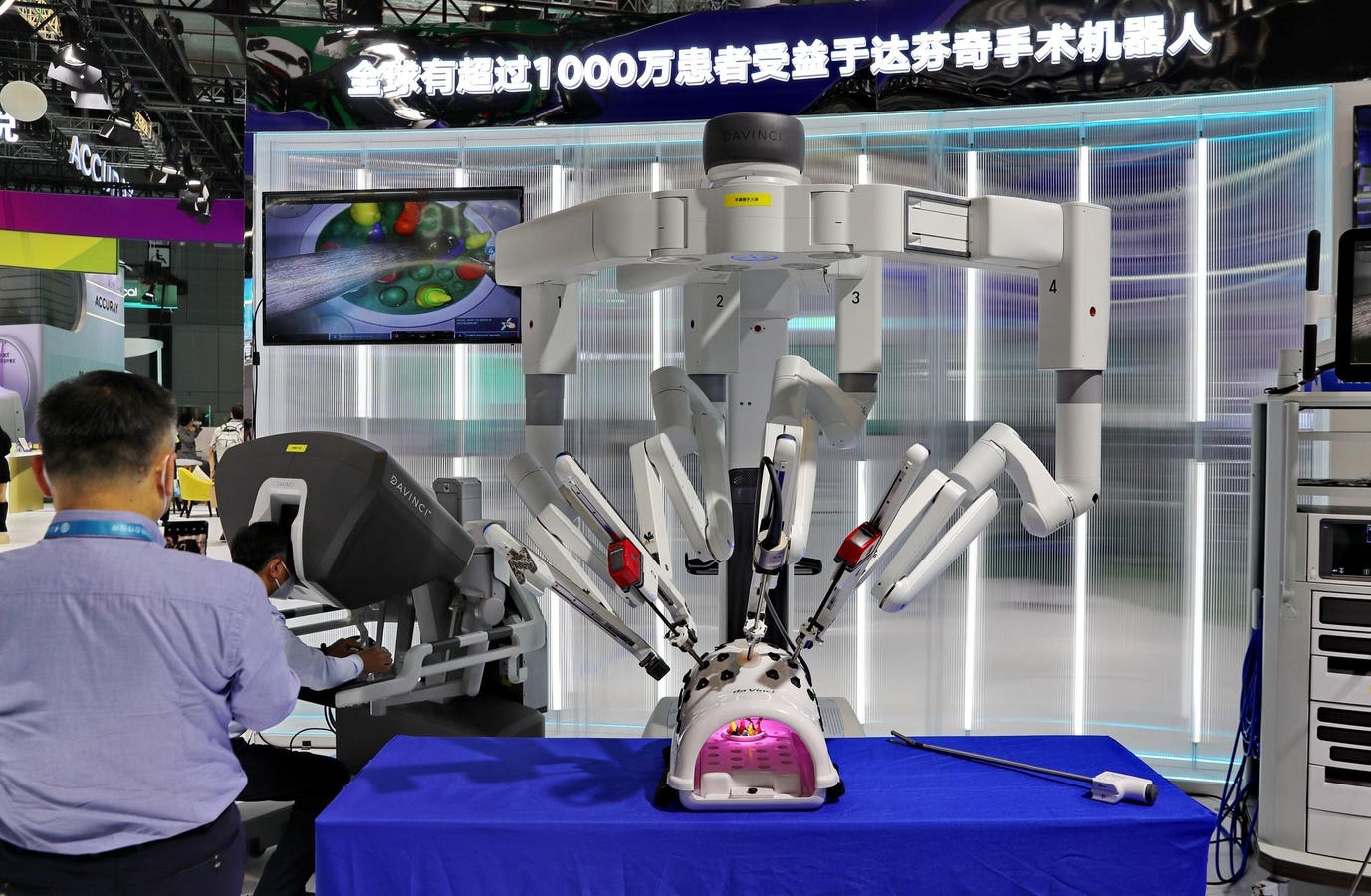

- For Intuitive Surgical, revenue growth over the recent past has been driven by a rebound in procedure volume, which was adversely impacted in the initial phases of the pandemic due to the shelter-in-place restrictions. The company continues to expand its installed base, which results in the growth of recurring revenues, such as consumables.

- Intuitive Surgical’s installed base has increased 35% to over 7,500 in 2022, compared to less than 5,600 in 2019.

- Medtronic also saw a rebound in sales in recent years, aided by higher procedure volume. The company also benefited from its new products, including the Micra AV pacemaker and Abre venous self-expanding stent system for Deep Venous disease.

- Its Medical Surgical segment sales are adversely impacted due to a continued decline in ventilator demand. Furthermore, forex headwinds have also weighed on the overall top-line growth in recent quarters.

- Looking at the last twelve month period, Intuitive Surgical’s 8.9% sales growth fares better than -3.9% for Medtronic.

- Our Intuitive Surgical Revenue Comparison and Medtronic Revenue Comparison dashboards provide more insight into the companies’ sales.

- Looking forward, Intuitive Surgical’s revenue is expected to grow faster than Medtronic’s over the next three years. The table below summarizes our revenue expectations for the two companies over the next three years. It points to a CAGR of 13.6% for Intuitive Surgical, compared to a 2.1% CAGR for Medtronic, based on Trefis Machine Learning analysis.

- Note that we have different methodologies for companies negatively impacted by Covid and those not impacted or positively impacted by Covid while forecasting future revenues. For companies negatively affected by Covid, we consider the quarterly revenue recovery trajectory to forecast recovery to the pre-Covid revenue run rate. Beyond the recovery point, we apply the average annual growth observed three years before Covid to simulate a return to normal conditions. For companies registering positive revenue growth during Covid, we consider yearly average growth before Covid with a certain weight to growth during Covid and the last twelve months.

2. Intuitive Surgical Is More Profitable, And It Comes With Lower Risk

- Intuitive Surgical’s reported operating margin slid from 30.7% in 2019 to 25.3% in 2022, while that for Medtronic fell from 20.5% to 18.2% over the same period.

- Looking at the last twelve-month period, Intuitive Surgical’s operating margin of 24.2% is better than 18.2% for Medtronic.

- Our Intuitive Surgical Operating Income Comparison and Medtronic Operating Income Comparison dashboards have more details.

- Looking at financial risk, Intuitive Surgical is much better placed than Medtronic. Its <1% debt as a percentage of equity is significantly lower than 24% for the latter, while its 50% cash as a percentage of assets is much higher than 7% for the latter, implying that Intuitive Surgical has a better debt position and has more cash cushion.

3. The Net of It All

- Intuitive Surgical has demonstrated better revenue growth, is more profitable, and offers lower financial risk. On the other hand, Medtronic is available at a comparatively lower valuation.

- Now, looking at prospects, using P/S as a base, due to high fluctuations in P/E and P/EBIT, we believe Intuitive Surgical will likely offer better returns, despite its higher valuation.

- If we compare the current valuation multiples to the historical averages, both are comparable. Intuitive Surgical stock trades at 17.8x trailing revenues compared to its last five-year average of 20.6x, and Medtronic stock trades at 3.8x trailing revenues vs. the last five-year average of 4.4x.

- Our Intuitive Surgical Valuation Ratios Comparison and Medtronic Valuation Ratios Comparison have more details.

- The table below summarizes our revenue and return expectations for Intuitive Surgical and Medtronic over the next three years and points to an expected return of 39% for ISRG over this period vs. a 12% expected return for MDT stock, implying that both stocks offer good buying opportunity at current levels, but if one has to pick among the two, ISRG appears to be a better bet, based on Trefis Machine Learning analysis – Intuitive Surgical vs. Medtronic – which also provides more details on how we arrive at these numbers.

While ISRG may outperform MDT in the next three years, it is helpful to see how Intuitive Surgical’s Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.Furthermore, the Covid-19 crisis has created many pricing discontinuities, which can offer attractive trading opportunities. For example, you’ll be surprised at how counter-intuitive the stock valuation is for Medtronic vs. Polaris.

Despite higher inflation and the Fed raising interest rates, ISRG stock has risen 23% this year. But can it drop from here? See how low Intuitive Surgical stock can go by comparing its decline in previous market crashes. Here is a performance summary of all stocks in previous market crashes.

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since 2016.

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here